to - The Stock Exchange of Mauritius

advertisement

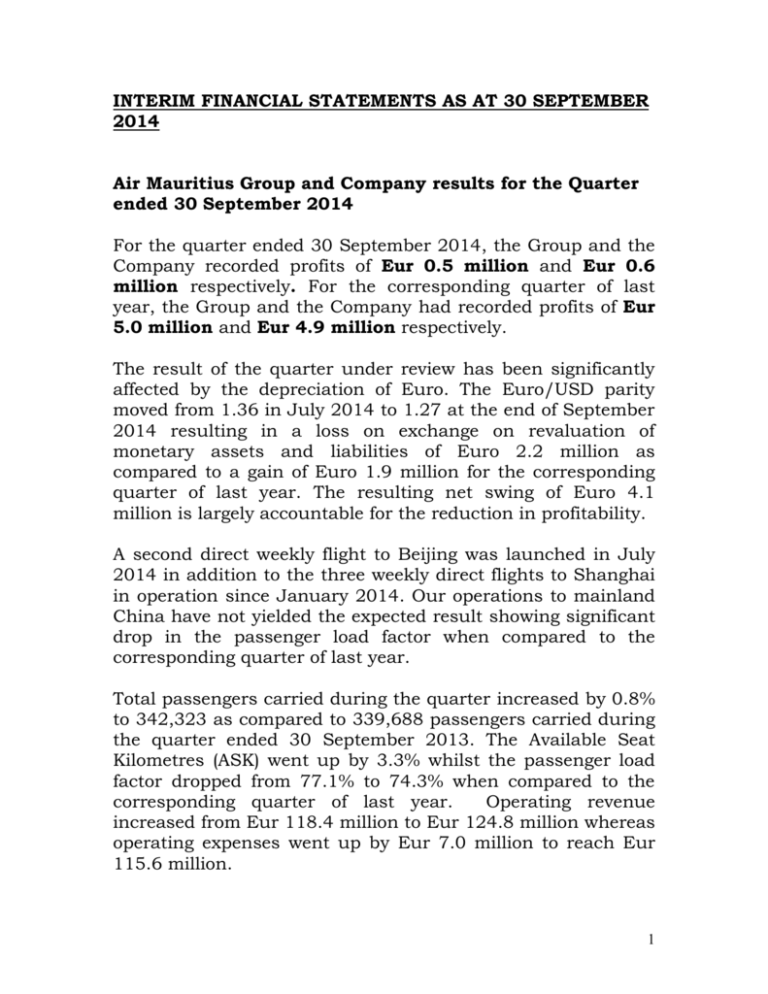

INTERIM FINANCIAL STATEMENTS AS AT 30 SEPTEMBER 2014 Air Mauritius Group and Company results for the Quarter ended 30 September 2014 For the quarter ended 30 September 2014, the Group and the Company recorded profits of Eur 0.5 million and Eur 0.6 million respectively. For the corresponding quarter of last year, the Group and the Company had recorded profits of Eur 5.0 million and Eur 4.9 million respectively. The result of the quarter under review has been significantly affected by the depreciation of Euro. The Euro/USD parity moved from 1.36 in July 2014 to 1.27 at the end of September 2014 resulting in a loss on exchange on revaluation of monetary assets and liabilities of Euro 2.2 million as compared to a gain of Euro 1.9 million for the corresponding quarter of last year. The resulting net swing of Euro 4.1 million is largely accountable for the reduction in profitability. A second direct weekly flight to Beijing was launched in July 2014 in addition to the three weekly direct flights to Shanghai in operation since January 2014. Our operations to mainland China have not yielded the expected result showing significant drop in the passenger load factor when compared to the corresponding quarter of last year. Total passengers carried during the quarter increased by 0.8% to 342,323 as compared to 339,688 passengers carried during the quarter ended 30 September 2013. The Available Seat Kilometres (ASK) went up by 3.3% whilst the passenger load factor dropped from 77.1% to 74.3% when compared to the corresponding quarter of last year. Operating revenue increased from Eur 118.4 million to Eur 124.8 million whereas operating expenses went up by Eur 7.0 million to reach Eur 115.6 million. 1 Air Mauritius Group and Company results for the half year ended 30 September 2014 The profit recorded in the second quarter reduced the Group and the Company losses for the half year ended 30 September 2014 to Eur 6.2 million and Eur 6.3 million respectively. For the corresponding period last year, the Group and the Company had recorded losses of Eur 3.1 million and Eur 3.3 million respectively. The loss on exchange on revaluation of monetary assets and liabilities for the semester amounted to Eur 2.6 million as compared to a gain of Eur 2.2 million for the corresponding semester of last year. The resulting net swing of Eur 4.8 million is largely accountable for the increased loss recorded. The number of passengers carried went up by 3.6% to reach 641,158 as compared to 618,797 during the half year ended 30 September 2013. The Available Seat Kilometres (ASK) went up by 4.6%. Operating revenue of the Company went up by Eur 11.7 million to reach Eur 229.1 million whereas operating expenses increased by Eur 9.7 million from Eur 209.4 million to Eur 219.1 million. The Gross and Operating profits continue to improve. Shareholders’ Funds In spite of the positive results for the second quarter, losses brought forward from the first quarter reduced the total Shareholders’ Funds for the Company from Eur 83.7 million as at 31 March 2014 to Eur 75.5 million as at 30 September 2014. Consequently the net assets per share as at 30 September 2014 is Eur 0.74 (Rs 29.28) as compared to Eur 0.82 (Rs 33.77) as at 31 March 2014. 2 Outlook The depreciation of the Euro will continue to impact the results of the company; however, this may be mitigated by the recent fall in price of fuel. The company, on the other hand, has been proactive in implementing a series of initiatives to boost up traffic on its network in the wake of fiercer competition on major routes. 3