Excel project: tools for data analysis

advertisement

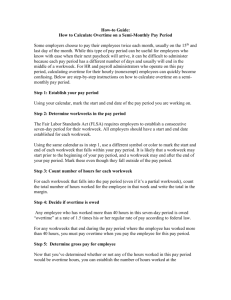

EXCEL PROJECT: TOOLS FOR DATA ANALYSIS By: Kara McNish INTRODUCTION Class: Personal Finance/Careers, Full year course, graduation requirement Unit: Income and Taxes Classroom: Computer lab with desktop computers, 2010 Microsoft Office and SMART Board Students: All freshman, range of Advanced to SPED, 504, ELL Objective: Students will understand how taxes affect net income and be able to show this through the Excel Payroll Project. Standards: 9.2.8.A.7., 9.2.8.A.9, and 9.2.12.A.9 INTRODUCTION Activities: Day 1: Bellwork: Question via Edmodo Prime Time 1: Whole group instruction Day 1 of gross vs. net pay and parts of a pay check (tax and non tax deductions) Down Time: Complete Questions on class discussion via Google Forms Prime Time 2: Whole group demonstration of completed examples of Excel Payroll Project they will be starting tomorrow . Exit Ticket: Poll questions via Edmodo polling students on their comfort level with Excel for tomorrow’s project INTRODUCTION Activities: Day 2: Bellwork: Question via Edmodo Prime Time 1: Whole group instruction Day 2 of and overview of the Excel Payroll Project and how to utilize the formulas in Excel using a Screen-Cast-O-Matic video (video will also be linked on Class Edmodo page so students can view individually and reference throughout project) Down Time: Students being work on their Excel Payroll Project Prime Time 2: Discuss any questions they may have regarding the project INTRODUCTION Activities: Day 3: Bellwork: Question via Edmodo Prime Time 1: Whole group instruction Day 3 review yesterday’s Excel formulas and functions, answer any questions, review rubric Down Time: Students being work on their Excel Payroll Project Prime Time 2: Discuss the analyzing of the data to complete the questions for Homework BRAINY BITS- LEARNING STYLES Abstract Sequential: Logical, conceptual learners Working in Excel, working with numbers Concrete Sequential: Organized, perfectionists Detailed directions, video (step by step) Abstract Random: Spontaneous, social Class discussion, being a student ambassador (helper) Concrete Random: Practical, hands -on Working with real life situation that is relatable to everyone especially students with a job BRAINY BITS- THE LOBES Frontal: Planning, thinking, and direct problem solving Temporal: Sound, music, face and object recognition Occipital: Exclusively used for visual processing Parietal: Calculations BASIC SKILLS Data in rows in columns Formatting (bold, font, underline, borders, fill) Column width adjustments, text alignments BASIC SKILLS 1. 3. 2. • • ADDITION & MULTIPLICATION formulas were utilized to calculate gross pay & net pay. MULTIPLICATION was used to calculate the tax deductions (only one shown). • SUM function was used to calculate the sum of all the deductions for each employee, as well as the sum of each individual deduction categories and, gross and net pay totals for all employees. TODAY function was used to set the date that the payroll is being done and can be used in the template for future week’s payrolls. This function automatically updates for the present days date. BASIC SKILLS • Freeze Panes were used to see the employee names with their gross pay and net pay. • Cell references on different sheets, were used to reference the gross pay sheet where the gross pay for each employee was already calculated via a formula, rather than recalculating. • Conditional Formatting “Data Bars” was used to visually show how many hours each employee worked. The longer the green bar the more hours worked, the shorter the bar the less hours worked. • Auto Fill was used to fill the number for employee numbers. BASIC SKILLS • Absolute reference, was used when calculating overtime pay. Every employee earns 1.5 their regular rate of pay so to calculate overtime pay, we referenced cell B21, which was the overtime pay rate, and added the $ to make it absolute and stay the same throughout all the overtime pay calculations. • Cell references on same sheets, we references the overtime pay rate to calculate overtime pay, this was located on the same sheet in the “rates” chart. ADVANCED SKILLS Chart Graph IF Function Graph comparing gross vs. net pay of each employee. Chart used to reference “rates” for taxes and overtime rates. IF function used for regular & over time hours. Function for regular hours states, if hours worked is <40.5, then regular hours worked is“40”, if not then it is equal to D3. Function for overtime hours states, if the hours worked are >40.5 then subtract total hours worked (D4) from Regular hours worked (F4) and use that number, if not then “0”. EVALUATION Studen ts will be graded based on this rubric. They will also have follow up questions to help them evaluate their data and not just input numbers and formulas. They will be asked to analyze the gross vs. net pay and the tax deductions. EXAMPLES Examples of a finished project: EXAMPLES Examples of a finished project: EXAMPLES Examples of a finished project: RESOURCES Advanogy. 2015. February 2015 <http://learning -stylesonline.com/overview/>. Cherry, Kendra. About Education. n.d. February 2015 <http://psychology.about.com/od/biopsychology/ss/brainstru cture_2.htm>. Serendip Studio. 2012. February 2015 <http://serendip.brynmawr.edu/bb/kinser/Structure1.html>. Wiggins, Dr. Sandy. CES. n.d. February 2015 <http://www.ces.ncsu.edu/depts/fcs/Professional%20PDFs/1 0a%20Gregorc%20Learning%20and%20Teaching%20Styles.pd f>.