Mobile-2_MobileBanking - FINAL

advertisement

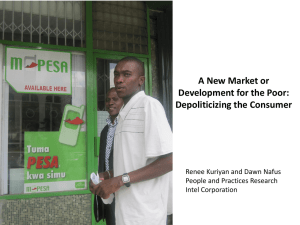

Mobile 2 Mobile Banking Nov 7, 2013 Alejandra Aneeq Michael Rimpei Key Terms 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Unbanked Financial inclusion Branchless Banking Remittance Mobile banking Adoption DFID (Bilateral aid agency of UK) Microfinance E-Wallet Over-the-Counter (OTC) Agenda Key Concepts Mobile banking Case Study: M-Pesa Case Study: EasyPaisa Guest: Tughral – Regional Mgr. North Pakistan (EasyPaisa) Innovation in development Financial Inclusion Key Concepts Unbanked: population that does not access formal and/or semi-formal banking services Financial Inclusion: Providing financial services to the unbanked Remittances: Transfer of money by a foreign worker to home country (we also use it in domestic terms) Branchless Banking: Delivery of financial services outside conventional bank branches using agents and 3rd party intermediaries & technologies Mobile Banking: Branchless banking through mobile phones (simplified) Need: “Access to finance facilitates entrepreneurial activity” Large number of workers away from home (international and domestic migrants) – Nick Hughes (M-Pesa ideator) Unbanked Percentage of Unbanked Remittance Difficulty in Cash Transfer No bank in a rural area No one has a bank account. Bring cash by him/herself by bus High cost Ask a bus driver to carry cash High risk Mobile banking Cellphone use in Kenya Source – Economics of M-Pesa Mobile banking US vs Developing World Mobile banking What is M-PESA Mobile based money transfer and microfinancing service in Kenya & Tanzania (East Africa) “M” is for mobile &“Pesa” is the Swahili for cash Operated by Safaricom and owned by Vodacom Started in 2007 Mobile banking Kenya, a conducive environment for mobile banking Large market for domestic remittances with high demand for transfer services High literacy levels Support of the Central Bank of Kenya High Mobile Penetration An entrepreneurial base of micro entrepreneurs Remittance Solution: Mobile Banking Transfer money without a bank account Transfer money safely and quickly Low remittance fee – 12% lower than banks*1 No long bus journey – reduce cost and time *1 Branchless Banking 2010: Who’s Served? At What Price? What’s Next?, CGAP, Sep., 2010 Remittance Scheme of M-Pesa Sender Receiver 3 6: Withdrawal operation 4: Buy m-money 2 M-Pesa m-money Account 7 Rural Agent Urban Agent 8: Withdraw cash 5: Transfer m-money Link Urban M-Pesa Agent 1 Urban Agent Rural Agent Bank Account 9 *1 M-PESA: Mobile Money for the “Unbanked” Turning Cellphones into 24-Hour Tellers In Kenya Rural M-Pesa Agent Over-the-Counter Need for Over-The-Counter Situation & Problem Neither a sender or a recipient have mobile banking account but they want to send money. Solution – Over-The-Counter A mobile banking agent of a sender transfers e-money by mobile banking on behalf of the sender, charges commission. A mobile banking agent of a recipient receives emoney on behalf of the recipient. The recipient gets money. Benefit of Over-The-Counter Relieve of account opening requirements Eliminate technical limitations *1 http://www.cgap.org/blog/mobile-money-otc-versus-wallets e-Wallet e-Wallet (account) vs Over-The-Counter E-Wallet Mobility OTC Customer retention Company Revenue Need ? *1 http://www.cgap.org/blog/mobile-money-otc-versus-wallets ? Remittance M-PESA – urban to rural money transfer http://www.economist.com/node/16319635 Financial Inclusion Socioeconomic profile of users 2008 2009 Users Nonusers Users Nonusers Annual Household Expenditure (USD) 3,600 2,000 2,900 1,400 Household with at least one cell phone 92% 52% 92% 39% Unbanked 25% 75% 50% 50% Rural Population 29% 71% 59% 41% Urban Population 53% 47% 76% 24% ** Source: Jack, Willian & Suri Tavneet. Mobile Money: The economics of M-PESA Change Adoption Socioeconomic profile of users Consumption and Education Level Early Adopters > Late Adopters > Non User Banked Early Adopters > Late Adopters > Non User Earliest Over users Wealthier and most educated time, M-PESA is being adopted by people of more varied socioeconomic levels Adoption Individual’s reasons for not using M-PESA Reason 2008 2009 Don’t own a mobile phone 28% 60% Don’t know about it 18% 3% Don’t need it 14% 21% Don’t understand it 5% 5% Adoption Success Factors Built Trust by good Branding - User experience - Investing on a national marketing launch Aggressive advertisement on television and radio Road shows and tents that travelled around the country Offering a product that is simple to use Building an extensive channel of retail agent Robust network - Attracting customers and stores at the same time Creating an attractive pricing scheme for customers and stores Financial inclusion Factor in common Kenya Brazil Pakistan Great number of unbanked people Use of informal means to get cash, send remittances, make withdrawal, etc. Low-income population Many people that live on rural areas Branchless Banking ** Source: McKay, Claudia & Pickens Marks. Branchless Banking 2010: Who’s served? At what price? What’s next? Mobile banking Started in 2009 in Pakistan Telenor (Mobile operator) bought 51% of Tameer Microfinance Bank before launch Expected to serve international remittances Over-the-counter transaction main activity Mobile banking Challenges for EasyPaisa: Slow adoption of mobile wallets / e-wallets E-wallets still require significant Know Your Customer requirements which cannot be met at the 30,000 agent level Businesses are also not accepting EasyPaisa as mode of payment Adoption Adoption Comparison Kenya M-Pesa Pakistan EasyPaisa Wallets 13 M (Aug ’13)** 2.4 M (12%) (Aug ‘13) Transactions a day 6,000,000 ~320,000* Market Share 98% 50% of all mobile of all mobile banking transaction banking transaction *State Bank of Pakistan http://www.sbp.org.pk/publications/acd/BranchlessBanking-Apr-Jun-2013.pdf **DFID Kenya Blog