CHAPTER 1 The Individual Income Tax Return

CHAPTER 1

The Individual Income Tax Return

2014 Cengage Learning

Income Tax Fundamentals 2014

Student Slides

Gerald E. Whittenburg

Martha Altus-Buller

Steven Gill

1

History of Taxation

Since 1913, when 16 th amendment was passed, the constitutionality of income tax has never been questioned by federal courts

Income taxes serve a multitude of purposes

2014 Cengage Learning 2

Objectives of Tax Law

Raise revenue

Tool for social and economic policies o o o

Social policy encourages desirable activities and discourages undesirable activities

Deductions for charitable contributions

Credits for higher education expenses

Economic policy as manifested by fiscal policy

Encourage investment in capital assets through depreciation

Credits for investment in solar and wind energy

Both economic and social

Exclude gain on sale of personal residence up to $250,000 ($500,000 if married)

2014 Cengage Learning 3

Primary Entities/Forms

Individual o

Taxable income includes wages, salary, selfemployment earnings, rent, interest and dividends o

An individual may file simplest tax form qualified for

1040EZ

1040A

1040 o

If error made on one of the three above forms, can amend with a 1040X

2014 Cengage Learning 4

Tax Formula for Individuals

This formula follows Form 1040

Gross Income less: Deductions for Adjusted Gross Income (AGI)

AGI less: Greater of Itemized or Standard Deduction less: Exemption(s)

Taxable Income times: Tax Rate (using tax tables or rate schedules)

Gross Tax Liability less: Tax Credits and Prepayments

Tax Due or Refund

2014 Cengage Learning 5

Standard Deduction & Exemptions

2013 standard deduction

Single

Married Filing Joint (MFJ)

Qualifying Widow(er) also known as Surviving Spouse

Head of Household (HOH)

Married Filing Separate (MFS)

$ 6,100

12,200

12,200

8,950

6,100

*Plus additional amounts for blindness or over 65: $1,200 if MFJ,

MFS or qualifying widow(er) and $1,500 if HOH or Single

Exemption = $3,900/person

2014 Cengage Learning 6

Who Must File

Based on filing status and gross income

◦ Generally, if exemptions plus greater of standard or itemized deductions exceed income, then filing is not necessary

◦

•

•

If taxpayer is claimed as a dependent on another taxpayer’s return, dependent’s standard deduction is:

• Greater of $1,000 or

See Figures 1.1

Earned income + $350 and 1.2 on pages

But never more than standard deduction

1-7 and 1-8

2014 Cengage Learning 7

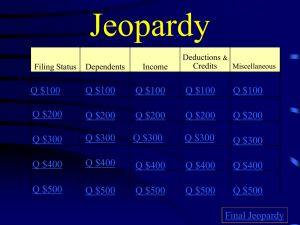

Filing Status

Single

◦ Unmarried or legally separated as of 12/31

◦ And not qualified as married filing separately, head of household or qualifying widow(er)

Married Filing Jointly (MFJ)

◦ If married on 12/31

– even if didn’t live together entire year

◦ Based on a 2013 Supreme Court ruling that struck down a portion of the Defense of Marriage Act (DOMA), same-sex couples may now file jointly

◦ If spouse dies during year, you can file MFJ in current year

Married Filing Separately (MFS)

◦ Each file separate returns

◦ Must compute taxes the same way - both itemize or both use standard

◦ If living in community property state, must follow state law

2014 Cengage Learning 8

Filing Status

Head of Household (HOH)

◦ Tables have lower rates than single or MFS

◦ Taxpayer can file as HOH if:

Unmarried or abandoned as of 12/31

Paid > 50% of cost of keeping up home that was principal residence of dependent child or other qualifying dependent relative

There is one exception to principal residence requirement. If dependent is taxpayer’s parent, he/she doesn’t have to live with taxpayer.

Note: A divorced parent who meets above rules and has signed

IRS/legal document, may still claim HOH even if dependency exemption shifted to ex-spouse

2014 Cengage Learning 9

Tax Computation

Seven brackets

o

10%, 15%, 25%, 28%, 33%, 35%, 39.6% o

Tax rate schedules for different filing types

Qualifying dividends and net long-term capital gains may be taxed at lower rates

o

Rates based on ordinary tax bracket

2014 Cengage Learning 10