Financing and Capitalizing Businesses

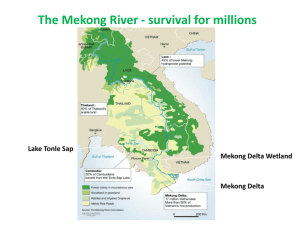

advertisement

FINANCING AND CAPITALIZING BUSINESSES Presented By Dawn McGee, CEO Goodworks Ventures, LLC SELF-FINANCING Using your own money and cash flow to build and grow a business. Pros: Cons: Keep all of your business, don’t have to answer to investors. Some products are too expensive for most people to finance on their own (e.g. pharmaceuticals). Don’t have to be in an extreme growth business. Personally very risky. Self-Financing Business Development Methodologies: Lean Startup “Bootstrapping” LEAN STARTUP Steps to creating a lean startup 1. Have an idea 2. Build a minimum viable product 3. Measure how customers are behaving right now 4. Conduct experiments to see if you can improve metrics from baseline to ideal 5. When experiments reach diminishing returns pivot Minimize the time through the loop. Source: http://lean.st “BOOTSTRAPPING” Eight Strategies for Successful Bootstrapping: 1. Find the right product or service: Try to sell the product before it’s built. If no one wants it adjust. 2. Immerse yourself: What does the market look like and where are the opportunities? 3. Become the expert yourself: Know your market inside and out. 4. Think in black and white: Don’t get bogged down by distractions, focus exclusively on core issues of making and selling. 5. Get ready for rough times ahead: Be frugal. 6. Don’t buy an existing business: Old cultures can be difficult to supplant with new. 7. Consider carefully before joining with a partner: Partners add complexity to decision making, make sure they’re bringing more value than problems. 8. Just jump in! The real learning occurs when the business begins. SELF-FINANCING RESOURCES The Lean Startup by Eric Ries Bootstrapping Your Business by Greg Gianforte and Marcus Gibson The Four Steps to the Epiphany and The Startup Owner’s Manual by Steve Blank Lean Customer Development Videos by Steve Blank parts 1, 2, 3, 4 Business Model Canvas Startup Weekend Resource List Startup Weekend Graphical Guide for Starting a Business in 54 Hours OUTSIDE CAPITAL Using other people’s money to build and grow a business. Pros: Cons: Ability to create products with long or expensive development cycles. Potential to lose control of your business. Less personal risk. Can be very time consuming, expensive, and difficult to secure outside capital. Sources of outside capital: Family and friends, banks, angel investors and venture capital investors. FAMILY, FRIENDS AND BANKS Family and friends are often the first source of outside capital. Banks have income and collateral requirements which make them less than ideal sources of capital for new businesses. Alternative debt financing from Community Development Financial Institutions or microlenders is more easily accessible by nascent entrepreneurs but is usually more expensive. ANGEL AND VENTURE CAPITAL Angel Investors: Wealthy individuals that invest in early and mid-stage businesses. Investment amounts tend to range from US$25,000-US$1 million. Venture Capital: Stage of investment after angel. Typically run by dedicated venture capital funds that collect money from multiple sources (limited partners) and invest in high risk high reward ventures on their behalf. Venture capital investments tend to fall between US$1 million-US$100 million. ANGEL AND VENTURE CAPITAL IN THE MEKONG REGION Investors are very interested in the opportunities that have arisen from a liberalization of economic policies in Myanmar, Cambodia, Laos, Thailand and Vietnam. There are, however, still some institutional challenges that are impeding progress. Challenges of investment in the Mekong: Uneducated workforce Markets are illiquid. Very few companies are listed on local stock exchanges. Lax enforcement of property rights and contracts. Legal frameworks for investment banking are unclear and in some cases don’t exist. Poor infrastructure Corruption VENTURE CAPITAL BY REGION Despite the challenges many firms have still chosen to invest because they believe in the region’s great potential. Venture Capital firms serving Mekong countries: Myanmar Cambodia Laos Thailand Vietnam Mandalay Capital Devenco VinaCapital Ardent Capital VinaCapital White Lion Ventures Uberis Capital Angel Investment International VNET Venture Capital Finansa Vietnam Ltd. Leopard Capital Leopard Capital Leopard Capital M8VC Co IDG Ventures Vietnam Cube Capital SCVD Mekong Capital Ltd. Bagan Capital Cambodia Capital Insitor Navis Capital ARUN, LLC Synergy Social Ventures MEKONG AREA VENTURE INVESTMENT MOORE CORP. Kingdom Breweries Ltd Asia Chemical Corporation Established in 2007, Moore is an online content and advertising company with a first-mover online ad network (VietAd), a pioneering music streaming portal (Nghenhac.info), the leading photo storage and sharing site (Anhso.net), and flexible content management system solutions for online publishers. Kingdom Breweries brews and distributes premium beer for the local Cambodian market and export markets in Thailand, UK and France. ACC is a leading distributor of high-quality specialty ingredients, chemicals, non-oil related commodities and other materials, sourcing from worldwide suppliers and selling to a wide range of leading enterprises in Vietnam. The company specializes in supplying to the food and beverage industry. Investor: IDG Vietnam Investor: Leopard Capital Investor: Mekong Capital