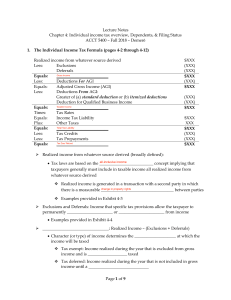

STUDY GUIDE FOR TEST 1 – INCOME TAX CHAPTER 1 Be able to identify what qualifies as a tax Know all terminology in the chapter Be able to calculate taxes Know how to calculate the effective tax rate Know how to calculate the marginal tax rate CHAPTER 2 Know taxpayer filing requirements Understand statute of limitations Know taxpayer due date and extensions Study tax professional responsibilities o Statement on Standards for Tax Services o IRS Circular 230 Know taxpayer and tax practitioner penalties CHAPTER 4 Know individual income tax formula Be able to calculate gross income Understand exclusions and deferrals Know what goes on “For AGI” vs. “From AGI” Know the itemized deductions Know the character of income Understand tax credits and tax prepayments Study Dependency requirements, qualifying child and qualifying relative Know and be able to identify the filing status CHAPTER 5 Know what is included in Gross Income (economic benefit, realization and recognition) Study all the principles in this chapter Study when taxpayers recognize income (accounting methods, constructive receipt and claim of right) Study who recognizes the income (community property vs. common law systems) Know the types of income (income from services, property and other sources) Understand exclusion provisions