GST - Federation of Indian Chambers of Commerce and Industry

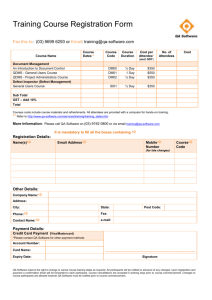

advertisement

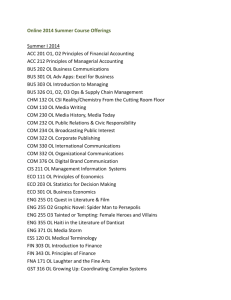

MSME Sector and Goods and Services Tax (GST) May 14, 2013 New Delhi S Madhavan Co-Chairman, Task Force on GST Federation of Indian Chambers of Commerce and Industry Current State of Play • Constitution of three Committees by the Empowered Committee - Revenue Neutral Rates of Central GST and State GST - Place of Supply Rules - Dual Administrative Control - Threshold and exemptions in GST regime - Taxation of Inter-State Trade - GST on imports • Draft Reports of the Committees deliberated upon by the Empowered Committee in its meeting on 10th and 11th May, 2013, in Musoorie; Reports yet to be finalized 2 Issues of Specific Relevance to MSME Sector • Threshold Limit - Rs.1.5 crores for Central Excise - Rs.10 lakhs for Service Tax - Different Value Limits for VAT for different States - Likely threshold limit Rs.25 lakhs • Dual Administrative Control - Central GST - Central Government (Excise & Customs) - State GST - State VAT Authorities 3 Implications of GST for the MSME Sector Supply Chain Management - Possibility of lowering cost of operations due to: - Compression of the supply chain - Disintermediation - Unfettered credits throughout the chain - Centralization and Uniformity of Sourcing - Traditional hub and spoke distribution model is seriously challenged - Impact of tax payments on stock transfers - Impact of replacement of exemptions by refund of taxes Product pricing: - B2C and B2B supplies - Product affordability 4 - Product reach/market share Conclusions Engagement with External Stakeholders Stay actively engaged in all dimensions of the GST debate Make representations to the Government to ensure that all issues pertaining to GST implementation are addressed Internal Preparations Identify areas in business models/supply chains/processes which need to be re-engineered Identify requirements of reconfiguration of IT systems, modification in documentation, MIS and accounting Identify training needs, both internal as well as external Get ready for a smooth transition to the new tax regime 5 Thank You 6