NY MCTMT - svapa.org

advertisement

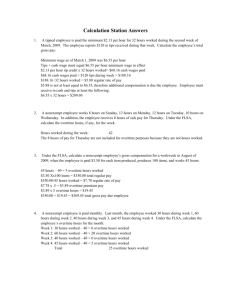

Imperative Payroll Calculations David Diaz 6/19/2014 • Calculating federal income tax using the wage bracket method • Calculating federal income tax using the percentage and annualized percentage method • Calculating federal income tax using supplemental rates • Calculating the regular rate of pay and overtime • Net to gross calculations Calculating Using the Wage Bracket Method Using the wage bracket method you can find the federal income tax to withhold by going to the table based on the employee’s W-4 info and pay period. Find the correct line based on wages and scroll to the correct column based on their allowances. In this case our employee is Married with 3 allowances, is paid bi-weekly, and has $2120 of taxable wages. In this case their federal income tax is $167. Calculating using the percentage and annualized percentage method Using the percentage method allowance amounts and percentage method tables you can calculate federal income tax. We will use the same example of a married employee, claiming 3 allowances, paid bi-weekly, and taxable wages of 2120. They have 3 allowances so we take the bi-weekly allowance amount of 151.90 and multiple it by 3 for a total of 455.70. Subtract 455.70 from the taxable wages to get 1664.30. Next we use the table 2 of the percentage method tables, use column b for married, and scroll down to the correct over under line. We subtract 1023 from 1664.30 to get 641.30, then multiple that by 15% to get 96.20 and finally add that to 69.80 to get total income tax of 166. Using the annualized percentage method is similar to the percentage method but is how most payroll systems calculate income tax. We will use the same example of a married employee, claiming 3 allowances, paid bi-weekly, and taxable wages of 2120. Since they are paid bi-weekly we will multiply their wages of 2120 by the 26 pay periods to get annual taxable wages of 55120. They have 3 allowances so we take the annual allowance amount of 3950 and multiple it by 3 for a total of 11850. Subtract 11850 from the taxable wages to get 43270. Next we use the table 7 of the percentage method tables, use column b for married, and scroll down to the correct over under line. We subtract 26600 from 43270 to get 16670, then multiple that by 15% to get 2500.50, add that to 1815 to get total income tax of 4315.50 and divide that by the 26 pay periods to get 165.98 of income tax. Calculating using supplemental rates To calculate wages using the supplemental rate you multiple the total taxable wages by 25% or 39.6% if the employee has over 1,000,000 in supplemental wages in the year. Using our example of 2120 of wages we would get 530 for 25% and 839.52 for 39.6% Regular Rate of Pay and Overtime Regular Rate of Pay • Calculated by taking total included wages earned and dividing it by the total hours worked to earn those wages during the work week. • The Fair Labor Standards Act (FLSA) requires that all nonexempt employees be paid a premium of 50% of their regular rate of pay for hours worked in excess of 40 per week. Regular Rate of Pay • Earnings include: Shift differentials, nondiscretionary bonuses, non-cash payments, retroactive pay, on-call pay, and supplemental disability payments. • Earnings excluded: Gifts, sick pay, holiday pay, vacation pay, PTO, jury duty pay, bereavement pay, discretionary bonuses, benefit plan contributions, overtime, and premium pay under a union contract. Discretionary Vs Non-discretionary Bonuses • • Nondiscretionary bonuses are contractual or agreed upon bonuses or incentives related to production, efficiency, attendance, quality, or other measure of performance. These must be included in calculating the regular rate of pay. Discretionary bonuses are at the company or owners discretion. There is not a contractual or agreement in place. These are not included in calculating the regular rate of pay. Regular Rate of Pay Example 1 In one week Alan worked 30 hours in the office at $25 per hour and 20 hours in the field at $20 per hour. His regular rate of pay for the week is $23 per hour. Office pay: 30x25=750 Field pay: 20x20=400 Total pay: 750+400=1150 Total hours worked: 30+20=50 Regular rate of pay: 1150/50=23 Regular Rate of Pay Example 2 In one week Roberta worked 45 hours at $40 per hour and received a nondiscretionary bonus of $250. Her regular rate of pay for the week is $45.56 per hour. Hourly pay: 45x40=1800 Total pay with bonus: 1800+250=2050 Regular rate of pay: 2050/45=45.56 Overtime Example 1 In one week Alan worked 30 hours in the office at $25 per hour and 20 hours in the field at $20 per hour. His regular rate of pay for the week is $23 per hour and his gross pay is $1265. Office pay: 30x25=750 Field pay: 20x20=400 Total pay: 750+400=1150 Total hours worked: 30+20=50 Regular rate of pay: 1150/50=23 Overtime pay: 10x23x0.5=115 Gross pay: 1150+115=1265 Overtime Example 2 In one week Roberta worked 45 hours at $40 per hour and received a nondiscretionary bonus of $250. Her regular rate of pay for the week is $45.56 per hour and her gross pay is $2163.90. Hourly pay: 45x40=1800 Total pay with bonus: 1800+250=2050 Regular rate of pay: 2050/45=45.56 Overtime pay: 5x45.56x0.5=113.90 Gross pay: 2050+113.90=2163.90 Grossing Up Payments Gross Up Formula • An IRS-approved formula that employers can use to determine the taxable gross payment when the employer wishes to pay the employee's share of tax. • Gross Pay= desired net/(100%-total % of all taxes) Gross Up Example • Bob’s employer wants to pay him a $1000 net bonus. Calculate the gross amount to pay Bob. • Total tax %= 25+6.2+1.45= 32.65% • 100%- 32.65%= 67.35% • $1000/67.35%= $1484.78 Overtime Piecework Acceptable Methods • There are two acceptable methods for calculating the overtime due to pieceworkers under the FLSA: 1. Once the regular rate of pay is determined, the pieceworker must be paid; in addition to the piecework earnings, an amount equal to one half the regular rate of pay times the number of hours worked over 40 in the workweek. 2. If employee agrees before the work is performed, they may be paid at a rate of not less than 1 ½ times the regular piece rate for each piece made during the overtime hours. Method 1 Example • • • • • • • John receives $1.15 for each toy truck he assembles, plus a $.15 bonus per truck for each truck over 352 that he assembles in a regular 46 hour work week. In one week John assembled 420 trucks. Regular piecework earnings: 420 trucks x $1.15 = $ 483.00 Production bonus: 68 trucks x $.15 = $10.20 Total piecework earning: $483.00 + $10.20 = $ 493.20 Regular Rate of pay: $493.20/46= $10.72 Overtime premium pay: Total earnings: 6x10.72x0.5= $32.16 $493.20 + $ 32.16 = $525.36 Method 2 Example • • • • • John receives $3.00 for each truck he paints and $4.50 for each truck he paints after working 40 hours in a workweek. In one week, John painted 140 trucks in the first 40 hours and 18 in the next five hours. Regular piecework earnings:140 x $3.00 = $420.00 Overtime piece rate: $3.00 x 1.5 = $4.50 Overtime piecework earning:$4.50 x18 = $81.00 Total earnings: $420.00 + $81.00 = $ 501.00 Q &A