Investment Practice: Optimizing Life Returns

advertisement

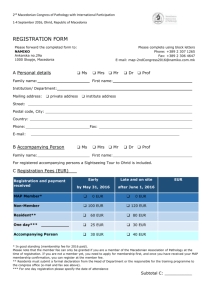

Investment Practice: Optimizing Life Returns By Orestis Hadjipanayis What Defines an Investment? Giving up an asset today for one of greater value in the future. Human beings carry an individual collection of assets. Evolution dictates an ever positive return of these assets. Level of personal development depends on the compound rate of return on our assets. What Defines an Asset? Any recourse owned by an entity from which future benefits can be extracted. Personal Assets: Time Intelligence (Inc. Talents & Skill) Education Wealth Genetic bias inherent in all assets except time. Only our actions regulate the rate of return on our assets. Personal development is a relative game. Optimum Strategy: Identify our best assets. Investment in those assets yields best returns. Managing our Education assets on a return basis Returns on primary & high school education are colossal! Development from uneducated to educated. Only time is invested. Its free moneywise. Ever increasing sums of money required for academic education. Calls for greater scrutiny. Wealth: Utilizing our financial assets most efficiently After education investment is completed, excess wealth must be allocated most efficiently. Most household wealth concentrated on real estate. Evaluating the home purchase decision Buy or Rent ? 2 Bedroom flat in Nicosia costs approx. 180,000 EUR How can we deploy 180,000 EUR of our wealth most efficiently? Rent Monthly rent is 680 EUR Annual Cost is 680 X 12 = 8,160 EUR Rental Yield is Annual Rent / Purchase Price Rental Yield is 4.5 % Our 180,000 EUR are kept in the bank earning a deposit rate of 4,5% per annum. Assuming a flat macro economic scenario, purchasing a home does not increase our wealth. Qualitative aspects render Renting as a net + Buy only when Rental yields > Return on money (e.g. deposit rate) Remember! Investment in our best asset yields the most Example of a personal asset Possess the right skill set so as to set up one of the best Kebab shops in town. Conservatively assume to sell 80 pitas / day Sell 80 X 30 = 2500 pitas / month Hypothetical income statement (EUR) Total monthly sales 2500 X 6 + 1000 (supplements) = 15000 Gross Profit (60%) 9000 Staff (2+) 2500 Rent 1200 Other (Advert, Insurance, etc.) 800 Net Profit Before Tax 5250 Net Profit after Tax 4200 Wealth created over a 10 year period Annual earnings = 4,200 X 12 = 50,400 EUR 50,400 x 10 = 504,000 EUR Of course money earned every year will be deposited earning 4,5%. Hence real Wealth created is close to 700,000 EUR Investment required to set up the kebab assumed to 80,000 EUR. Investment in our best asset turned 80,000 to 700,000 EUR. Annual Compounded Return of 25% per annum Dilemma facing our skilled Kebab man in year 1 : Use 80,000 as down payment to buy a flat to forgo the 4,5% cost otherwise incurred if he rented. … or rent the flat and invest the 80,000 EUR in himself, earning 25% per year ! Bearing in mind that people’s dreams extend to earning north of 4,5% , Home buying should be treated with a grain of salt! Financial Investing: Screen opportunities against each other Investment Options Interest-bearing Investments: Stocks or Bonds Non-Interest bearing Investments (Commodities): Real Estate, Crude Oil, Nat. Gas, Industrious Metals (Copper, Plat etc.), Precious Metals (Gold, Silver) and Agriculture (Wheat, Soy etc.) Investing in commodities is betting on macroeconomics. Not an Investment ! Bonds: Debt Instruments. Investing in bonds is purchasing the debt of an entity. No. of Birds in the Bush When If Fixed maturity date Fixed interest payment Fixed price Known Known Uncertain Stocks: Piece of ownership in a business No. of Birds in the Bush When If Uncertain Uncertain Uncertain Investing in a stock requires understanding of the nature and competitive advantages of the business. Bonds & Stocks trade in the stock market. Prices fluctuate depending on optimism or pessimism of market participants. Market should serve you not guide you. Apply same criteria to full ownership of a business. Buying 0,01% a business requires the same knowledge as buying 100% of a business. Stockholder is a business owner. The change in the Value of a stock in the stock market does not change the value of the business.