FASB 143 – Asset Retirement Obligations

advertisement

Lecture Notes for Acct 592

Prof. Teresa Gordon

FASB 143 – Asset Retirement Obligations

Scope: Applies to legal obligations associated with the retirement of a tangible long-lived asset

resulting from

Acquisition

Construction, or development

Normal operation

Legal obligation:

Based on existing or enacted law, statute or ordinance

Based on written or oral contract

Based on legal construction under the doctrine of promissory estoppel

Promissory estoppel: a promise made without consideration may be enforced to prevent injustice if the

promisor should have reasonably expected the promisee to rely on the promise and the promisee did actually

rely on the promise to his or her detriment

Examples:

Landfill that must be capped and closed

Off-shore oil rig that must be dismantled and removed

Decontamination activities for nuclear power plant

Measurement at Fair Value

Fair value of ARO is the amount at which that liability could be settled in a current transaction

between willing parties

In other words, NOT based on a forced liquidation transaction price

Quoted market values are best if available

Present value analysis may be the best technique available to determine fair value

Note: the expected cash flow approach will probably be the only appropriate technique for most AROs.

[See Concept Statement No. 7, Para. 44 for description.]

Uncertainties in the amount and timing are incorporated into the fair value calculation

The entity’s credit standing is reflected in the discount rate used

[credit-adjusted risk-free rate]

If a range is estimated for the timing or amount of the estimated cash flows, probabilities

associated with possible outcomes are explicitly considered in an expected value

computation

Events that give rise to ARO may occur over multiple reporting periods

Examples: Liability for decommissioning a nuclear power plant is incurred as contamination occurs.

Liability associated with PAST operation of an newly acquired operating landfill would be recognized

at acquisition. Additional obligations would be recognized each year as a result of operating the

landfill.

During each period, a new, separate layer of ARO is measured and recognized

Improper Operation or Catastrophic Accident

Environmental remediation liabilities that result from improper operation of a long-lived asset are not AROs.

Example: A certain amount of normal spillage might be anticipated as part of ARO. A major spill

caused by failure to comply with company’s safety procedures is not part of an ARO.

Presumably, a loss would be recognized for a catastrophe during the period it occurred although

FASB 143 does not discuss this point.

687284295 2/5/16

Page 1

Lecture Notes for Acct 592

Prof. Teresa Gordon

Initial Recognition

The period in which an asset retirement obligation (ARO) is recognized:

If a reasonable estimate can be made -- when it is incurred

If a reasonable estimate cannot be made initially – when it becomes possible to make a

reasonable estimate of the fair value of the liability

To offset the liability, the entity will increase {debit} the carrying amount of the related longlived asset by the same amount as the ARO liability recorded

Subsequent Recognition and Measurement

Period-to-period changes in ARO are recognized differently:

1. related to the passage of time

2. related to revisions in assumption about timing or amount of cash flows

First step:

Measure and incorporate changes in liability due to passage of time to arrive at a new

carrying value

Use an interest rate method applied to beginning balance using the original creditadjusted risk-free discount rate

The change is called an accretion expense and is classified as an operating expense on the

income statement.

Note that it is computed like interest expense and is based on the discount rate used when the ARO

was established

Second step:

Measure changes resulting from revisions to assumptions

Upward revisions: use current credit-adjusted risk-free discount rate

Downward revisions: use original credit-adjusted risk-free discount rate

Downward revisions may also use a weighted-average credit-adjusted risk-free

discount rate

Recognize as an increase in the carrying value of the related long-lived asset {the debit}

and an increase in the ARO {the credit}.

Note that this does not immediately affect the income statement. But the

amount of ARO asset depreciated in the current and future years will be

increased or decreased accordingly

Transition

Effective for fiscal years beginning AFTER June 15, 2002

Companies will have to retroactively recognize ARO assets and liabilities.

The effect on current year will be included in operating income

The effect on prior years will be presented net of tax as a cumulative effect of a change in

accounting principle

687284295 2/5/16

Page 2

Lecture Notes for Acct 592

Prof. Teresa Gordon

EXAMPLE 1 – Asset Retirement Obligation

A waste management company opens a landfill on January 1, 2003. It is legally required to

properly cap and close the landfill and restore the surface of the land for alternative use. The

estimated useful life of the landfill is 12 years. The land was purchased in 2001 for $600,000.

Upon closure, the land will be donated to the country for a park. The estimated value of the tax

deduction related to the gift is $200,000. The cost incurred during 2002 to ready the property for

use as a landfill was $800,000. The estimated capacity of the landfill is 120,000 tons of garbage.

Level of usage is expected to be constant over the life of the landfill.

The company uses the following assumptions to compute the fair value:

1. Labor costs based on current marketplace wages:

Estimated Cash

Probability

Expected Cash

Flows

Assessment

Flows

$300,000

25%

$375,000

50%

$450,000

25%

2.

3.

4.

5.

6.

7.

Expected overhead rate = 80% of direct labor costs

Expected cost of materials for closure = $85,000

Normal profit margin for contractors in this industry = 20%

Risk premium that a contractor would demand for bearing the uncertainty of a commitment

this far into the future = 7% of the estimated inflation-adjusted cash flows

The risk-free rate of interest on January 1, 2003 is 4%. The credit standing adjustment is 8%

for a total discount rate of 12%

Assumed inflation rate = 3%

Initial ARO Liability at January 1, 2003

Expected labor and material costs

Allocated overhead

$

$

460,000

300,000

760,000

152,000

912,000

1.425761

1,300,294

91,021

1,391,315

$

357,116

375,000 * 80%

Markup on direct costs

$760,000 * 20%

Expected cash outflow before inflation

Inflation factor

3% for 12 periods

Inflation adjusted cashflow

Market risk premium

1,300,294 * 7%

Expected future cash outflow at closure of landfill =

Present value

687284295 2/5/16

12% for 12 periods

Page 3

Lecture Notes for Acct 592

Prof. Teresa Gordon

Computing depreciation or depletion expense:

Historical cost of land

Preparation costs

Residual value

Asset retirement obligation capitalized

$

$

$

600,000

800,000

(200,000)

Depreciation base

Estimated capacity in tons of garbage

120,000

Depletion or depreciation rate per ton

$

Accretion expense is based on the ARO capitalized. Multiply the beginning of the year balance

in the ARO liability by the credit-adjusted risk-free rate (the same rate used to discount the future

cash flows).

The following schedule of expenses assumes that there is no need to revise any of the

assumptions that affect anticipated future cash flows.

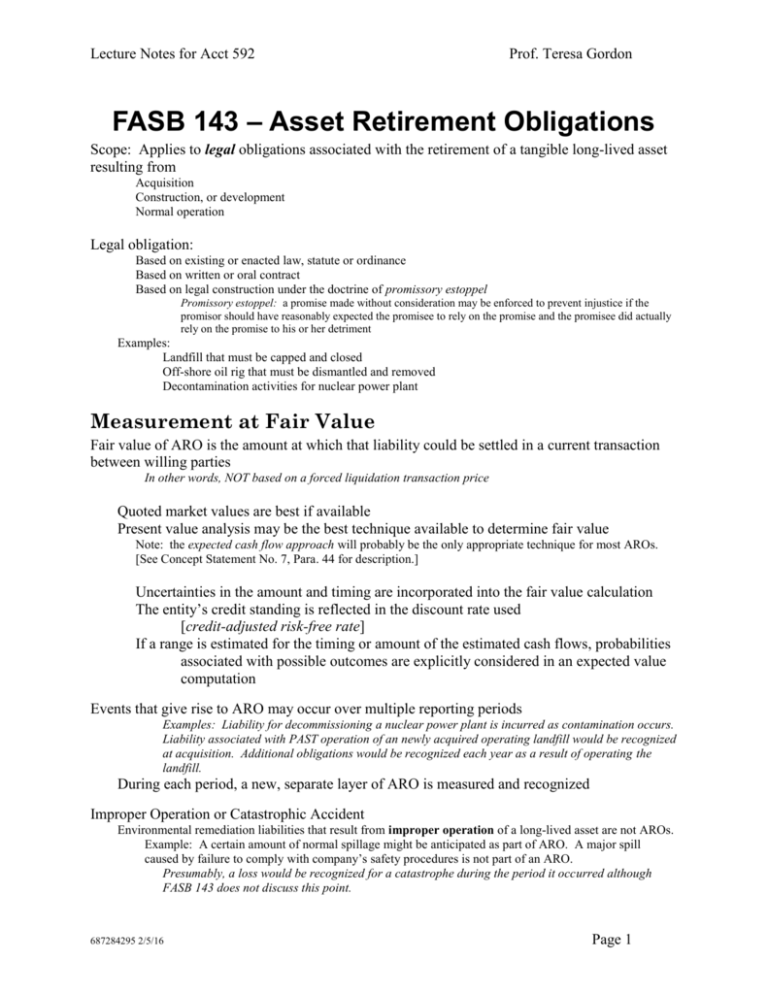

Year

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

687284295 2/5/16

ARO - BOY

357,116

399,970

447,966

501,722

561,929

629,360

704,883

789,469

884,206

990,310

1,109,147

1,242,245

ARO - EOY

399,970

447,966

501,722

561,929

629,360

704,883

789,469

884,206

990,310

1,109,147

1,242,245

1,391,315

12% $

12.98

Accretion

Depreciation

Expense

Expense

42,854

129,760

47,996

129,760

53,756

129,760

60,207

129,760

67,431

129,760

75,523

129,760

84,586

129,760

94,736

129,760

106,105

129,760

118,837

129,760

133,098

129,760

149,069

129,760

1,034,199

1,557,116

Total Expense

172,614

177,756

183,516

189,966

197,191

205,283

214,346

224,496

235,864

248,597

262,857

278,829

2,591,315

Page 4

Lecture Notes for Acct 592

Prof. Teresa Gordon

Example 2 – Same facts as Example 1 EXCEPT:

New regulations are announced in early 2008. The projected costs are consequently expected to

increase by the following amounts. All other assumptions remain the same.

Labor increases by

Materials increase by

Credit-adjusted risk-free rate

15% $

50% $

10%

56,250

42,500

Since this is an UPWARD adjustment in the ARO, the increase is computed using the current

credit-adjusted risk-free rate.

Expected increase in labor and material costs

Allocated overhead on direct labor

* 80%

Markup on direct costs

* 20%

Expected cash outflow before inflation

Inflation factor

3% for 7 periods

Inflation adjusted cashflow

Market risk premium

Expected future cash outflow at closure of landfill =

Present value

10% for 7 periods

The accretion cost on this new ARO will use the discount rate from 2008 (not the original one

from 2003). Consequently, it is probably easier to compute the additional accretion expense in a

new set of columns.

For the depreciation expense, we first have to determine the carrying value of the landfill

BEFORE the change in the assumptions – at the end of 2007. Then we re-compute the

depreciation rate over the remaining useful life.

Historical cost

Initial ARO recognized

1,400,000

357,116

1,757,116

Less accumulated depreciation

Carrying value at end of 2007

Upward adjustment to ARO

Less salvage value

(200,000)

Depreciation base

Remaining capacity in tons of garbage

Revised rate per ton

687284295 2/5/16

Page 5

Lecture Notes for Acct 592

Prof. Teresa Gordon

Upward Revision of Cash Flows for Landfill Example

Initial ARO

ARO - BOY

ARO EOY

Upward Revision in ARO

12%

Accretion

Expense

ARO - BOY

ARO - EOY

10%

Accretion

Expense

Depreciation

Expense

Total

Expense

2003

357,116

399,970

42,854

129,760

172,614

2004

399,970

447,966

47,996

129,760

177,756

2005

447,966

501,722

53,756

129,760

183,516

2006

501,722

561,929

60,207

129,760

189,966

2007

561,929

629,360

67,431

129,760

197,191

2008

629,360

704,883

75,523

2009

704,883

789,469

84,586

2010

789,469

884,206

94,736

2011

884,206

990,310

106,105

2012

990,310

1,109,147

118,837

2013

1,109,147

1,242,245

133,098

2014

1,242,245

1,391,315

149,069

1,034,199

687284295 2/5/16

Page 6

Acct. 315 – Spring 2003

Solutions

Homework Exercises:

1.

Joseph Company acquired a tract of land containing an extractable natural resource. Joseph is

required by the purchase contract to restore the land to a condition suitable for recreational use

after it has extracted the natural resource. Geological surveys estimate that the recoverable

reserves will be 2,500,000 tons and that the land will have a value of $1,000,000 after

restoration. Relevant cost information follows:

Land ................................................. $9,000,000

Asset retirement obligation (asset).... 1,500,000

a.

b.

c.

What should be the depletion charge per ton of extracted material?

If the beginning balance in the asset retirement obligation (liability) account is $1,500,000 at

1/1/01 and the credit-adjusted risk-free discount rate used to determine the ARO was 8%, what

accretion expense be for 2001 and 2002?

What is the balance in the ARO liability account at 12/31/02?

687284295 2/5/16

Page 7

Acct. 315 – Spring 2003

Solutions

2.

A Fairfax Inc. is legally responsible for decontamination procedures associated with operating

a chemical plant it acquired on January 1, 2001 for $50,000,000. The acquisition cost was

attributed as follows: $48,000,000 for the plant and $2,000,000 for the land. The future cash

flows for decontamination were analyzed and discounted back to the present using a 5% creditadjusted risk-free rate. The asset retirement obligation was initially recognized at $2,000,000.

The expected useful life of the plant is 25 years. At the end of its useful life and after

decontamination, the plant should be worth $4,000,000 (not including the value of the land).

Fairfax uses the straight-line method to depreciate buildings and related manufacturing

facilities.

1.

What amount of depreciation expense should be recognized for 2001?

2.

What amount will be recognized as accretion expense for 2001?

3.

What amount will be recognized as accretion expense for 2002 assuming that no revisions in

assumptions regarding the asset retirement obligation are considered necessary?

4.

What is the ending balance in the asset retirement obligation on 12-31-02?

687284295 2/5/16

Page 8

Acct. 315 – Spring 2003

Solutions

Asset retirement obligation – Example 1 – year 2

Measurement of change in cashflows

Labor increases by

Materials increase by

Expected labor and material costs

Allocated overhead

$

56,250

Expected increase

Markup

Expected cash outflow before inflation

Inflation factor

Inflation adjusted cashflow

Market risk premium

Expected future cash outflow at closure of landfill =

Remaining useful life:

Present value

15% $

50% $

80%

20%

3%

7%

10%

56,250

42,500

98,750

45,000

143,750

28,750

172,500

1.229874

212,153

14,851

227,004

116,489

7periods

7 periods

Revised depreciation expense (current and prospective method)

Historical cost

1,400,000

Initial ARO recognized

357,116

1,757,116

Less accumulated depreciation

(648,798)

Carrying value at end of 2007

1,108,318

Upward adjustment to ARO

116,489

1,224,806

Less salvage value

(200,000)

Depreciation base

1,024,806

Remaining capacity in tons of garbage

Revised rate per ton

687284295 2/5/16

$

70,000

14.64

Page 9

Acct. 315 – Spring 2003

Revised Schedule of Expenses

and assuming that no adjustments of assumptions need to be made

12%

Initial ARO

Accretion

Year

ARO - BOY

ARO - EOY

Expense

2003

357,116

399,970

42,854

2004

399,970

447,966

47,996

2005

447,966

501,722

53,756

2006

501,722

561,929

60,207

2007

561,929

629,360

67,431

2008

629,360

704,883

75,523

2009

704,883

789,469

84,586

2010

789,469

884,206

94,736

2011

884,206

990,310

106,105

2012

990,310

1,109,147

118,837

2013

1,109,147

1,242,245

133,098

2014

1,242,245

1,391,315

149,069

1,034,199

Solutions

10% $

14.64

Upward Revision in ARO

Accretion

Depreciation

ARO - BOY

ARO - EOY

Expense

Expense

129,760

129,760

129,760

129,760

129,760

116,489

128,138

11,649

146,401

128,138

140,952

12,814

146,401

140,952

155,047

14,095

146,401

155,047

170,551

15,505

146,401

170,551

187,607

17,055

146,401

187,607

206,367

18,761

146,401

206,367

227,004

20,637

146,401

110,515

1,673,605

Total Expense

172,614

177,756

183,516

189,966

197,191

233,573

243,801

255,232

268,010

282,293

298,259

316,107

2,818,318

ok

Check:

Historical cost:

ARO initial

ARO adjustment

Salvage

$

$

687284295 2/5/16

Page 10

1,400,000

357,116

116,489

(200,000)

1,673,605

ok

Acct. 315 – Spring 2003

Solutions

Homework Exercise – Solution, Problem 1

1. Asset Retirement Obligation and Depletion – Joseph Co.

a.

What should be the depletion charge per ton of extracted material?

(9,000,000 cost + 1,500,000 ARO – 1,000,000 RV)/2,500,000 tons = 3.80

b.

If the beginning balance in the asset retirement obligation (liability) account is

$1,500,000 at 1/1/01 and the credit-adjusted risk-free discount rate used to determine

the ARO was 8%, what accretion expense be for 2001 and 2002?

For 2001: 1,500,000 * .08 = $120,000 accretion expense

For 2002: (1,500,000 + 120,000) * .08 = $129,600 accretion expense

c.

What is the balance in the ARO liability account at 12/31/02?

1,500,000 + 120,000 + 129,600 = $1,749,600

687284295 2/5/16

Page 11