James Renwick, Ashford BC CIL Presentation

advertisement

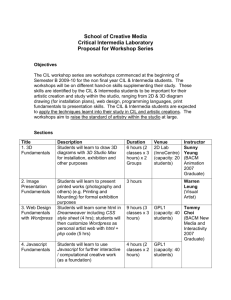

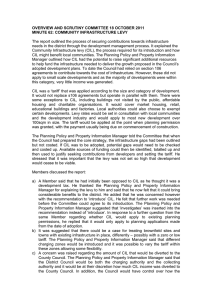

KHG Future Funding Workshop Community Infrastructure Levy – 14 June 2013 James Renwick Ashford Borough council Main drivers behind CIL Decreased Government funding – focus on ‘deliverability’ and levering nongovernmental funding Localism – generate (and allocate) income ….locally NPPF (and ‘Harman Report’) - LPAs to be clear on what is going to be charged, Local plans to show infrastructure can be afforded CIL – A changing picture…….. Planning Act 2008 Localism Act 2011 CIL: ‘….Duty to pass on…..’ ‘….appropriate available evidence……’ ‘ ……support development’ Neighbourhood Planning Local finance considerations CIL: ‘infrastructure to support development’ ‘definition of infrastructure….. affordable housing’ Removed affordable housing from definition of infrastructure Regs 2010 Regs 2011 Instalments policy Stat Guidance 2010 ‘….in the opinion of the authority….’ Regs 2012 Regs 2013 ‘Boles bung’ ‘Section 73’ issue resolved Stat Guidance 2012 NPPF 2012 Harman Report 2012 ‘….charging authorities will need to show ….’ Stat Guidance 2013 ‘spending / reporting by parish councils’ The basics…..at present • Must prove there is a need to charge CIL…….??? • Must show (broadly) what infrastructure will be S106 / CIL (Affordable housing will remain as S106) • Must show that after introducing CIL a sufficient amount of sites (i.e local plan housing target) will remain viable • CIL rates(s) set by economic viability after all other policy costs considered • Charged per m2 on the increase in built floor space (GIA) • Divergence in rates for geography or ‘intended use’ – where economically proven…….! The basics…..at present • Not compulsory…but S106 restricted (Regulation 123 – post April 2014) • Required to collect– no discretion, precedence over other policy requirements • Payment as cash, or in land; - 15% (cash) direct to the Parish council where development occurred - 25% if there is Neighbourhood Development Plan or development approved through Neighbourhood Development Order • Mandatory ‘Social housing relief’ – 100% relief on floor space proposed, must be repaid if the unit changes to private / market housing with 7 years (Housing Act 1988) • Development for the ‘purposes’ of a charity are exempt • Discretionary ‘charitable relief’ on investment activities Current approaches / judgements (specific to housing) • CIL being set with regard to adopted affordable housing policy ...... however some have modelled CIL around the assumption that AH levels will be affected (or currently not being achieved) in certain localities. • Residential charges are a single rate (but split geographically); however some have proposed threshold rates • Discretionary charitable relief (relief on investment activities) supported but very few defined. Proposed reforms….. • ‘Scale’ of development to allow for different rates • Must publish a draft regulation 123 list as part of the examination • CIL could be paid as the cash value of infrastructure • Mandatory (100%) relief for selfbuild homes • Discretionary relief for ‘discounted market sales’ Conclusions…..? • Effect of Local finance considerations? • Balance between affordable housing and CIL? A key consideration in local plan reviews • More specific analysis on the ability for certain locations to afford policy requirements?