Overview EU-wide Stress Test 2014

advertisement

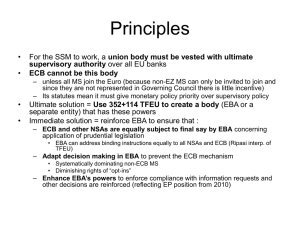

Overview EU-wide Stress Test 2014 Mario Quagliariello – Head of the Risk Analysis Unit 24/07/2014 - PRUEBAS DE ESTRÉS - La Visión del Regulador y el Impacto en la Banca JORNADA DEL CLUB DE GESTIÓN DE RIESGOS - Madrid Agenda 1 Context 2 Key features 3 Process and timeline 2 It's a long way to the ST … It's a long way to go… EU-wide stress test 2011 Pre-emptive capital raising Credit sensitivities Disclosure (capital and sovereign) EU-wide recapitalisation 9% after sovereign buffer EUR 204bn capital strengthening CT1 ratio of 11.7% comparable to US EU CT1 sufficient if RWA can be trusted EU-wide stress test 2014 AQRs EBA recommendation Common definition of NPL and forbearance CAs responsibility PIT assessment of capital, with minimum threshold Forward looking assessment and reaction function Significant frontloading RWA consistency Ongoing, leading to supervisory consistency, transparency and benchmarking 3 Capital strengthening: from the EBA recap exercise to “frontloading” ahead of stress test Tier 1 ratio – excluding hybrids (weighted average, 55 EU banks, source: KRI, RAR) T1 ratio excluding hybrid instruments after the EBA’s 2011 Recommendation reached 11.6% December 2013 (from 9.2% in Dec-2011). Capital offerings continued in Q4 2013 and first half of 2014, both common equity and hybrids. Total issuance of AT1 CoCos by EU banks in 2014 (as of 27 May, billion EUR, 10 EU banks, Source: Bloomberg, EBA calculations) Issuance of equity has allowed the cleaning of balance sheets (additional provisions) and contributed to strengthening banks, with completed and announced deals since July 2013 amounting to EUR 45 billion (SSM banks - 49 banks out of the 128). AT1 CoCos issuance (EU banks) around EUR 22bn during 2014 (as of 27 May). • 19 AT1 offerings of 10 EU banks in Q2 2014, compared to 8 offerings in total in 2013. 4 De-risking, deleveraging and cleaning of balance sheets Total assets and Risk-weighted assets – EUR tn, and specific allowances for loans (source: Risk Dashboard) European banks have accomplished significant adjustments on the asset side by • cutting risky assets (de-risking); • shrinking their balance sheets (deleveraging); • cleaning balance-sheets provisioning). (loan sales and increasing The adjustment accelerated towards the end of 2013 (cut-off date for the AQR and the stress test). Banks have been frontloading impairments: additional provisioning of EUR 25bn between Jun2013 and Dec2013. Also the recent increase in NPLs might to some extent reflect the new EBA definitions, contributing to a more reliable picture. Positive developments, but no room for complacency. The AQR has to assess the reliability of balance sheets and banks may end up needing additional capital. Banks and supervisors need to be prepared and ready to take actions as a result of these exercises. 5 Agenda 1 Context 2 Key features 3 Process and time line 6 Who does what Common methodology, templates Data hub for final dissemination European Systemic Risk Board European Commission • Common scenario (in cooperation with ECB, NCAs) 28 Nations, 28 National Supervisory Authorities and ECB • • Responsibility for the quality assurance Assessment of the reliability and robustness of banks’ assumptions, data, estimates and results Definition and communication of any additional sensitivities Supervisory reaction function Non-SSM National Competent Authorities SSM ECB, National Competent Authorities • • Joint work and information sharing • • European Banking Authority 124 banks in 2014 EU-wide stress test • 20 Non-SSM banks 104 SSM banks Calculation of bottom-up stress test results 7 What drives the EBA stress test methodology Why an EU-wide stress test? Comparable and transparent identification of potential risks across the entire EU Comprehensive, consistent and relevant scenario Tools Constrained bottom-up methodology (key features, risk quantification, templates for data collection) Benchmarks Transparency Detailed disclosure to inform supervisors and market participants Cooperation Cooperation amongst supervisors and other involved parties 8 Overview key features (1/2) Consolidation Scenario Time-horizon and reference date Capital • Highest level of consolidation • Perimeter of the banking group as defined by the CRD/CRR • Common baseline and adverse macro-economic scenarios and stressed market parameters for positions sensitive to a change of market prices • CAs may develop additional sensitivities to incorporate country specific features • Consolidated year-end 2013 figures • Scenarios applied over a period of three years (from 2014 to 2016) • CET1, with transitional arrangements; CoCos converting into CET1 or written down upon trigger are reported if trigger is above the CET1 ratio in the adverse scenario • CAs may, in addition, assess the impact of the stress test on other yardsticks • Common application of prudential filters 9 Overview key features (2/2) Hurdle rate • 8% Common Equity Tier 1 ratio for the baseline scenario • 5.5% Common Equity Tier 1 ratio for the adverse scenario • CA may calibrate possible supervisory measures based on a ladder of intervention points and set higher hurdle rates Static balance sheet • Zero growth assumption for baseline and adverse scenario and same business mix • Assets and liabilities that mature replaced with similar financial instruments in terms of type, credit quality and original maturity; no workout of defaulted assets • Exemption due to mandatory restructuring plans announced before reference date Risk coverage • Solvency stress test – credit risk, market risk, sovereign risk, securitisation, cost of funding, non-interest income and costs, operational risk; no liquidity stress test • CAs may include additional risks but results reported under common approach Process • EBA responsible for common methodology, templates, disclosure • Competent authorities responsible for quality assurance, additional sensitivities/scope/yardsticks, reaction function • Outcome of AQR may inform starting point 10 Overview disclosure: 9 templates, 12k data points P&L • Main P&L items like net interest income, net trading income, impairments for financial assets and other comprehensive income ~130 Credit risk • Exposure, RWA, value adjustments, provisions, default and loss rates • No disclosure of credit risk parameter Market risk • Market risk position by main risk types ~40 • Securitisation exposure, RWA and impairments ~50 Securitisation Sovereign RWA Capital • Sovereign exposure by country, maturity and accounting treatment ~6,500 ~4,930 • RWA by risk type ~50 • Capital position, components, adequacy including, stressed • Capital restructuring ~310 11 Agenda 1 Context 2 Key features 3 Process and time line 12 Tentative time line April Preparation Calculation May June July August September October Finalisation methodology, templates, scenario Advance data collection Iteration with banks ST calculation by banks Disclosure Disclosure preparation 29/04/14 Publication methodology, templates, scenario Workshop with banks Submission first results to EBA via CAs EBA feedback on results to CAs Publication of results Milestones Publication ECB benchmarks Submission close-tofinal results to EBA 13 Process is ongoing and on track (1/2) The publication of the stress test methodology and scenarios took place on 29 April 2014. An EBA “Q&A” process is in place to ensure immediate support to banks and supervisors. • We have received more than 1000 questions from banks and published on the EBA extranet. • The EBA QA team is liaising with the ECB as well as NCAs for more complex or controversial issues. Banks have submitted the data for the advance data collection and preliminary results. • The EBA has run statistical quality checks and provided feedback to NCAs • The EBA distributed benchmarks on the stress test starting point in June to NCAs as originally planned and currently working on “deltas”. • Benchmarks to be used as part of the quality assurance process NCAs and ECB are carrying out 14 Process is ongoing and on track (2/2) The EBA is currently discussing details of communication in liaison with SSM colleagues as well as non SSM countries. • Including disclosure of additional national sensitivities, and • Stress test outcome for subsidiaries • Possible additional yardsticks/metrics to be disclosed • Interaction with banks EBA is facilitating the cooperation and coordination between home and host authorities in the stress test as well as in the AQR Quality assurance and join-up of AQR and ST, led by competent authorities, are key for the success of the exercise. 15 EUROPEAN BANKING AUTHORITY Tower 42, 25 Old Broad Street London EC2N 1HQ Tel: +44 2073821770 Fax: +44 207382177-1/2 E-mail: info@eba.europa.eu http://www.eba.europa.eu