Interconnection_101_.. - The Vote Solar Initiative

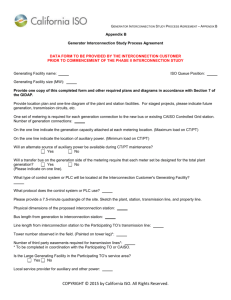

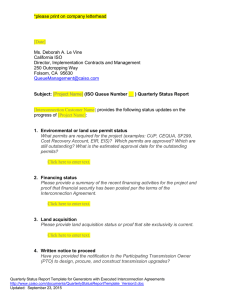

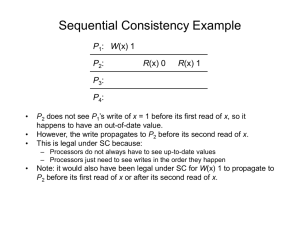

advertisement

California Interconnection 101 An Update on Reform: What’s Happening and Why it is Important March 16, 2011 Sky C. Stanfield sstanfield@keyesandfox.com (510) 314-8204 Interconnection Issues • • • • • Fundamental to solar development Complex web of procedures Backlog in interconnection queue Reform at CAISO, PG&E and SCE Possible Reform of Rule 21 Why Interconnection Matters • Interconnection procedures govern how a solar system gets to connect to the grid so that the energy it produces can be used by others off-site. • Fundamental to participation in the energy market The Many Ways to Interconnect in California • CAISO’s GIP (FERC) • Utility WDATs (FERC) – PG&E – SCE – SDG&E • Rule 21 (CPUC) Three factors determine which procedure applies: • Transmission or Distribution • Location • Wholesale or Net Metered System? The Jurisdictional Debate • FERC generally has jurisdiction over interconnection of wholesale systems • CPUC has jurisdiction over QF interconnections to a utility distribution system when selling full output to the utility. – There is some debate about whether the CPUC has jurisdiction over interconnection of QFs that are not selling their full output to the utility • CPUC also has jurisdiction over the connection of net metered systems – If AB 920 rate is avoided cost should be CPUC jurisdiction Interconnection Pre-2011 • CAISO and the IOUs previously had two sets of interconnection procedures – Larger Generators (LGIP) employing a cluster process – Small Generators (SGIP) used a serial study process • They are now merging them into one set of procedures, known simply as the GIP Why the Need for Change? • Many more systems trying to interconnect than historically – RPS Goals – Emphasis on Distributed Generation (RAM, SB 32, IOU PV Programs) • Interconnection speculation • Lead to a clogged serial study queue The New GIP • From serial to clusters • CAISO, SCE and PG&E (SDG&E??) • Four Processes – Cluster Study – Independent Study Process (ISP) – Fast Track – 10kw Inverter Process (not in CAISO) The Cluster Study • Essentially the same at CAISO, PG&E and SCE • Any size project • One study a year, two application windows • Takes minimum of 510 days – Does not include time for upgrades – Assumes application filed last possible day • A two study process- Phase I and II Cluster Study Costs • Higher upfront fees- $50,000 + 1,000/MW • Financial Security Deposits – Due after Phase I and incrementally thereafter • Potentially more equitable overall Independent Study Process • Any size project • Can apply at any time- takes ½ a year • Same application fees and deposits as the Cluster • Must pass “Electrical Independence” Test • CAISO Requires a Commercial Operation Date (COD) that cannot be met in the cluster study Fast Track • Size Restricted – CAISO- 5MW – PG&E- 5MW (3MW on 21kv, 2MW on 12kv) – SCE- 2MW • Can apply at any time- takes just over a month • Lower fees • Must pass 6 to 10 screens • Improved by allowing some construction of interconnection facilities What’s the Fuss About? • Cluster study takes 18 months • Most Wholesale DG Programs require 18 months to COD • Limited applicability of expedited processes • High upfront costs of participation • Variation on key aspects amongst programs Rule 21 • CPUC jurisdictional • Principally used for net metered systems • Three Components: – Simplified interconnection – Supplemental review – Study process Rule 21’s Limitations • No-export screen: – Screen 2: Will power be exported across the PCC? If Yes, Generating Facility does not qualify for Simplified Interconnection • If screens are failed move to supplemental review and/or full study • Full study process has no defined parameters on cost or timing Rule 21 vs. WDAT • Issue raised in SB32 • PG&E proposing use of WDAT for all QF interconnections • Will Rule 21 reform take on the study process? On the Radar • • • • SCE and PG&E’s FERC filings Will SDG&E start reform? Rule 21 reforms CAISO has started GIP Reform II IREC Resources www.irecusa.org Sky Stanfield sstanfield@keyesandfox.com