Chapter 17.2 Accounting

advertisement

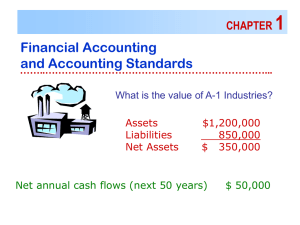

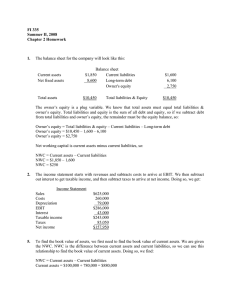

Chapter 17.2 Accounting Accounting The systematic process of recording and reporting the financial position of a person or an organization. Keeping track of the money that you spend and receive! Accountant Rules for Accountants Generally Accepted Accounting Principles (GAAP) Financial reports – summarized financial information about the financial status of a business. Property Anything of value that is owned or controlled. Assets and Current Assets Property Assets and other items of value converted to cash during the normal cycle (1 year or less) Asset-Accounts Receivable Total amount of money owed to a business Money credit received in payments – sold on Fixed Assets Items of value that will be held for more than one year (not converted). Equipment, buildings “Equity” One year or more! Liabilities Creditors claims to assets of a business Debts Measured by amount of money owed to creditors. Accounts Payable – short term liabilities owed to creditors The Accounting Equation Assets Both = Liabilities + Owner’s Equity sides must always be in balance. Financial Statements Summarize the changes from business transactions Income Statement – Revenue, expenses Balance Sheet – assets, liabilities, OE Statement of Cash Flows – incoming and outgoing money