Aegon`s

advertisement

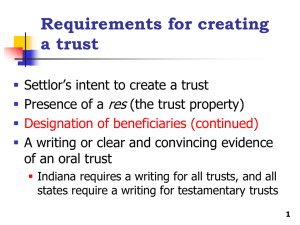

GENERATIONAL TRUST PLANNING AND ADVISER CHARGING Jim Callaghan Business Development Manager – Guarantee Sales Learning Objectives • By the end of the session you’ll be able to explain • IHT Planning through Loan Trusts and Discounted Gift Trusts • The technical details of these trusts • The interaction of trust planning and adviser charging Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging The number of estates hit by IHT in 2014 will increase by? A. B. C. D. 10% 25% 33% 50% The number of estates hit by IHT in 2014 will increase by? A. B. C. D. 10% 25% 33% 50% London £424,000 South East £305,000 IHT Threshold £150,000 London £81,000 South East £77,000 UK £62,000 Source: Office for Budget Responsibility UK £251,000 IHT Threshold £325,000 Why? • It isn’t just about IHT planning…. • …. it’s about control: • • • • Who gets the money When they get the money How they get the money Avoiding the need for probate • But let’s not ignore the tax benefits Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging Bare or Discretionary? Bare • Potentially Exempt Transfer • Outside estate after seven years • Beneficiaries and shares cannot be changed • Legal entitlement at 18 – 16 in Scotland Discretionary • Control over who and when • Chargeable Lifetime Transfer (IHT100) • 20% Lifetime Charge (= 25% if Settlor pays) on excess over £325k Nil Rate Band Handset Question: Would you like more information on the changes to 10 year and exit charges? 1. Yes please 2. No thank you Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging Gift Trust • • • • • • • Simple Outright Gift Capital No interest for Settlor Parents to children Grandparents to grandchildren Popular for school fees/educational funding Gift trust (bare) Settlor makes gift into trust Trustee Growth outside estate from day one. IHT free. Trustee Gift £ Absolute beneficiaries: Can’t be changed Entitled at age 18 (16 Scotland) Not settlor though PET Outside estate after seven years. trust (bare) GiftGift trust (discretionary) Settlor makes gift into trust Trustee Growth outside estate from day one. IHT free. Trustee Gift £ Absolute Range of beneficiaries: beneficiaries: Can’t be changed Children/Grandchildren Entitled at former age 18 spouse (16 Scotland) Spouse or Not settlor though CLT NRB back PET after seven years. Outside estate Potential 20% after seven tax, years. 10-year & exit charges Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging Loan Trust • • • • • • • Settlor retains right to return of capital Freezes IHT liability No Gift element, so no PET/CLT All growth immediately outside estate Income stopped/started at any time Slower-burn Appropriate for younger settlors – parents to children Peter is 45 and in poor health Needs to think about IHT planning Also wants to supplement income He sets up a £200,000 Discretionary Loan Trust Trustees have a number of investment options: Deposit Account OEIC/Collective Investment Single Premium Bond 17 After consideration, Trustees invest in a Unit Linked Guaranteed bond: Certainty of £10,000 p.a. income for a minimum of 20 years Range of risk graded funds Enhanced death benefits Highest bond value = £220,000 Dies after year nine Cash-in value on death is £70,000 Bond pays out £130,000 18 Without Protection With Protection Investment Amount £200,000 £200,000 Payments Received £90,000 £90,000 Outstanding Loan £110,000 £110,000 Death Benefit £70,000 £130,000 Shortfall on Loan £40,000 Nil IHT @ 40% £44,000 £44,000 Capital left to Children £26,000 £86,000 Trustee Liability Yes No 19 Settlor Income IHT efficiency Legacy Beneficiaries Trustees Repayment of loan Investment strategy Minimum responsibilities IHT efficiency Legacy Tax efficiency Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging Discounted Gift Trust • Settlor retains right to regular income stream • Single or joint (spouse or civil partner) • Fully underwritten • Discount based on age, health and income (but not gender) • Discount on death within seven years • Appeals to older ages – grandparents to grandchildren Discounted Gift Trust • Clive and Alice Jenkins retired couple • Nil rate band allowance used • £250,000 of investments each • Potential IHT of £200,000 • Need £20,000 income per year • Leave money on death for grandchildren Discounted Gift Trust • Joint Life Bare Discounted Gift Trust for £500,000 • Total discount = £260,009 • Potential IHT saving = £104,003 • 4% income = £20,000 per year • Income to survivor on first death • Beneficiary access on second death Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging Taxation of a bond held in Trust The “Pecking Order” (S467 Income Tax Act 2005) • The Settlor where alive and UK resident (and also in tax year of death). Marginal rate. Possible top slicing relief • UK-resident Trustees following tax year of settlor’s death or where settlor non-UK resident. Liable at rate applicable to trusts – 45% - no top slicing relief • Where trustees non-UK resident, the Beneficiaries to the extent they have benefited at their marginal rates • However, assignment to Beneficiaries may be more tax efficient • Bare trusts are exception to this rule, as gain assessed to tax on the Beneficiary, subject to anti-avoidance provisions Gift (Disc) Gift (Bare) Loan (Disc) Loan (Bare) DGT (Disc) DGT (Bare) Income Access Control IHT Trust Planning Decision Tree Handset Question: Would you like a copy of Aegon’s Trust Decision Tree? 1. Yes please 2. No thank you Why Single Premium Bonds? Certainty of returns with Unit Linked Guarantees (Income, Capital, Death) Single Premium Bonds = Non-income producing asset Wide variety of trusts SINGLE PREMIUM BOND Administration simplicity No tax on Fund switches Income tax deferred until a chargeable event occurs – can use assignments No income tax using 5% withdrawal facility No further tax on underlying income Agenda • Bare v Discretionary Trusts • Gift Trusts • Loan Trusts • Discounted Gift Trusts • Taxation • Adviser Charging Adviser charging • Watch out for pitfalls – particularly GWR • Landscape has changed post-RDR Settlor Trustees Step 2 Step 1 £ Settlor is the adviser’s client – i.e. the person with the wealth, however… …on the gift of capital to a trust, the Settlor cannot benefit in anyway from the trust fund – i.e. any adviser charge for managing Settlor’s affairs. Adviser can have a separate relationship with the trustees to provide advice. Key Point The settlor could be a trustee – however they would be dealing with the adviser in a different legal capacity step 3 Beneficiaries These will likely be the children or grandchildren of the settlor. Settlor Initial fee for adviser on recommending trust planning Ongoing fee for adviser on reviewing other personal assets What is the easiest way for the adviser to be remunerated for the services to his client? Trustees £ Adviser Initial fee for adviser on recommending trustee investments Ongoing fee for adviser on reviewing trustee investments. Potential for ad-hoc payments for advice to the trustees. These are the Adviser’s remuneration options – not all may be met from the product Initial Adviser Charge • Use Pre-Investment option where available – Premium is the Contribution less the IAC – Gift/Loan into Trust is the Premium – Settlor not seen to benefit from trust property • If only Post-Investment IAC facilitated: – – – – Settlor must pay adviser directly out of own funds Or, initial advice recorded as provided to the Trustees Will be part of first year’s 5% “income” allowance Gift/Loan into Trust is the Contribution/Premium • Existing bonds – Owned by Settlor can be assigned into trust (Gift Trust only) Pre-investment – Settlor IAC Settlor’s cheque: £100,000 Initial Adviser Charge: £3,000 Bond Investment: £97,000 Gift into Trust: £97,000 • Loan Trust – Loan to be repaid is £97,000 • DGT – Income and discount calculated on % of £97,000 Pre-investment – Trustee IAC Settlor’s cheque: £100,000 Bond Investment: £97,000 Initial Adviser Charge: £3,000 Gift into Trust: £100,000 • Loan Trust – Loan to be repaid is £100,000 • DGT – Income and discount calculated on % of £100,000 • DGT – Income will be lower in year one Ongoing Adviser Charge • Will count towards the 5% p.a. “income” allowance • 0.5% OAC = Max 4.5% “income” • Avoid fund-based OAC • Bonds assigned into trust by Settlor will need new OAC agreement signed by Trustees • OAC paid from Loan Trust by Trustees will not reduce the outstanding loan • OAC paid from DGT by Trustees will reduce the Settlor’s income for discount purposes Conclusion • The benefits of trust planning are just as relevant in the post-RDR environment… • … but the consequences of getting it wrong can be serious • Ensure you check which options your provider facilitates • Unit Linked Guarantees can add an additional level of certainty to trust planning Handset Question: Would you like more information on how Unit Linked Guarantees can help with Trust Planning? 1. Yes please 2. No thank you Learning Objectives • By the end of the session you’ll be able to explain • IHT Planning through Loan Trusts and Discounted Gift Trusts • The technical details of these trusts • The interaction of trust planning and adviser charging Thank you Jim Callaghan Business Development Manager – Guarantees jim.callaghan@aegon.co.uk 07740 897 330 aegon.co.uk @aegonuk Aegon is a brand name of Aegon Ireland plc. Aegon Ireland plc, registered office: 2 nd floor, IFSC House, Custom House Quay, Dublin 1, Ireland. Registered in Ireland (No.346275). Authorised by the Central Bank of Ireland and subject to limited regulation by the Financial Services Authority. Details about the extent of regulation by the Financial Service Authority are available from us on request. An Aegon Company. www.aegon.ie © 2014 Aegon Ireland plc 42