View Presentations

advertisement

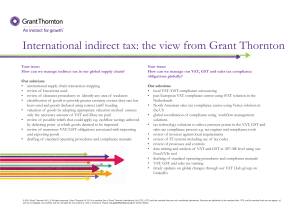

Place of provision of services: An international perspective Distance to GST. Has the Union budget 2012 shortened it? Saturday, June 2nd, 2012 Michael Evans CA FCPA FTI Taxsifu © Liability is limited by a scheme approved under Professional Standards Legislation. 1 Scope of topic The two approaches to collection of VAT/GST NZ, Singapore, Australia, Canada, South Africa The EU Sharing the tax base and enforcement in Federal jurisdictions and common markets 2 The “NZ model” GST is payable to the central government by the supplier on goods and services supplied by him Exported goods and services are zero-rated Registered recipients claim input tax credits “Place of supply” is used to identify transactions for which the obligations of registration and collection of GST can be imposed Imports of goods are subject to GST at the border Reverse charge applies to acquisition by registered traders of services from offshore No reverse charge in Singapore Limited application in Australia and NZ 3 EU model VAT is payable by the supplier to the State in which he is established for: Goods and services supplied by him in that State to recipients in that State Goods and services supplied if the place of supply is in that State Goods and services supplied by him to unregistered recipients in another State Sometimes a different rule for goods Services supplied to non-EU recipients do not have a place of supply in any State of the EU effectively a zero-rate 4 EU model (cont) VAT is payable by a recipient that is registered in a State if: The supplier is not established in that State The place of supply is in that State The reverse charge “Place of supply” is used to identify the State of taxation Which state collects the revenue Imports of goods are subject to GST at the border Reverse charge applies to acquisition by registered traders of services from offshore 5 Difference The difference between the two models is: NOT ABOUT how much VAT / GST is collected BUT IT IS ABOUT how the revenue is shared between the States The problem arises because State taxing authority How to claim ITCs for tax collected by other State Enforcement is easier on local sale by local authority Supplier is the main point of focus 6 Sharing revenue between States Singapore and NZ – no sub-national states Australia and Canada – central collection Australia - Redistributed on “HFE” system Interim report of GST distribution review panel Canada – proportionate to provincial consumption EU model – collected by member States on supplies made “in the member State” Place of provision for inter-state supplies - general B2B services – where registered recipient is established » Reverse charge in place of receipt B2C services – where supplier is established 7 EU specific rules Connected with immovable property Transport Passenger – place of transport proportionate to distance Goods – place of departure Cultural, artistic, sporting, scientific, educational, entertainment or similar – where carried out Loading and handling / valuations and work on movable property – where the work is carried out Short term hire of transport – place of delivery 8 EU Specific rules Restaurant and catering On board ships, boats or trains – point of departure Otherwise - where the services are carries out Electronically supplied services by person outside the EU – place where unregistered recipient is resident Effective use and enjoyment override Generally if recipient is not registered, in the place in which the 9 Other ideas for Federal jurisdictions Common external tariff (CET) model Lodge in home State GST and ITC separated per State State pays across to other States P-VAT Supplier pays GST collected to other State CVAT Separate return to central clearing house for interstate sales Each registrant pays interstate GST and claims interstate ITC 10 Comments Generally, traders are not required to register and collect VAT/GST in the State in which they are not established – lack of enforcement Audit and integrity issues Trader in one State does not remit VAT/GST on sale made from its establishment (to a resident in another State) Risk of fraud, error, inconsistent interpretation Recapitulative statements in EU – expert study » http://ec.europa.eu/taxation_customs/common/public ations/studies/index_en.htm Only relevant in practice for registered recipient with exempt supplies. 11 Comments Different rates / scope? Complexity, uncertainty and inconsistency Rules reflect negotiations between the States as to revenue share US States have enforcement limitations for goods purchased from interstate GST on imported goods and services How to match integrity, State revenue needs, certainty, simplicity and neutrality 12 Exported services from EU licences, trade marks and similar rights advertising services; consultants, engineers, consultancy firms, lawyers, accountants , data processing and the provision of information; obligations to refrain from pursuing or exercising a business activity or a right referred banking, financial and insurance transactions including reinsurance, with the exception of the hire of safes; the supply of staff; the hiring out of movable tangible property, with the exception of all means of transport; access to natural gas and electricity distribution systems and the provision of other services directly linked thereto; Telecommunications, radio and television broadcasting services; electronically supplied services 13 NZ zero-rated exported services Services directly connected with goods or real property outside the country Not connected with tangible property in NZ To a non-resent that is not in the country Not connected with tangible property in NZ To any person who is not in the country where use and enjoyment is outside Rights or information for use outside the country Restrictive covenants for same International transport of goods and passengers Services connected with temporary imports 14 Michael Evans CA, FCPA, FTI Regd. Tax Agent (55349002) PO Box 1678, Rozelle, NSW, 2039 Phone: +61 2 98183315 Mobile: +61 412252228 email: mbevans@taxsifu.com.au Liability is limited by a scheme approved under Professional Standards Legislation. 15