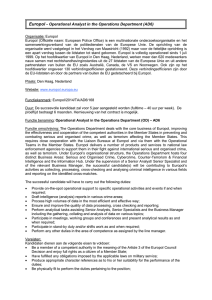

Europol for the EU

advertisement

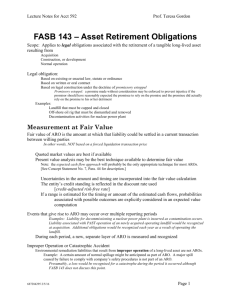

Europol Unclassified – Basic Protection Level Taiex workshop on strengthening national and international co-operation in asset recovery Ankara, 21-23 May 2012 Burkhard Mühl, Senior Specialist Europol Criminal Assets Bureau Asset seizure and confiscation • 70 % of all crimes are committed for financial gain - Confiscation attacks this core motive and prevents that criminal wealth be used for other crimes • It allows to target the decision-makers within criminal organisations • It may have a deterrent effect (“crime does not pay”) and help removing negative role models • Criminals and their illegal profits move almost effortlessly across the borders • Relatively limited number of confiscation cases in the EU and modest amounts recovered if compared to estimated revenues of organised crime groups 2 Europol Criminal Assets Bureau Responsibilities of ECAB Operational • To provide support to all mandates crime areas in order to identify and seize/freeze criminal assets • To directly support Member States in tracing criminal assets located outside their jurisdictions Strategic • To support Member States in the establishment of Asset Recovery Offices in line with European Law (Council Decision 2007/845/JHA) and to facilitate the information exchange between them via the Europol SIENA System • To hold the permanent Secretariat of the ‘The Camden Asset Recovery Inter-Agency Network – CARIN ‘ • To manage The Europol Financial Crime Information Centre Web Site – FCIC 3 3 EU Council Decision on Asset Recovery Office(s) What is it’s purpose? • Obliges every Member State to set up ARO Principal obligation to set up/ designate 1 (or 2) AROs per Member State - Legal/constitutional set-up of every MS • Creates legal EU framework for existing informal network CARIN • Establishes legal obligation for co-operation between AROs of different legal nature EU Council Decision on Asset Recovery Office(s) Background • CARIN Network • Austrian Presidency initiaitive, supported by Belgium and Finland ARO = Office charged with • the facilitation of the tracing and identification of proceeds of crime and other crime related property (!) which may become the object of an order made by a competent judicial authority for freezing or seizure or for confiscation in the course of criminal or, as far as possible under the national law of the Member State concerned, civil proceedings. EU Council Decision on Asset Recovery Office(s) Obligation to exchange infomation and best practices • Regardless of legal nature of ARO • Reference to the Framework Decision on simplifying the exchange of information between the law enforcement authorties of the MS of the EU - Procedures, Channel,Data protection regime, Time limits • Co-operation is aimed at exchanging information on location and identification of seizable property = police co-operation Conclusion FD AROs EU Council Decision on Asset Recovery Office(s) = • important ‘instutional brick’ in the EU framework for confiscation of criminal proceeds • Mutual recognition of freezing orders/confiscation orders is contingent upon the swift exchange of information between AROs INDICATORS TO MEASURE THE EFFECTIVENESS OF AROS 1. Direct or indirect powers to freeze assets 2. Level of access to existing databases and registers 3. Ease of access to financial information (formally or informally, without a court order 4. Access to a secure system of information exchange 5. Level of involvement in asset management (ensuring the cohesion of the confiscation chain). 8 INDICATORS TO MEASURE THE EFFECTIVENESS OF AROS 6. Level of involvement of CARIN contact points in their activities (thus preventing the duplication of efforts) 7. Success in regularly meeting time limits stipulated in the Swedish initiative 8. Ability of keeping statistics on their activities and access to judicial statistics. 9. Resources & capacity (with respect to needs eg capacity to act as a central contact point, minimum number of financial investigators) 10 . Availability and participation in appropriate training. 11. 9 Level of multidisciplinarity in ARO composition. ARO SIENA Project √ A direct link for AROs to SIENA is recommended √ Provides High security standards for exchanging sensitive information √ 17 AROs are already added as a subgroup under SIENA: Austria, Belgium, Bulgaria, Cyprus, Denmark, Estonia, Finland, France, Germany, Hungary, Lithuania, Luxembourg, Netherlands, Poland, Slovak Republic, Spain, United Kingdom √ Recommended to forward SIENA requests also to the Europol Criminal Assets Bureau (ECAB) 10 The role of Europol in the information exchange between AROs √ Through Europol Criminal Asset Bureau access to Europol databases and capacities: Analysis Cross-matching Identification of new leads √ Co-operation with third countries with operational Europol agreement: Australia, Canada, Croatia, Iceland, Norway, Switzerland, USA, Monaco 11 Co-operation with Third Parties ARO SIENA Statistics 2011 Sent Received DE.ARO 41 ES.ARO 23 FR.ARO 22 FI.ARO 14 UK.ARO 12 EE.ARO 10 NL.ARO 6 BG.ARO 5 LT.ARO 5 HU.ARO 5 DK.ARO 4 BE.ARO 4 LU.ARO 3 CY.ARO 1 SK.ARO 1 Grand Total DE.ARO ES.ARO FR.ARO EE.ARO FI.ARO DK.ARO SK.ARO UK.ARO 50 23 19 16 14 8 3 1 Grand Total 156 134 ARO SIENA Statistics 2012 (1st quarter) Sent DE.ARO FR.ARO FI.ARO10 ES.ARO UK.ARO EE.ARO BG.ARO AT.ARO LT.ARO2 PL.ARO DK.ARO NL.ARO Grand Total Received 15 10 7 4 3 3 2 2 2 1 61 DE.ARO ES.ARO FR.ARO EE.ARO FI.ARO4 DK.ARO Grand Total 31 8 7 6 2 58 Centralised bank account registers (CBRs) EU Internal Security Strategy: Five steps towards a more secure Europe, COM(2010)673, 22 November 2010: To help trace the movement of criminal finances, some MS have set up a central register of bank accounts. To maximise the usefulness of such registers for law enforcement purposes, the Commission will in 2012 develop guidelines. ARO Platform • Established in 2009 by the Commission and Europol to enhance co-operation and co-ordination of Asset Recovery Offices at EU level - (Council Decision 2007/845/JHA). • Identified a need to improve the access to centralised data bases, in particular to financial information in order to trace and identify bank accounts effectively across the EU • Sub-Working Group on centralised bank account registers (CBRs) established in March 2011 • First operational meeting held in June 2011 (Belgium, Bulgaria, Croatia, Czech Republic, Denmark, France, Italy, Luxembourg, Moldova, Netherlands, Portugal) Centralised bank account registers (CBRs) Seven countries so far have centralised bank account registers: Croatia - FINA, Germany - BaFin, France - FICOBA, Italy - National Tax Register, Portugal – Banco de Portugal, Romania – National Agency of Fiscal Administration and Slovenia - AJPES. Belgium has a central point of contact at the National Bank which performs a similar role. Some countries, e.g. Bulgaria, Czech Republic, Finland, Hungary, Slovakia and Spain are currently considering to introduce legislation establishing CBRs. 17 ARO Platform Sub Working Group Meeting at the COM on 15 March 2012 • Agreement to have a clear recommendation for the MS to establish a national centralised (or centrally accessible) bank account register in an electronic format, managed by a public authority. • Banks should provide information on the financial relationship with their customers. The CBR should collect information on bank accounts in general and this should include information on all financial products like saving accounts, loans, receivables, credit cards, debit cards, securities, trusts, insurance products, safety deposit boxes etc. ARO Platform Sub Working Group • Data on beneficial ownership of bank accounts and signatories should be included. Discussion has shown that this is a difficult issue, and more discussion might be needed. • Altough it would be ideal, the CBR should not include any details of transactions or the balance of the account. • Consent that online access to CBR is provided to law enforcement agencies in the course of a criminal investigation without the prior need for authorisation by judicial authorities • Law enforcement should be able to consult CBR also on 19 request of a foreign competent authority (ARO, FIU) without the need for an MLA procedure ARO Platform Sub Working Group • No clear position on whether national courts should have access to CBR for debt recovery purposes as this question might be outside the scope of the sub working group. CARIN 58 Members 48 Countries / Jurisdictions: Albania, Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Israel, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta, Moldova, Monaco, Montenegro, The Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States of America 9 International Organisations: Europol, Egmont Group, Eurojust, International Criminal Court (ICC), International Monetary Fund (IMF), Interpol, OLAF, United Nations Office on Drugs and Crime (UNODC), World Bank 21 WORLD CARIN ARINSA RRAG Thank you for your attention! Burkhard Mühl, MA Senior Specialist Europol Criminal Assets Bureau Tel.: +31(0)703531623 Mobile: +31(0)652560497 burkhard.muhl@europol.europa.eu