Document

Mutual Funds

Definition: A Mutual Fund is a institution which collects small amount of money from retail investors and invest the pool money in the stock, debt and money market and pay the investors dividend in form of units.

The units can be sold off by the investors to realize money from their investment

Type of Mutual Fund

On the basis of their organization Mutual

Fund may be i.

Unit Trust ( is a British form of organization where the investor can enter the investment once and exit once) ii. Mutual Fund ( Is the US equivalent of

Unit Trust and it has exit and entry point at the will of the investor)

On the basis of continuity MFs can be: i.

Close ended: It has a period in which the investor can invest and it has a closing time when all investments are redeemed.

ii. Open ended: It starts the investment on a certain day and the investors can keep on purchasing the MF until the MF closes down. They can also sell off their holding at any point of time.

NFO or New Fund Offer:

This refer to the first time issuance of a new mutual fund in the market.

Generally, very specific market oriented MFs investment like, equity or sectarian fund, debt fund, money market fund or balanced finds are sold in the market in the NFO’s

NFO vs. IPO:

NFO refer to the issuance of a Mutual Fund

IPO refer to the issuance of equity share

NFO are issued by Asset management Companies

IPO’s are issued by Public Limited Companies

NFO is an investment oriented term for both the company and investors

IPO is investment for investors and capital issuance for companies

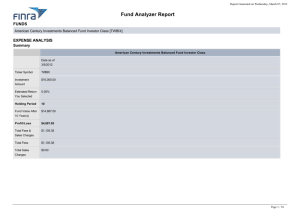

NAV: This refer to the term net asset value.

Investment in an MF means getting an asset by investors. The sum of these asset is the total value of the MF.

Total Market Value of the Asset – Administrative Charge –

Depreciation of the fund

NAV = ----------------------------------------------

The total numbers of the investment units held

Dividend In MF: Dividend in MF is NAV

Based.

At the end of an investment period say 1 month, 3monts or 1 year, a statement is issued to the investors stating the NAV and the units held by them.

The product of NAV and Units is the total divided available to the investor (s)

FUND Management: Each Mutual Fund by name will have a fund manager whoc will: i.

Act as the investment and portfolio guide to the fund under his control.

ii. He/she shall be responsible for all legal compliance iii. He/she will be responsible for the growth of the fund.

iv. He/she will reduce the market risk of the investment

AMFI and regulation:

Association of Mutual Fund In India (AMFI) is the body which regulates the MF’s in India.

It works in tandem with the SEBI and Stock exchanges for promoting investment habit and investment protection In India.

ROLE OF AMFI: i.

Monitor the MF’s ii.

Advice the MF’s iii. Conduct Exam for having qualified distributor for MF’s

Organization Of MF:

TRUST

Mutual Funds

Equity or sectSarian fund

Debt Fund Balanced Fund Index Fund

Money market fund

Advantage: i.

Easy to invest ii. No need to understand the market iii. Professional help iv. Easily available v. Constantly Upgraded vi. NAV is public information vii. Legal protection

Disadvantage:

1. Subjected to market risk

2. No special protection law

3. Very difficult to judge one fund from another

Some terms in MF:

1. Front and Back Load: Administrative charges paid while entering or exiting the investment

2. Upfront means administrative charge paid one time at the time of investment

3. Liquidate: To sale the MF units

4. Settlement: T + 3 days

5. SIP: Systematic Investment Plan.

6. NO default: Not being able to invest does not lead to default.

7. Unit Linked: All the investment are invested in units which is changed from time to time.