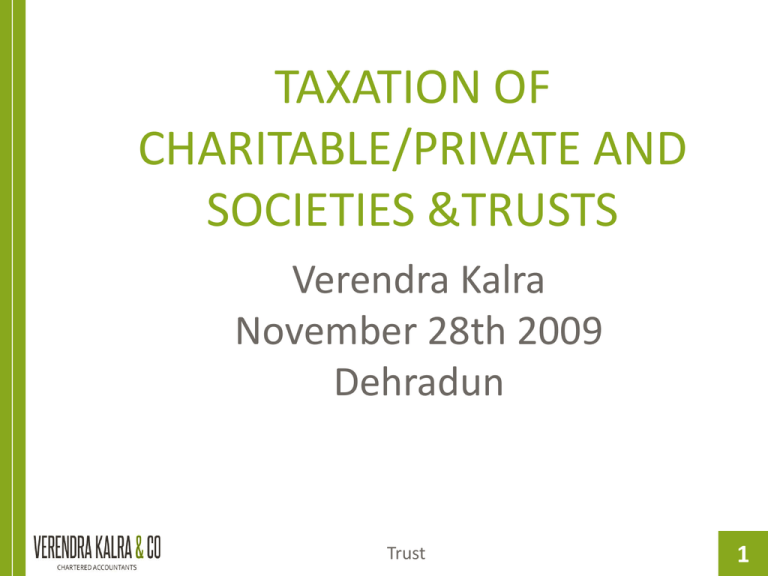

Bare Trust - Verendra Kalra

advertisement

TAXATION OF CHARITABLE/PRIVATE AND SOCIETIES &TRUSTS Verendra Kalra November 28th 2009 Dehradun Trust 1 PRESENTATION ON TAXATION OF CHARITABLE/PRIVATE AND SOCIETIES &TRUSTS ORGANISED BY ON November 28, 2009 AT Presented by: CA Verendra Kalra Structure of a Non Profit Organization in India In India non profit organizations can be registered as: Trusts Societies Section 25 Companies • The Income Tax Act gives all categories equal treatment, in terms of exempting their income and granting 80G certificates, whereby donors to non-profit organizations may claim a deduction against donations made. Foreign contributions to non-profits are governed by FCRA regulations and the Home Ministry Trust 3 Comparison among Trust, Society & Section 25 Company Points of Differences Trust Society Section 25 Company Statute / Legislation Relevant State Trust Act or Indian Trust Act, 1882 Societies Registration Act, 1860 Indian Companies Act, 1956 Jurisdiction Deputy Registrar/Charity commissioner Registrar of societies (charity commissioner in Maharashtra). Registrar of companies Registration As trust As Society As a company u/s 25 of the Indian Companies Act. In Maharashtra, both as a society and as a trust Registration Document Trust deed Memorandum of association and rules and regulations Memorandum and articles of association. and regulations Stamp Duty Trust deed to be executed on non-judicial stamp paper, vary from state to state No stamp paper required for memorandum of association and rules and regulations. No stamp paper required for memorandum and articles of association. Members Required Minimum – two trustees. No upper limit. Minimum – seven managing committee members. No upper limit. Minimum three .No upper limit. Board of Management Trustees / Board of Trustees Governing body or council/managing or executive committee Board of directors/ Managing committee Mode of Succession on Board of management Appointment or Election Appointment or Election by members of the general body Election by members of the general body Trust 4 Meaning of ‘Trust’ A trust is a relationship in which : • a person or entity (the trustee) holds legal title • to certain property (the trust property or trust corpus), but is bound by a fiduciary duty to exercise that legal control • for the benefit of one or more individuals or organizations (the beneficiary), who hold ‘beneficial’ or ‘equitable’ title. • The trust is governed by the terms of the (usually) written trust agreement and local law. • The entity (one or more individuals, a partnership or a corporation) that creates the trust is called the settlor. Trust 5 Types of Trusts • Bare Trust A trust where the beneficiary is absolutely entitled to the assets, and the trustee is obliged simply to pay them over to the beneficiary. ‘Resulting’ and ‘Constructive’ trusts are usually bare trusts. Bare trusts generally do not continue for any length of time, unless they arise out of protracted litigation, or the beneficiaries are minors (in which case the bare trust must continue till they reach majority) • Constructive Trust It is imposed by law as an equitable remedy. It generally occurs due to some wrong doing, where the wrong doer has acquired legal title to some property and cannot in good conscience be allowed to benefit from it. • Resulting Trust It is a form of implied trust which occurs where a trust fails, wholly or in part, as a result of which the settlor becomes entitled to the assets. Trust 6 Types of Trusts • • Discretionary Trust It is an arrangement where the trustee may choose, from time to time, who (if anyone) among the beneficiaries is to benefit from the trust, and to what extent, so long as the decision is made based on the beneficiaries best interests. The purpose of such a trust is that no individual can claim to be entitled to any specific interest in the trustee’s assets, which often has tax advantages or asset protection advantages. Fixed Trust the entitlement of the beneficiaries is fixed by the settlor. The trustee has little or no discretion. E.g. a trust for a minor (to X if she attains 21) a life interest (to pay the income to X for her lifetime) Trust 7 Types of Trusts • • • Hybrid Trust It combines elements of both fixed and discretionary trusts. The trustee must pay a certain amount of the trust property to each beneficiary fixed by the settlor. But the trustee has the discretion as to how any remaining trust property, once these fixed amounts have been paid out, is to be paid to the beneficiaries. Express Trust It arises where a settlor deliberately and consciously decides to create a trust, over his or her assets, either now or upon his death. In these case this will be achieved by signing a trust instrument which will either be a will or a trust deed. Implied Trust It is created where some of the legal requirements for an express trust are not met, but an intention on behalf of the parties to create a trust can be presumed to exist. Trust 8 Types of Trusts • Intervivos Trust A settlor who is living at the time the trust is established creates an intervivos trust. • Testamentary Trust A trust created in an individual’s will. • Irrevocable Trust It is the one that will not come to an end until the terms of the trust have been fulfilled. • Revocable Trust A trust of this kind can be revoked (cancelled) by its settlor at any time. Trust 9 Public Trusts • Like private trusts, public trusts may be created inter-vivos or by will. • Public trusts are however governed by general law, though the principles forming the basis of the Indian Trusts Act can be applied in the case. It was held in the case of State of UP Vs. Bansi Dhar, AIR (1974) SC 1084, 1090 that “it is true that Indian Trusts Act relates only to private trusts, public charitable trust have been expressly excluded from its ambit. But while provisions of section 83 of the Trusts Act proprio vigore do not apply, there is a common area of principles which covers all trusts, private and public, and merely because they find a place in the trusts Act, they cannot become untouchable where public trusts are involved.” • It is a trust established for charitable purposes; normally must be for the benefit of public at large or a class of beneficiaries. • These are entitled to special treatment under the law of taxation. Trust 10 Public Trusts • These are exempt from the rule against perpetuities, which would otherwise require a trust to come to an end after a certain period. Charitable trusts may continue indefinitely. • A formal deed is not necessary to constitute a public trusts, even where immovable property is dedicated because section 5 of Indian Trusts Act 1882 is not applicable on public Trusts. • Public trusts are an exception to the well settled rule that there is no valid trust unless the objects thereof are specified. The trusts is not allowed to fail for uncertainty . Trust 11 Public Trusts • A charitable trust is synonymous with public trust. There is nothing called as a private charitable trust. • Charitable trusts come under the doctrine of cy-pres, under which if the charitable purposes of the trust cannot be fulfilled, then they can be replaced by new and more appropriate charitable purposes. • Management or Control may vest in private hands. In the case of Smt. Ganesha Devi Rami Devi Charity Trust Vs. CIT (1969) 71 ITR 696, 704 (Cal) it was held that “the implication, therefore, is that if the trust or fund is controlled by a body of persons which is not a public body, but if it enures to the benefit of a public it will still be a charitable trust or fund Trust 12 Private Trusts • Private trust may be created inter vivos or by will. • Private trust are governed by the provisions of the Indian Trust Act 1882 • It has one or more particular individuals as its beneficiary. • Where immovable properties worth more than Rs. 100 are transferred, trust will not be operated unless it is registered (Gostha Behari Gose Vs. University of Calcutta, AIR 1972 Cal 61 ) .Trust created by will does not require any stamp • Private trusts are void for perpetuity Trust 13 Partly Private and Partly Public Trusts? • Dedication may be absolute , or it may be partial. Where the dedication made by a settler in favor of an idol covers the entire beneficial interest which he had in the property, the debutter is an absolute or complete debutter. Where, however, some proprietary or pecuniary right or interest in the property is either indisposed of or is reserved for the settlor’s family or relations, a case of partial dedication may arise. ( K.Mukherjea’s Hindu Law of Religious and Charitable trusts, 4th edition page 174-5) Trust 14