Tax Returns - Trinity Catholic High School

advertisement

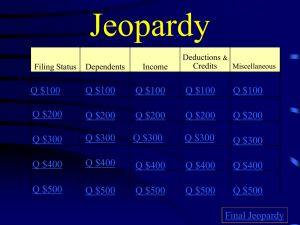

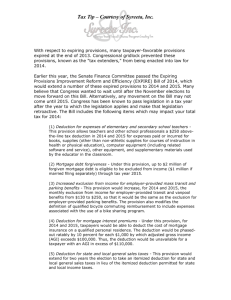

TAX RETURNS Economics WHY DO WE HAVE FEDERAL INCOME TAX? Market Economy – capitalist National defense Social Security Medicare Income assistance Environment Agriculture Interest on national debt DIFFERENT TYPES OF FEDERAL TAXES Social Security Taxes Corporate Income Tax Individual Income Tax WHAT IS INDIVIDUAL FEDERAL INCOME TAX? HOW IS IT PAID? HOW IS IT PAID? Primary revenue for the government Federal income tax is withheld from every paycheck Employers send the withholdings to the Internal Revenue Services January 31 of each year, employers must furnish employees a W-2 with income received and tax collected Social Security Tax The total income earned Medicare withheld Federal tax withheld Paid to you by your employer Or incurred on your behalf Verify SS # correct Employer ID Number must be completed Name and address correct Employer name and address correct BACKGROUND Wages, Salaries, Bonuses, and Commissions are compensation received by employees for services performed. Tips are gratuities for services performed Food service, baggage handlers, hair dressers Can be received in form of: Cash Goods and services Awards Tax benefits All are taxable income and must be reported on the federal individual tax returns The income should be reported on the W-2, 1099, or Wage and Tax Statement REMEMBER All wages, salaries, bonuses, commissions, and tips must be taxed and reported on federal tax returns EMPLOYER Send withheld taxes to the federal government Payroll taxes include Social Security (FICA) tax and Medicare tax Social Security – 4.2% Medicare – 1.45% REMEMBER: You completed W-4 form when you started a job determining the number of exemptions or any additional money to withhold for tax purposes TYPES OF INDIVIDUAL FEDERAL TAX RETURNS 1040EZ 1040 U.S. Individual Income Tax Returns 1040A Income tax return for Singles and Joint Filers with no dependents Individuals can file this form who have varied incomes and would like to take various deductions 1040X – Amended tax returns 1040EZ Most Simple Form Line 1 – W-2 Information Line 2 – taxable interest information Line 3 – Unemployment compensation Line 4 – Adjusted Gross income Add line 1, 2, and 3 Line 5 – exemption amount Line 6 – subtract line 5 from line 4 Line 7 – Federal Income Tax withheld from box 2 of W2 Line 10 – find tax by using tax table 1040 Line 7 – W2 income information Line 8 – Interest earned on money Deposited in deposit, savings, credit unions Used to buy CDs or bonds Lent to another person or business Can be taxable or tax exempt Reported on form 1099 Line 9 – 21 – income received from other sources Dividends, alimony, IRA distributions, Unemployment, capital gains or loss, social security benefits Sch C – business, Sch E – rental, Sch F - farm DEPENDENTS A person must meet requirements of either a “Qualifying Child” or a “Qualifying Relative” to be claimed as a dependent (Line 6d) OVERVIEW OF THE RULES You cannot claim any dependents if you, or your spouse if filing jointly, could be claimed as a dependent by another taxpayer You cannot claim a married person who files a joint return as a dependent unless that joint return is only a claim for refund and no tax liability You cannot claim a person as dependent unless that person is a U.S. citizen, U.S. resident aliens, U. S. national, or a resident of Canada or Mexico You cannot claim a person as dependent unless that person is your qualifying child or qualifying relative QUALIFYING CHILD Son, daughter, stepchild, eligible foster child, brother, sister, half brother, half sister, stepbrother, step sister, or a descendant of any of them Child under 19 years of age at the end of year, under age 24 at the end of year, a full time student, any age permanently and totally disable Child must live with you for more than ½ the year Child had support more than ½ the year Child not filing a joint return for the year QUALIFYING RELATIVE The person cannot be a qualifying child The person either related to you in one of the ways or must live with you all year in your household The person’s gross income for the year must be less than $3700 You must provide more than half of the person’s total support for the year FILING STATUS The filing status determines the rate at which income is taxed. There are five filing statuses: Single Married filing jointly Married filing separately Head of household Qualifying widow(er) with dependent child EXEMPTIONS There are two types of exemptions Personal exemptions for taxpayer and spouse Dependency exemptions for dependents Each exemption reduces the income that is subject to tax by the exemption amount. In 2011, the exemption amount is $3700 Taxpayers cannot claim an exemption for a person who can be claimed as a dependent on another tax return Line 42 STANDARD DEDUCTION The standard deduction reduces the income that is subject to tax. The amount of the standard deduction depends on the filing status, the age of the taxpayer and spouse, whether the taxpayer or spouse is blind, and whether the taxpayer can be claimed as a dependent on another taxpayer’s return 2011 STANDARD DEDUCTION Single $5,800 Head of Household $8,500 Married filing a joint return $11,600 Qualifying widow(er) with dependent child $11,600 Married filing a separate return $5,800 The standard deduction is increased for taxpayers and spouses who are age 65 or older or who are blind The standard deduction may be reduced for taxpayers who can be claimed as dependents on another taxpayer’s return For 2011, the standard deduction for a taxpayer who can be claimed as a dependent on another taxpayer’s return is Earned income plus $300 But not less than $950 And not more than the standard deduction for single filing status ($5800) CHILD TAX CREDIT AND ADDITIONAL CHILD TAX CREDIT The child tax credit allows taxpayers to claim to tax credit of up to $1000 per qualifying child under the age of 17. When a taxpayer’s child tax credit is more than their tax liability, they may be eligible to claim an additional child tax credit as well as the child tax credit. TAX CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES A tax credit is a dollar-for-dollar reduction of the tax. The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of children under age 13 and for a disabled spouse or dependent. The maximum amount of qualifying expenses is $3000 for one qualifying person and $6000 for two of more qualifying persons. The credit is between 20 and 25 percent for the qualifying expenses. Form 2441 Line 48 TAXPAYER REQUIREMENTS Incur expenses in order to work or look for work Earn income for work performed during the year File a joint return, if married Maintain a home that was also the home of qualifying person Pay the expenses to someone other than the taxpayer’s child under age 19 or the taxpayer’s dependent claimed on the tax return CHILD OR DEPENDENT REQUIREMENTS Child, under the age of 13, for whom a dependency exemption is claimed Dependent, or a person who could be claimed as a dependent if his or her gross income was less than the exemption amount, who is physically or mentally incapable of self-care Spouse who is physically or mentally incapable of self-care EXPENSE REQUIREMENTS Household services Care services EDUCATION CREDITS Taxpayers have two credits available to help offset the costs of higher education, by reducing their income tax. Requirements Taxpayer’s filing status and AGI or MAGI Eligible education institution Qualified tuition and related expenses Form 8863 Line 49 EARNED INCOME CREDIT Earned income credit is a refundable tax credit for certain people who work and whose earned income and adjusted gross income are under a specific limit Form EIC Line 64 REFUND, AMOUNT DUE, AND RECORD KEEPING Refunds When total tax payments are greater than the total tax Receive the refund by direct deposit Received a split refund dividing your refund, up to three different accounts Receive the refund by check via mail Apply the refund to the estimated tax for the following year CONTINUE Request a deposit of their refund to a TreasuryDirect online account Use their refund to buy up to $5000 US Series I Savings Bonds Use their refund to begin a savings program and to plan for retirement Amount Due When the total tax is greater than the total tax payments Pay by check or money order Pay by credit card Pay by direct debit from an account at a financial institution Taxpayers who cannot make payment in full need to contact the IRS Record Keeping It is important that taxpayers keep good records Identify sources of income Keep track of expenses Prepare tax returns quickly and accurately Support items reported on tax returns Keep track of the basis of property Taxpayers need to keep tax-related documents for at least three years TRANSMISSION OR FILE Tax Return Preparation Manual By mail Electronic Online, self prepared Authorized IRS e-file provider Volunteer Income Tax Assistance (VITA) sites TCE (Tax Counseling for the Elderly) sites operated by AARP Paid tax preparers SELF-EMPLOYMENT INCOME AND THE SELF EMPLOYMENT TAX Self employed individuals are independent contractors, not employees. Report on Schedule C – income, expenses, profits (line 12) Self Employed taxes are reported on Form SE INDEPENDENT CONTRACTORS Perform services for others Are self-employed Are their own bosses Report their earnings on Form 1099 Report self employment income, expenses, and profit or loss on Schedule C Calculate the self employment tax on Schedule SE Report the self employment tax on form 1040 THE PERFECT TAX STRUCTURE 1. Provide desirable incentives to work, save and invest 2. Is viewed as fair 3. Is easy to understand, and 4. Generates sufficient revenues to fund spendings decisions KINDS OF TAXES Proportional taxes – take the same percentage of income from people in all income groups Progressive taxes – take a larger percentage of income from people in higher-income groups than from people in lower-income groups Regressive taxes – take a larger percentage of income from people in lower-income groups than from higher income groups