Public Goods - Gore High School

advertisement

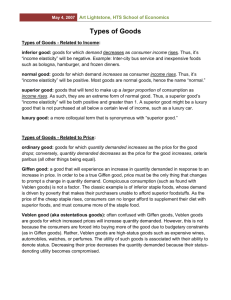

Public Goods SLO- Describe, explain and analyse as appropriate; • Public and Private Goods • Collective goods and the Market • Collective provision of Public Goods Do now. Discuss the following questions with the person beside you What would NZ be like without a police force? How would people protect themselves and their property? How would those who couldn’t afford to pay for protection survive? How do you prevent people who haven’t paid benefiting? Types of Economic Goods Types of Economic Goods Private Goods Rival Depletable Excludable by price Clear price signals No significant externalities Social equilibrium = Market equilibrium Allocative efficient situation Mixed Goods Have externalities Market equilibrium ≠Social Equilibrium Market Failure The nature of Public Goods Non-rival One persons consumption of the good does not reduce its availability to others. Non-excludable by price Once the good has been provided it is not possible to prevent others from using it even if they haven't paid to use it. Non depletable No clear price signals. Often provided by government Public Goods and free-rider Behaviour -notes A free rider is a person who consumes a good without paying for it. (People who use a public good without contributing for its payment) Public goods result in free rider behaviour because they are non-excludable by price. What does this mean?? If you were a producer of street lamps how would this behaviour affect you? Public Goods Consumers know they can use a public good without paying for it, so producers in the private sector will be unable and unwilling to produce these goods. As it is not possible for them to make a profit. How are public goods produced then? notes In many cases for a public good to be available at all the government will need to provide them. How does the government pay for these goods? The government will charge people collectively through the tax system Collective goods - notes These public goods funded in this way are classified as collective goods. Collective goods – goods that are provided free of charge and are paid for collectively through the tax system Example, rates public footpaths, street lights paid from What about Roads? Some people claim that roads are a public good. But some could are they are not. Thank about this, then discuss with your neighbor. Roads Non rival- one person using the road does not stop others from using it, until congestion sets in. Non excluable- Once the road is built it is generally not possible to prevent others from using the road. Because of this free rider behaviour the govt usually provides roads free of charge. Most roads are paid for through tax. But…. Private vehicle owners pay… Registration fee Road user charges Tax on petrol What about road tolls? There is a possibility with technology that in the future roads will be provided by the private sector or though public private partnerships. User Pays Consumer have to pay to use a good or service, such as paying a toll to use a road. Once a good has been provided for it costs no more for another person to use it therefore MC=0 PUBLIC GOODS MODEL -notes Charging a fee on a bridge. $ Al locative efficiency is where MC=MB capacity The model shows that charging a fee for the public good, in this case, results in a loss of welfare not gained by another party. MB Fee $2 Q We can conclude it is more efficient to build a bridge from taxes and not charge for it. Total benefit less total cost Loss of welfare (CS) Total benefit Total cost Public goods and the media A lot of media broadcasting is non-rival and non excludable. Some broadcasters work towards privatising the positive externality Sky TV - scrambles the signal to prevent potential free riders. Other types of goods Rival Non rival Excludable Nonexcludable Private goods e.g. food, clothing Club goods e.g. Sky TV Common pool resources e.g. fisheries Public Goods e.g. lighthouse Allocation of Public goods Weak and non existent price signals means that market allocation is not possible. How do you think we choose which public goods are to be provided? The political system! And voters The socially optimal output of public goods is where MSB=MSC, or where TSB-TSC is at a max Public GOODS ALLOCATION MSB=MSC TSB-TSC maximum TSB $ $ MSC TSC MSB Q Q Society also needs to determine the best mix of public goods. Roading, defence, health care, and education. Healthcare What determines the mix of public goods? There will be a trade off involved. Due to scarcity. We cannot have everything in the quantities we want due to insufficient resources. If more healthcare is provided there might be less education. Education Exercises page