Rixom, Brett Vita - American Accounting Association

advertisement

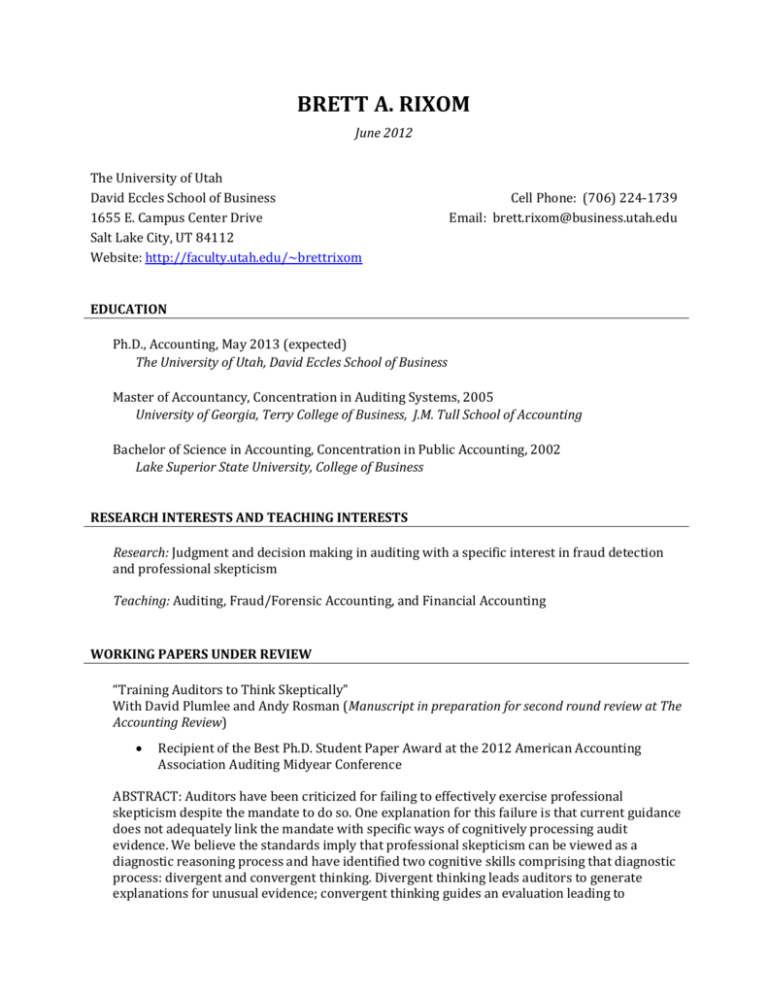

BRETT A. RIXOM June 2012 The University of Utah David Eccles School of Business 1655 E. Campus Center Drive Salt Lake City, UT 84112 Website: http://faculty.utah.edu/~brettrixom Cell Phone: (706) 224-1739 Email: brett.rixom@business.utah.edu EDUCATION Ph.D., Accounting, May 2013 (expected) The University of Utah, David Eccles School of Business Master of Accountancy, Concentration in Auditing Systems, 2005 University of Georgia, Terry College of Business, J.M. Tull School of Accounting Bachelor of Science in Accounting, Concentration in Public Accounting, 2002 Lake Superior State University, College of Business RESEARCH INTERESTS AND TEACHING INTERESTS Research: Judgment and decision making in auditing with a specific interest in fraud detection and professional skepticism Teaching: Auditing, Fraud/Forensic Accounting, and Financial Accounting WORKING PAPERS UNDER REVIEW “Training Auditors to Think Skeptically” With David Plumlee and Andy Rosman (Manuscript in preparation for second round review at The Accounting Review) Recipient of the Best Ph.D. Student Paper Award at the 2012 American Accounting Association Auditing Midyear Conference ABSTRACT: Auditors have been criticized for failing to effectively exercise professional skepticism despite the mandate to do so. One explanation for this failure is that current guidance does not adequately link the mandate with specific ways of cognitively processing audit evidence. We believe the standards imply that professional skepticism can be viewed as a diagnostic reasoning process and have identified two cognitive skills comprising that diagnostic process: divergent and convergent thinking. Divergent thinking leads auditors to generate explanations for unusual evidence; convergent thinking guides an evaluation leading to Brett Rixom (page 2 of 4) eliminating infeasible explanations. We developed materials to train these skills and assess their effectiveness in improving diagnostic reasoning. In an assessment using auditors from three of the Big Four firms, we found that divergent-thinking training increases both the number and quality of explanations generated, and divergent- and convergent-thinking training leads to the likelihood of choosing the correct explanation more than four times that of divergent-thinking training alone. A follow-up assessment using Master of Accounting students finds similar results regarding the benefit of receiving both types of training and provides evidence that when convergent thinking does not follow divergent thinking, students prematurely eliminated potentially acceptable explanations by engaging in “consistency checking” when generating explanations. DISSERTATION Essay One: “Accountability and Performance-Based Benefits: The Differentiating Effects of Extrinsic Motivators on Effort and Performance” Essay Two: “The Effects of Accountability and Performance-Based Benefits on Auditors’ Fraud Detection Judgments” DESCRIPTION: In two separate studies, this dissertation will compare the roles of two types of extrinsic motivators – accountability and performance-based benefits – on effort and decision performance in tasks such as fraud detection. The first study explores the underlying cognitive and behavioral mechanisms to show their differential effects in an abstract setting. I anticipate that performance-based benefits (vs. accountability) will lead to more cognitive effort during the initial stages of a task and less visible effort exerted during the execution stage of the task. This will show the types of tasks that different extrinsic motivators will positively influence. The second study will examine whether the underlying mechanisms of accountability and performance-based benefits lead auditors to different performance outcomes in detecting fraud. I anticipate that performance-based benefits will cause auditors to strategically change the nature of their audit procedures while accountability will cause auditors to increase more physical/observable acts such as audit documentation. The fraud detection performances may also differ, where auditors who receive performance-based benefits will be more successful at detecting fraud compared to those who are only held accountable. This dissertation potentially has important implications for both the fraud detection and motivation literatures. Rather than simply showing when motivation influences performance, these studies may show how accountability and performance-based benefits differentially influence effort and how this effort ultimately influences outcome performance. It has the capability to demonstrate that holding auditors more accountable for finding fraud may not be sufficient to improve detection. Instead, an approach that links performance-based benefits to fraud detection may improve auditors’ performance in finding fraud. CONFERENCE PRESENTATIONS “Training Auditors to Think Skeptically,” Savannah, GA, American Accounting Association Auditing Midyear Meeting, 2012 With David Plumlee and Andy Rosman Brett Rixom (page 3 of 4) “Training Auditors in Professional Skepticism,” Portland, OR, American Accounting Association Annual Meeting of the Western Region, 2010 INVITED PRESENTATIONS Panelist on “Feedback from the Trenches,” Chicago, IL, Accounting Doctoral Scholars Program Orientation Conference, 2008 COMPETITIVE RESEARCH FUNDING Marriner S. Eccles Graduate Fellow in Political Economy, $15,000 Award, 2012 – present Center for Audit Quality Grant (with David Plumlee and Andy Rosman), $39,720 Award, 2009 Graduate School Travel Assistance Award , $400 Award, 2010 and 2012 TEACHING EXPERIENCE David Eccles School of Business, The University of Utah Instructor, ACCT 5510 Auditing, Spring 2011 Instructor rating: 5.66 out of 6 Graduate Teaching Assistant, ACCT 6540 Fraud/Forensic Accounting, Spring 2009 ACADEMIC AWARDS AND HONORS David Eccles School of Accounting Ph.D. Student Teaching Award, 2012. AAA J. Michael Cook Doctorial Consortium Fellow, Lake Tahoe, CA, 2011 Research Assistantship, University of Utah, 2008 – present Dean’s List, University of Georgia, 2004 – 2005 Michigan Competitive Scholarship, Lake Superior State University, 1998 – 2001 Presidential Scholarship, Lake Superior State University, 1998 – 2001 Phi Kappa Phi Honor Society SERVICE ACTIVITIES Reviewer, American Accounting Association Annual Meeting of the Western Region, 2012. Brett Rixom (page 4 of 4) RELEVANT WORK EXPERIENCE LarsonAllen LLP, Philadelphia, PA Senior, Audit and Assurance, 2005 – 2008 Active Internet Marketing, Traverse City, MI Senior Accountant, 2002 – 2004 PROFESSIONAL CERTIFICATION AND MEMBERSHIPS Certified Public Accountant, State of Pennsylvania Pennsylvania Institute of Certified Public Accountants American Institute of Certified Public Accountants Association of Certified Fraud Examiners American Accounting Association including the Auditing and Accounting, Behavior and Organizations Sections CONFERENCE S AND MEETINGS ATTENDED American Accounting Association Auditing Midyear Meeting, 2009-2012 Utah Winter Accounting Conference, The University of Utah, 2009-2012 American Accounting Association Auditing Doctorial Consortium, 2009-2012 American Accounting Association Annual Meeting, 2011 AAA J. Michael Cook Doctorial Consortium, Lake Tahoe, CA, 2011 Conference on Intersection of Psychology & Economics, The University of Texas at Austin, 2010 American Accounting Association Annual Meeting of the Western Region, 2010 American Accounting Association ABO Midyear Meeting, 2010 American Accounting Association ABO Doctoral Consortium, 2010 Society for Judgment and Decision Making Conference, 2009 Accounting Research Symposium, Brigham Young University, 2008 Accounting Doctoral Scholars Conference, 2008