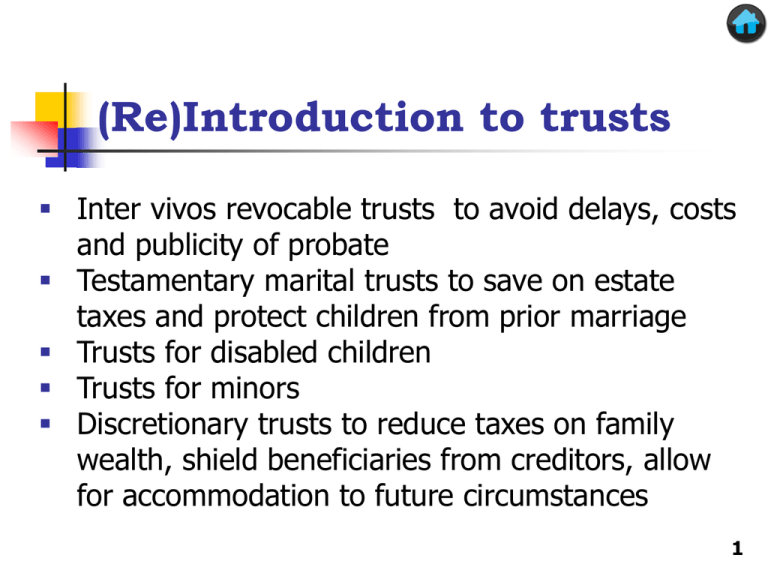

Introduction to Trusts

advertisement

(Re)Introduction to trusts Inter vivos revocable trusts to avoid delays, costs and publicity of probate Testamentary marital trusts to save on estate taxes and protect children from prior marriage Trusts for disabled children Trusts for minors Discretionary trusts to reduce taxes on family wealth, shield beneficiaries from creditors, allow for accommodation to future circumstances 1 Statistics and sources of law Statistics $760 billion held in ~1.25 million private and charitable trust accounts (2006) More than 2 billion tax returns reporting (2007): $142.5 billion in gross income $3.7 billion in fiduciary fees $1.6 billion in attorneys fees Sources of Law Restatements of Trusts First (1935) Second (1959) Third (2003, 2007, in prog) Leading Multivolume Treatises Scott; Bogert Uniform Laws Uniform Trust Code (2000) 2 Uniform Trust Code adoptions (2009) WA MT ME ND VT MN OR NH ID WI SD NY WY RI CT MI PA IA NE NV OH IL UT MD WV CA MO VA KY OK NM WV also has adopted NC TN AZ NJ DE IN CO KS MA AR SC MS AL GA TX LA FL AK HI 3 The settlor, trustee, and beneficiaries, p. 547 Trust Property Settlor Promise to manage property in best interests of Beneficiaries Trustee Beneficiaries 4 Third-party rights as trustee Trustee individual Creditors of the Trust Creditors of the Individual 5 Trust creation We’ve already seen that it’s simpler to create a trust than to execute a will—no need to satisfy the attestation and witnessing requirements of wills We’ve also seen that trusts require settlors, trustees and beneficiaries (with individuals being able to serve multiple roles for a single trust) Today, we discuss in more detail some of the requirements for creating a trust 6 Requirements for creating a trust Settlor’s intent to create a trust Presence of a res (the trust property) Designation of beneficiaries A writing or clear and convincing evidence of an oral trust Indiana requires a writing for all trusts, and all states require a writing for testamentary trusts 7 Lux v. Lux Lux v. Lux 288 A.2d 701 (R.I. 1972), p. 557 2. 3. 4. All the rest…of my estate…I give to my grandchildren, share and share alike. Any real estate…shall be maintained for the benefit of said grandchildren and shall not be sold until the youngest of said grandchildren has reached twenty-one years of age. Should it become necessary to sell any of said real estate to pay my debts…it is my express desire that said real estate be sold to a member of my family. Did Philomena “intend[] that her real estate be held in trust for the benefit of her grandchildren”? 8 Lux and settlor intent Did it matter that Ms. Lux did not say she was creating a trust? No Did it matter that Ms. Lux did not appoint a trustee? No—”a trust never fails for lack of a trustee” (the executor became trustee) 9 Lux and settlor intent Which facts indicated intent to create a trust? She did not give her grandchildren outright ownership of the property The property had to remain unsold until the youngest grandchild reached age 21 The property was to “be maintained for the benefit” of the grandchildren Note the major contrast with wills With wills, form matters a whole lot With trusts, courts look to function 10 Jimenez v. Lee Jimenez v. Lee 547 P.2d 126 (Ore. 1976), p. 558 Mrs. Diercks makes $500 gifts to all three children, deposited in an account in names of children and Lee. $1000 1945 Plaintiff sues, seeking to recover proceeds or original gifts. 1960 1956 Mr. Lee Paternal grandmother purchases $1000 bond for plaintiff, registered in names of plaintiff and plaintiff’s parents. Plaintiff $500 Lee cashes bond and closes bank account, purchasing stock with proceeds as “custodian” for his children. Mrs. Diercks 11 What facts suggested that a trust was created? The court found a trust because (p. 559) Lee’s own testimony and other evidence demonstrated that the $1,500 in gifts were given for the educational needs of his daughter In a letter, Lee acknowledged that he held the funds “in trust” for the children (and Lee was a lawyer) Moreover, a trust—and not a custodianship—is the relationship traditionally created by a gift imposing fiduciary duties upon an adult for benefit of a minor. If a custodianship is intended instead, the donor should specifically say so. 12 Why did Lee claim he was a custodian, not a trustee? As a custodian he could use the property for the “benefit” of the minor; as a trustee, he could use it only for education purposes Because he did not kept clear records, he was better off if he was not restricted in use of the funds As a custodian, he would escape liability because the statute of limitations would have run If he was a custodian, the statute of limitations on his duty to account elapsed two years after Betsy reached majority, or in 1968. If he was a trustee, the statute of limitations did not begin to run until he accounted (which 13 he had never done). Why did the daughter sue Lee? There was not a lot of money at stake— perhaps something over $2,000 in the end How would the lawsuit affect Lee when he wrote his will? Maybe their relationship was irreparably frayed 14 Demonstrating intent I, JOHN DOE, of Indianapolis, Indiana, declare myself trustee of the "______ DECLARATION OF TRUST," consisting of the property identified on the attached Schedule of Property, which property and all additions, investments, and accretions shall be administered upon the following terms: If your client wants a “precatory trust” (page 562), then the language also should be clear: “I wish, but do not legally require, that C permit D to live on the land.” 15 Outright gifts To complete an outright gift, rather than a gift in trust, there generally must be a delivery and acceptance of the gift Actual delivery Constructive delivery (e.g., a key to a house so the donee can pick up the painting given as a gift) Symbolic delivery (e.g., a writing such as the letter in Speelman) 16 Requirements for creating a trust Settlor’s intent to create a trust Presence of a res (the trust property) Designation of beneficiaries A writing or clear and convincing evidence of an oral trust Indiana requires a writing for all trusts, and all states require a writing for testamentary trusts 17 Creation of a trust: Necessity of trust property A trust is not valid without a trust property or res It need not be a sizeable amount of property, it need not be a present interest, and it need not be an interest that is certain to vest at some point Even though the property requirement is not a substantial one, it can still result in the failure of an intended trust, as some of our cases for today demonstrate 18 Establishing a res “Settlor herewith deposits the sum of One Dollar ($1.00) as the initial corpus of the trust” 19 Unthank v. Rippstein, Unthank v. Rippstein 386 S.W.2d 134 (Tex. 1964), p. 569 20 Why didn’t Craft create a valid trust? Did he designate a beneficiary? Did he demonstrate intent to create a trust? Yes. Iva Rippstein Actually, he demonstrated intent to create a will when he stated that he was binding his estate to make the monthly payments—and Texas allows holographic wills The court should have found a valid holographic will (certainly more like a will than Kuralt’s letter) Did he identify any trust property? Only by implication, which the court concluded was not sufficient. As a result, the court found an unenforceable 21 promise Brainard v. Commissioner Brainard v. Commissioner 91 F.2d 880 (7th Cir. 1937), p. 572 Brainard orally declares trust of expected profits from stock trading in 1928 for benefit of wife, mother, and minor children. Dec. 1927 Stock trading is profitable. Brainard pays himself $10,000 as trustee and distributes profits among trust beneficiaries. Beneficiaries declare trust income on 1928 income tax return 1928 1929 Did trust arise in 1927, with Brainard’s oral declaration, prior to making the profits? No, according to the court, since the profits did not come into existence until they were earned. But why aren’t future profits a res? 22 Can future profits be a res? The Brainard court was obviously worried about making it too easy for someone to evade taxes. After all, we have an oral declaration, and Brainard traded under his own name. Of course, what constitutes a trust for most purposes may differ from what constitutes a trust for tax purposes. Recall that the creation of a revocable inter vivos trust provides a number of advantages, but does not reduce tax obligations (page 439). See the note on page 576 for further discussion. 23 Speelman v. Pascal, Speelman v. Pascal 178 N.E.2d 723 (N.Y. 1961), p. 572 Pascal acquires exclusive rights to produce musical and film based on Shaw’s “Pygmalion.” License to expire in 1956. 1952 Pascal makes various attempts to produce show. Pascal promises, in writing, a portion of the profits of the (still unproduced) show to Miss Kingman (aka Miss Speelman). Feb. 22, 1954 Pascal dies. July 1954 “Did the delivery of this paper constitute a valid, complete, present gift to [Speelman]…?” 24 Can future profits be a res? Technically, the issue in Speelman is whether we have a valid gift rather than a trust, but the same question arises—is there a property right being transferred? Yes, we have the assignment by Pascal to Speelman of an enforceable right of Pascal to future sums. According to the court, there was “nothing left for Pascal to do in order to make an irrevocable transfer to plaintiff of part of Pascal’s right to receive royalties from the productions. . .” (page 575, end of opinion). 25 Can future profits be a res? What in the letter (page 573) suggests that Pascal had not transferred his right to Speelman? The second paragraph of the letter which states that Pascal’s lawyer will confirm the arrangement “in a legal form.” 26 Note 1, page 575 Brainard involved the oral testimony of interested witnesses to establish a trust that avoided taxes An oral declaration of trust is permissible, but the possibility of fraud leads courts to apply other requirements strictly What about the fact that Pascal had a contract that entitled him to future profits while Brainard was promising profits from the sale of stocks that he might not even have owned at the time? This view is supported by the Restatement provision cited in the note, but note also that the Field case cited on page 575 by the Speelman court did not involve an existing contract 27 Note 2, pages 575-76 a) Looks like Brainard. We have a gratuitous promise. No gift because there was no delivery of a gift or written instrument. No trust because O did not declare a trust and no res. b) This counts as a trust. The stocks that O already owns constitute the res. This is how we make Brainard’s trust look like it has a res. If Brainard declared himself trustee of stock which he already owned and stipulated that the dividends would go to him while the other beneficiaries would receive the capital gains, the practical effect is the same as a trust of the future profits in stock trading, but the stock would provide a corpus (Restatement (Third) of Trusts, § 41, comment b). 28 Note 2, pages 575-76 c) Looks like Brainard, but now we have a notarized writing. On the other hand, still no res. If we follow the logic of Brainard, no valid trust. If we think Brainard was driven by the fact of an oral declaration with interested witnesses, then maybe this case comes out differently. d) We have an invalid trust, per Brainard. 29 Requirements for creating a trust Settlor’s intent to create a trust Presence of a res (the trust property) Designation of beneficiaries A writing or clear and convincing evidence of an oral trust Indiana requires a writing for all trusts, and all states require a writing for testamentary trusts 30 The requirement of trust beneficiaries A trust must have one or more ascertainable beneficiaries—if we can’t identify the beneficiaries, the trust will fail—there must be someone to whom the trust owes fiduciary duties and who can call the trustee to account Charitable trusts need not have ascertainable beneficiaries Trusts for one’s descendants may have currently unascertainable beneficiaries when the trusts are created 31 Clark v. Campbell Clark v. Campbell 133 A. 166 (N.H. 1926), p. 579 Testator Trustees Friends I therefore give and bequeath to my trustees all my property embraced within the classification aforesaid in trust to make disposal by the way of a memento from myself, of such articles to such of my friends as they, my trustees, shall select. Must “the bequest for the benefit of the testator’s ‘friends’…fail for the want of certainty of the beneficiaries”? Yes. One can designate relatives, or subsets thereof, but not “friends.” 32 Indefinite beneficiaries A power in a trustee to select a beneficiary from an indefinite class is valid. If the power is not exercised within a reasonable time, the power fails and the property subject to the power passes to the persons who would have taken the property had the power not been conferred. Uniform Trust Code § 402(c), Ind. Code § 30-4-2-1(f) But outside UTC states, the drafting lesson is not to create a power in a trustee to appoint among an indefinite group. Give the power to the selector individually, rather than as a trustee (note 1, p.581) 33 The will of Marilyn Monroe, p. 582 1) Did Monroe intend to create a trust? The words “it being my desire” are precatory words, and she said “give and bequeath” so no trust, and Strasberg takes as a devisee. (But some courts would say the words demonstrate intent to create a trust, especially since the executor is the contingent taker.) 2) If Monroe intended a trust, did she designate an ascertainable beneficiary? No ascertainable beneficiaries, so trust fails, and personal effects go to the 34 residue of the estate. The rest of the story Strasberg never distributed any of Monroe’s personal effects to the friends or colleagues to whom Marilyn was devoted In fact, he requested the return of several of Marilyn’s possessions that she had given to a colleague When Strasberg died, he left a will granting Marilyn’s personal effects to his wife, who, like her husband, chose not to give any of Marilyn’s personal effects to friends or colleagues of Marilyn 35 In re Searight’s Estate, In re Searight’s Estate 95 N.E.2d 779 (Ohio App. 1950), p. 582 George Searight “$1000 to be used…to pay Florence…for the keep and care of my dog as long as it shall live.” Executor/Trustee “I give and bequeath my dog, Trixie…” Florence Hand 36 Can a dog be a beneficiary of a trust? We know from Russell (page 359), that you can’t leave property in a will to a dog Would it have been a problem if George had created a trust for the benefit of dogs in general? No, he could have created a charitable trust for dogs (page 583, top) The problem here is that George designated a particular dog, so we have a private trust, and we don’t have a beneficiary who can enforce the terms of the trust 37 Can a dog be a beneficiary of a trust? The court permitted the bequest, treating it, like other courts, as an “honorary trust” (page 583) Such trusts are valid as long as the “trustee” is willing to carry out the terms of the bequest (hence the term honorary). (The court also said that it could be called a gift with a power (page 583).) Note that while Trixie was not in a position to enforce the trust, the residuary beneficiaries of the will have some ability to do so since they can seek reversion of the trust if the trustee neglects the responsibilities of the trust. 38 Trusts for noncharitable purposes, p. 586 Honorary Trust Transferee is not obligated to carry out settlor’s purpose If transferee declines, she holds the property on resulting trust and property reverts to settlor or settlor’s successors Used in Searight’s Estate Statutory Purpose Trust Statutory trust for pet animal or other noncharitable purpose Authorized by UTC §§408409 and UPC §2-907 Typically authorize court to reduce excessive trust property and provide for enforcement by settlor or court appointee Ind. Code § 30-4-2-18 39 Requirements for creating a trust Settlor’s intent to create a trust Presence of a res (the trust property) Designation of beneficiaries A writing or clear and convincing evidence of an oral trust Indiana requires a writing for all trusts, and all states require a writing for testamentary trusts 40 Requirement for a writing Generally, a writing is not required, except for testamentary trusts or trusts of land Clear and convincing evidence required to validate oral trust But in Indiana, “a trust in either real or personal property is enforceable only if there is written evidence of its terms bearing the signature of the settlor or the settlor's authorized agent.” Ind. Code §30-4-2-1(a) 41 Estate of Fournier Estate of Fournier (Slide 1) 902 A.2d 852 (Me. 2006), p. 589 Faustina Fogarty Juanita Flanigan Rose ?? ?? Curtis King George Fournier $400,000 in trust for Fogarty Josephat Madore Yvette Madore 42 Estate of Fournier, Estate of Fournier (Slide 2) 902 A.2d 852 (Me. 2006) (2) Fournier asks Madores to hold $400,000 in secret, to be delivered upon his death to Fogarty because she “needed it more” than his other sister. Note discovered with instructions Fournier dies testate. that $400,000 be divided among Fogarty, Flanigan and King. Court Residue in equal holds oral trust was for benefit of shares to Fogarty, all three residuary takers. Flanigan, and King. 2002 1998 or 1999 Fournier tells Flanigan of arrangement with Madores. 2005 Fournier gives Fogarty a gift of $100,000. Madores give $400,000 to Fogarty. Court finds oral trust of money for her benefit. 43 Fournier Note that the probate court weighed the conflicting testimony and found no trust, while the supreme court resolved the inconsistency in favor of a trust Why did the supreme court override the probate court? Maybe because Flanigan had an incentive to misremember/mislead while the Madores did not In the end, the trust’s beneficiaries turned out to the same as the will’s beneficiaries. Why did Fournier bother with the trust? Trying to evade taxes? 44 Olliffe v. Wells Olliffe v. Wells 130 Mass. 221 (1881), p. 593 Semisecret Trust Desire to create trust appears on the face of the will Terms are undisclosed Extrinsic evidence not needed to prevent unjust enrichment Devise is unenforceable Secret Trust Devise is absolute on the face of the will Extrinsic evidence necessary to prevent unjust enrichment Court will impose a constructive trust on promisor But Restatement would treat semisecret trusts like secret trusts 45