June 2014 Mission Institute

advertisement

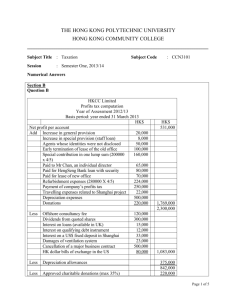

________________: June 2014 __________ Presenter: Corey A. Pfaffe, CPA, PhD _______________: June 2014 ____________ Agenda: Today—Financial “hot topics” update Tomorrow—Ministry topics from a “friendly” Presenter: Corey A. Pfaffe, CPA, PhD Financial “Hot Topics” Update Tax Review and Update • Foreign Earned Income Exclusion • Housing allowance • Ministry (“Business”) Expenses – Ministry or Personal (Ordinary and Necessary) – Missionary as earner versus family as earners • Support issues Housing Allowance: Review • Principal residence • Three-part test – Actual expenses – Designated amount – Fair rental value, plus actual cost of utilities • Partial reduction of deductible expenses Housing Allowance: Unconstitutional? Opting Out of Social Security • • • • 15.3% SECA; not 7.65% FICA Requirements Caution! Does opting out include the ACA? Retirement Plan Options: Review • Internal Revenue Code Section 403(b) plans • Traditional Individual Retirement Accounts (IRAs) • Roth IRAs (and Roth 403(b) plans) • • • • FBARs—Foreign Bank and Financial Accounts Report What? FinCEN Form 114, electronically reporting foreign financial interests and signature authority Who? Any U.S. person with aggregate value in foreign financial accounts exceeding $10,000 at any time in 2013 When? June 30, 2014 (may not be extended) Why? Consequence of failure to properly file “not to exceed $10,000 …” FBARs—Foreign Bank and Financial Accounts Report FBARs—Foreign Bank and Financial Accounts Report • Go to www.irs.gov and type “FBAR” in the search window • Engage a BSA E-Filer—a firm registered and authorized under the Bank Secrecy Act to file on behalf of others through the Financial Crimes Enforcement Network Affordable Care Act • “Individual Shared Responsibility Payment” – 2014: greater of 1% of your household income in excess of “filing threshold” OR $285 (for family of six) – By 2016: greater of 2.5% of your household income in excess of “filing threshold” OR $695 per person ($4,170 for family of six) • 100% exception for missionaries: – If you qualify for the foreign earned income exclusion with a onceper-year presence in the U.S. of no more than three months For more information... IRS Publications 54 – U.S. Citizens Abroad 463 – Travel 535 – Business Expenses 1771 – Charitable Contributions 1828 – Churches & Religious Org. IRS-Other Form 2555 – Foreign Earned Income Exclusion Form 8938 – Report of Foreign Bank and Financial Accounts (FBAR) Ministers Audit Techniques Guide For more information... • • • • • • Non-profit organization accounting principles Compensation practices Benevolent activities Contributions issues Foreign missions support Ministerial tax planning http://www.ministrycpa.blogspot.com/ _______________: June 2014 _____________ Ministry Topics from a “Friendly” Short-Term Missions Trips to “Your Place” • Handling fundraising • Qualified expenses • Reporting Three Required Ingredients in Any Successful Family Budget • A monthly budget – IN — net payroll checks, average draws – OUT — every pay period, every month, Budget Busters • A payday method • Staying on track between paydays Resources STRENGTHS: A slap upside STRENGTHS: the head! Easy-to-read, Testimonies Bible-rich teaching STRENGTHS: Gets a couple talking about money & priorities Communications with Your Supporters • Email often, but keep it short • Supporters want to hear about your personal and family needs, both spiritual and practical • It’s a delicate subject, but supporters said that they heard the least about your financial needs and gave the strongest indication of any subject that they did not hear enough about these needs