2015 Q2 FUND MANAGER’S REPORT

OLD MUTUAL ASIAN EQUITY

FUND

JOSHUA CRABB

FUND MANAGER

INVESTMENT OBJECTIVE

The objective of the Old Mutual Asian Equity Fund is to seek to achieve asset growth

through investment in a well-diversified portfolio of securities of Asian issuers or of issuers

established outside the Asian region which have a predominant proportion of their assets

or business operations in the Asian region. It is not proposed to concentrate investments in

any one industry or sector.

TOTAL NET ASSETS (MILLIONS):

FUND DOMICILE:

Ireland

BASE CURRENCY:

USD

BENCHMARK:

$239.2

MSCI AC Asia Pacific Ex Japan TR USD

MORNINGSTAR SECTOR:

EAA OE Asia-Pacific ex-Japan Equity

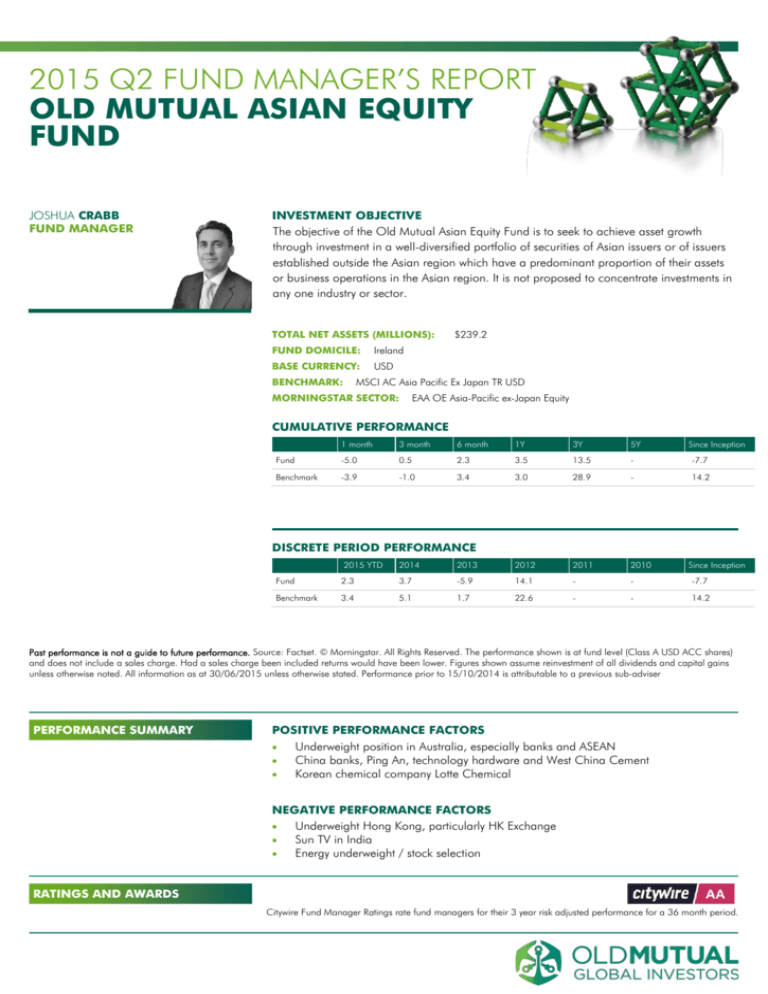

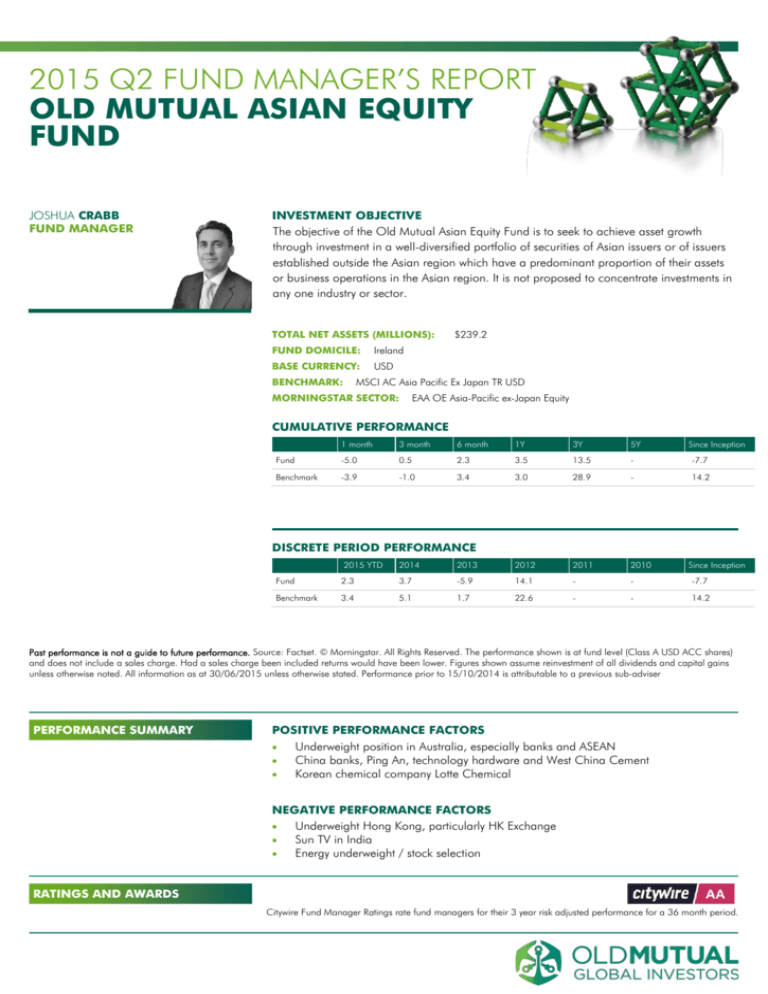

CUMULATIVE PERFORMANCE

1 month

3 month

6 month

1Y

3Y

5Y

Since Inception

Fund

-5.0

0.5

2.3

3.5

13.5

-

-7.7

Benchmark

-3.9

-1.0

3.4

3.0

28.9

-

14.2

DISCRETE PERIOD PERFORMANCE

2015 YTD

2014

2013

2012

2011

2010

Fund

2.3

3.7

-5.9

14.1

-

-

Since Inception

-7.7

Benchmark

3.4

5.1

1.7

22.6

-

-

14.2

Past performance is not a guide to future performance. Source: Factset. © Morningstar. All Rights Reserved. The performance shown is at fund level (Class A USD ACC shares)

and does not include a sales charge. Had a sales charge been included returns would have been lower. Figures shown assume reinvestment of all dividends and capital gains

unless otherwise noted. All information as at 30/06/2015 unless otherwise stated. Performance prior to 15/10/2014 is attributable to a previous sub-adviser

PERFORMANCE SUMMARY

POSITIVE PERFORMANCE FACTORS

Underweight position in Australia, especially banks and ASEAN

China banks, Ping An, technology hardware and West China Cement

Korean chemical company Lotte Chemical

NEGATIVE PERFORMANCE FACTORS

Underweight Hong Kong, particularly HK Exchange

Sun TV in India

Energy underweight / stock selection

RATINGS AND AWARDS

Citywire Fund Manager Ratings rate fund managers for their 3 year risk adjusted performance for a 36 month period.

Quarterly report

MARKET REVIEW

VOLATILITY PRESENTS OPPORTUNITY AS

LONG AS YOU CAN AVOID THE

PITFALLS OF BEING CAUGHT UP IN

BEHAVIOURAL MISTAKES

OLD MUTUAL ASIAN EQUITY FUND

GREECE, FED AND CHINA STOKE VOLATILITY

The MSCI Asia Pacific Ex Japan Index closed down about 3% over the quarter. However

over the same period it dropped 4%, rallied 12% then fell 10%. This pickup in volatility was

to be expected given the backdrop: Greece, Fed rate increases and China policy around A

share market moves. This may moderate over the near term given the recent spike, but we

expect the low volatility environment we have seen over recent years will not return. That

said we think volatility presents opportunity as long as you can avoid the pitfalls of being

caught up in behavioural mistakes and being whipsawed by following the market.

Over the period China was the stand out market. A shares continued their strong run and

since the bottom of the market toward the end of 2013, with a forward PE ratio of 7.4x the

market was trading at almost 21x by the end of June 2015 a little above the 18x of the S&P.

Although the A share market at this point does not offer value, the H share market (HSCEI),

however at 10x forward PE is still compelling.

From a sector perspective, diversified financials, which was predominantly around the huge

move in Hong Kong Exchange and Insurance (driven by Chinese insurers), performed well.

From a negative perspective, Australian banks, regional autos and Korean technology

performed poorly.

PERFORMANCE REVIEW

FUND OUTPERFORMS BENCHMARK

OVER THE QUARTER

AUSTRALIA BANKS STANCE SUPPORTS

RETURNS

The fund outperformed the benchmark over the quarter. Positive contributors to

performance were:

Underweight Australian banks on valuation concerns post strong runs

Overweight in Chinese banks on cheap valuations, yields and reform

Lotte chemical cyclical lift in profits on supply and demand imbalance

West china cement on cheap valuation and one road one belt stimulus

Ping An on cheap valuation and growing new business from middle class

Kolao on exposure to frontier market auto demand

Negative contributors to performance were:

Sun TV which was hurt on concerns of political interference

Underweight to Hong Kong, predominantly driven by the very strong performance of HK

exchange

Our underweight and stock selection in Energy given bounce in oil prices

Overweight in Samsung given perceived weakness in smartphone shipments

Quarterly report

FUND ACTIVITY REVIEW

STILL SEE VALUE IN H SHARE MARKET

OLD MUTUAL ASIAN EQUITY FUND

TAKING SOME PROFITS IN CHINA

From a country perspective, over the course of the quarter we reduced some of our strong

performing names in China. Although we still see value in the H share market with forward

PE of still only 10x, as opposed to the fully valued A share market at 21x, several of the

stocks have moved to much too fast and we anticipate better re-entry points. In addition the

surging A share market has resulted in a slower implementation of easing measures that are

necessary to stimulate the real economy than we believe would otherwise have happened.

On the other side of this we have increased our position in India. The Indian market had a

very strong run post the Modi win. As with political events implementation takes longer than

expected and as people questioned this combined with concerns of a weaker monsoon

impact the large rural economy, India under-performed China significantly. We used this

opportunity to add to names with good valuation support that stand to benefit the most from

the changes that Modi will effect in India. These are not, however, the expensive names that

have performed well over the last several years. Modi is a change and will change what

performs well, looking forward.

FUND POSITIONING AND

MANAGER’S OUTLOOK

VOLATILITY LIKELY TO REMAIN ELEVATED

There was significant amount of market and cross sectional volatility over the quarter,

VOLATILITY IS CREATING LOTS OF

INTERESTING IDEAS AT GOOD

something that may calm down in the very near term given the Greece aid extension, the

Fed statement is done for another month and an A share correction has occurred. However,

VALUATION LEVELS

volatility is likely to stay more elevated than markets have become used to over the last few

years. This is more normal and creates more opportunities, but does raise the risk of trend

following investors being whipsawed. Make sure you are making the right decisions for the

right reasons as things may change more rapidly than we are used to.

Asian markets have returned to cheap valuations with the MSCI Asia Pacific now back below

1.5x PB and 13x earnings. These have acted as good support levels over the last few years.

When we consider that the future is uncertain, despite what many try and predict, and

valuation tells us what the market is expecting, we are now expecting bad outcomes which

can result in positive surprise. It is important to look forward not backward. As a result we

are optimistic and think the volatility is throwing up lots of interesting ideas at good valuation

levels and we are taking the opportunity to buy them.

Quarterly report

OLD MUTUAL ASIAN EQUITY FUND

ONLINE

Download fund data and read investment

updates from this fund manager at

www.omglobalinvestors.com

CLIENT SERVICES

+353-16224499

Old Mutual Global Investors

(UK) Ltd

1 North Wall Quay, Dublin 1, Ireland

Building better solutions.

The value of an investment and the income from it can go down as well as up and investors may not get back the full amount invested. Past performance is not a guide to future

performance. The price of shares and the income generated may go down and up and may be affected by exchange rates. This communication has been prepared for general

information only. It does not purport to be all-inclusive or contain all of the information which a proposed investor may require in order to make a decision as to whether to invest

in the Fund. Nothing in this document constitutes a recommendation suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal

recommendation. We recommend that this document is read in conjunction with the latest factsheet, which provides additional information on the fund's main holdings, asset

breakdown, product details and investment manager. No investment decisions should be made without first reviewing the prospectus and the key investor information document

of the Fund which can be obtained from www.omglobalinvestors.com. This communication provides information relating to a fund known as Old Mutual Asian Equity Fund (the

“Fund”), which is a sub-fund of Old Mutual Global Investors Series plc. Old Mutual Global Investors Series plc is an investment company with variable capital established as an

umbrella fund with segregated liability between sub-funds which is authorised and regulated by the Central Bank of Ireland pursuant to the European Communities (Undertakings

for Collective Investment in Transferable Securities) Regulations 2011, as amended. Registered in Ireland under registration number 271517. Registered office: 33 Sir John

Rogerson’s Quay, Dublin 2, Ireland. This communication is issued by Old Mutual Global Investors (UK) Limited (trading name Old Mutual Global Investors), a member of the

Old Mutual Group. Old Mutual Global Investors is registered in England and Wales under number 02949554 and its registered office is 2 Lambeth Hill London EC4P 4WR. Old

Mutual Global Investors is authorised and regulated by the UK Financial Conduct Authority (“FCA”) with FCA register number 171847 and is owned by Old Mutual Plc, a public

limited company limited by shares, incorporated in England and Wales under registered number 3591 559. The prospectus and the KIID are available free of charge at: Austria:

Erste Bank der oesterreichischen Sparkassen AG, 1010 Wien, Petersplatz 7, Austria. Germany: Skandia Portfolio Management GmbH, Kaiserin-Augusta-Allee 108, 10553 Berlin,

Germany. France: BNP Paribas Securities Services, Les Grands Moulins de Pantin, 9 rue du Debarcadère 93500 Pantin, France. Hong Kong: Old Mutual Global Investors (Asia

Pacific) Limited, 24th Floor, Henley Building, 5 Queen's Road, Central Hong Kong. Luxembourg: BNP Paribas Securities Services, Luxembourg Branch, 33 rue de Gasperich, L5826, Grand Duchy of Luxembourg. Spain: Allfunds Bank, C/ La Estafeta 6, Edificio 3, 28109 Alcobendas, Madrid, Spain. Registered with the CNMV number 301, the 17

October 2002. Switzerland: Copies of the prospectus, the memorandum and articles of association, the key investor information documents as well as the annual and semiannual reports of the Fund may be obtained free of charge from the Swiss representative, First Independent Fund Services Ltd, Klausstrasse 33, 8008 Zurich, Switzerland. The

Fund is approved by the Swis s Financial Market Supervisory Authority. FINMA for distribution in and from Switzerland. The paying agent in Switzerland is BNP Paribas Securities

Services, Paris succursale de Zurich. Taiwan: Capital Gateway Securities Investment Consulting Enterprise, 9F/9F-1, No. 171, Songde Road, Xinyi District, Taipei City, Taiwan,

R.O.C. United Kingdom: Old Mutual Global Investors (UK) Limited, 2 Lambeth Hill, London, EC4P 4WR, United Kingdom. The Fund is recognised by the FCA. Other: Old

Mutual Global Investors Series plc, c/o Citibank Europe plc, 1 North Wall Quay, Dublin 1, Ireland.