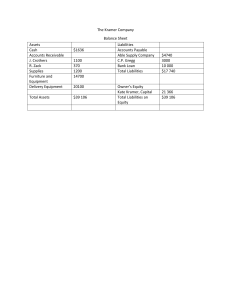

Remember: Pro forma means the statement is a projection or estimate. If you are just starting a business, you won’t have any accounting records yet. Regular financial statements are done the same way, they just use the actual numbers. This statement describes the cash going in and out of the business over a period of time. Steps to create: 1. Estimate your monthly cash receipts: Cash sales, collected Accounts Receivable, money from banks or investors 2. Estimate your monthly cash disbursements (cash paid out) Cost of goods, rent, taxes, payroll, supplies, utilities, insurance, loans 3. Cash receipts-cash disbursements= Net cash flow This statement shows expenses and revenues incurred over a period of time, and the net income (profit) or net loss. Steps to create: 1. Revenue: sales 2. Costs of Goods Sold: inventory costs 3. Gross Profit (Revenue-Cost of Goods Sold) 4. Operating Expenses: rent, utilities, advertising, insurance, supplies, payroll 5. Net Income Before Taxes 6. Taxes 7. Net Income/Loss After Taxes This statement shows what is owned, what is owed, and the equity at a specific point in time. Assets=Liabilities + Owner’s Equity (Accounting Equation) Steps to create: 1. List and total assets (cash, equipment, supplies, accounts receivable) 2. List and total liabilities (loans, accounts payable) 3. Add liabilities to owner’s equity and that total should equal your assets!