Internal Controls and Risk Assessment

Presented By:

Donna Denker, CPA

Donna Denker & Associates

Per SAS 99 – (2002) – “An intentional act that results in material misstatement to the financial statements that are subject to an audit.”

Financial Reporting Fraud

Misappropriation of Assets

External Fraud

Diverting cash receipts

Lapping

Stealing or forging checks

Altering bank deposits

Stealing petty cash

Creating fictitious vendors or overstating vendor accounts

Stealing inventory or equipment

Taking kickbacks

Abusing travel and entertainment reimbursements

Creating ghost employees or overstating hours worked

Opportunity

Fraudster’s

Need

Rationalization

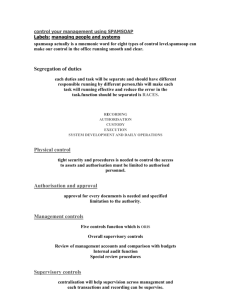

Defines internal controls

Describes the components of effective internal controls

Provides evaluation criteria for internal controls

Guidance on management’s reporting of internal controls over financial reporting

A process, effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of objections in any of the following categories:

Efficiency and effectiveness of operations

Reliability of financial reporting

Compliance with applicable laws and regulations

Integrity

Ethical Values

Competency

Entity must be aware of and deal with risks it faces

Entity must set objectives integrated with other activities so that the organization works together

Entity must establish mechanisms to identify, analyze and manage the related risk

Establishment of policies to ensure that risks are addressed

Execution of policies to ensure they are carried out correctly and completely

Systems to capture and exchange information

Monitoring all of the processes

Allow modifications as necessary

System should react dynamically by changing as conditions warrant

Existence or Occurrence

Completeness

Rights and Obligations

Valuation and Allocation

Presentation and Disclosure

Establish organization control environment

Risk identification and analysis

Communications

Monitoring

Human judgment

Breakdowns

Management overrides

Collusion

Message from the board and management

Ethics policy and repercussions for violations

Conflict of Interest policies

Recognizing temptations

Hiring policies

In-house or external training

Outside consultants to supplement if needed

Performance and skills evaluated periodically

Board does performance and skills evaluations for management

Understand your fraud risks

Set the tone at the top – zero tolerance policy

Oversee internal controls

Retain outside experts when in doubt

Ask questions and exercise skepticism

Whistleblower program

Commitment to excellence

All journal entries are authorized, supported and reviewed

Organizational chart

Job descriptions

Roles are supportive of financial reporting objectives

Considerations of segregation of responsibility

Responsibilities are commiserate with authority

Empowers employees

HR policies

Job descriptions

Pre-employment investigation

Ensure appropriate training

Regular performance evaluations

Competency is considered

Exit interview with staff

Funding agents and regulatory bodies

Vendors

Tribal Council

Creditors

Access to assets

News media

Changes

Employees

Technology

Personnel practices

Access to assets

Changes

Previously identified failures

Complexity of activities

Brainstorming sessions

Regular management meetings to discuss issues

Reacting to changes in a timely manner

Education or training programs

Supervision

Personnel evaluations

Segregation of duties

Early identification of changes

Physical Controls

Segregation of Duties

IT Controls

Management activities

Budget monitoring

Policy and procedures

•

• Policies establish what should be done

Procedures establish how it should be done

Staff to Staff

Management to Staff

Upward communication to Board

Vendors

Funding Agents

Independent Auditors

Policies and procedures

Management meetings

Departmental meetings

Financial Statements and Budget Reports

External financial reporting

Reports from External Auditors or

Regulators

Supervision of staff performance

Budget to Actual expenditure comparisons

Reconciliations and comparisons to physical assets

Enforcement of policies

Bank and investment statements

Vendors monthly statements

Federal agencies communicating concerns

External or internal auditors