Corporate Fact Sheet

advertisement

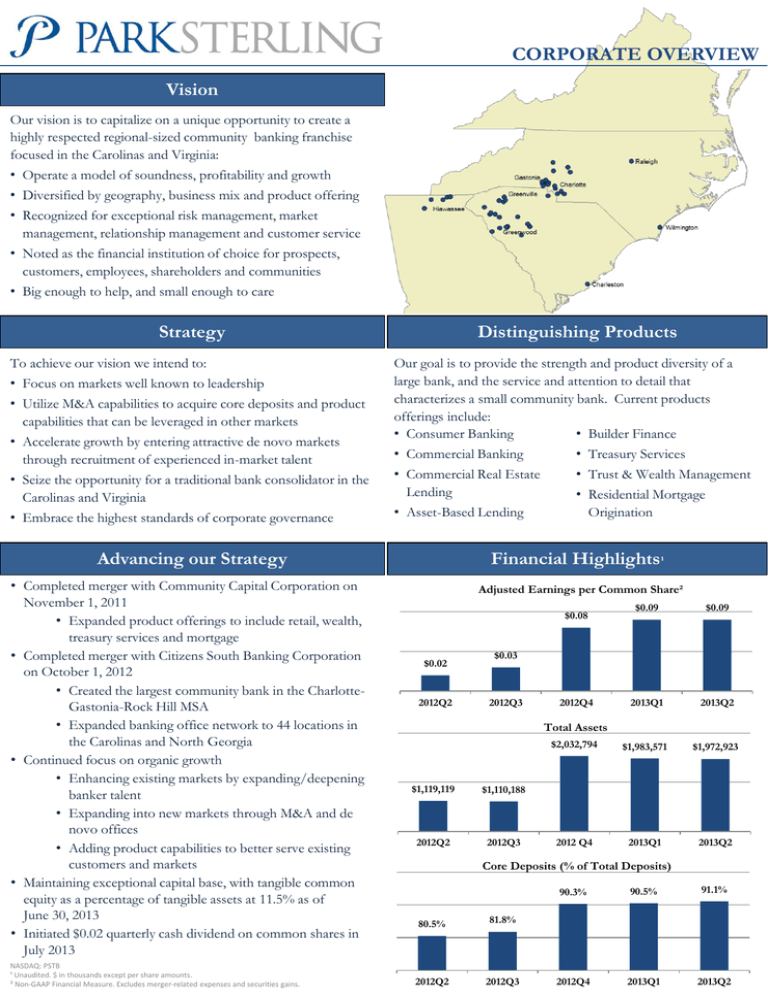

CORPORATE OVERVIEW Vision Our vision is to capitalize on a unique opportunity to create a highly respected regional-sized community banking franchise focused in the Carolinas and Virginia: • Operate a model of soundness, profitability and growth • Diversified by geography, business mix and product offering • Recognized for exceptional risk management, market management, relationship management and customer service • Noted as the financial institution of choice for prospects, customers, employees, shareholders and communities • Big enough to help, and small enough to care Strategy To achieve our vision we intend to: • Focus on markets well known to leadership • Utilize M&A capabilities to acquire core deposits and product capabilities that can be leveraged in other markets • Accelerate growth by entering attractive de novo markets through recruitment of experienced in-market talent • Seize the opportunity for a traditional bank consolidator in the Carolinas and Virginia • Embrace the highest standards of corporate governance Distinguishing Products Our goal is to provide the strength and product diversity of a large bank, and the service and attention to detail that characterizes a small community bank. Current products offerings include: • Consumer Banking • Builder Finance • Commercial Banking • Commercial Real Estate Lending • Asset-Based Lending Advancing our Strategy • Completed merger with Community Capital Corporation on November 1, 2011 • Expanded product offerings to include retail, wealth, treasury services and mortgage • Completed merger with Citizens South Banking Corporation on October 1, 2012 • Created the largest community bank in the CharlotteGastonia-Rock Hill MSA • Expanded banking office network to 44 locations in the Carolinas and North Georgia • Continued focus on organic growth • Enhancing existing markets by expanding/deepening banker talent • Expanding into new markets through M&A and de novo offices • Adding product capabilities to better serve existing customers and markets • Maintaining exceptional capital base, with tangible common equity as a percentage of tangible assets at 11.5% as of June 30, 2013 • Initiated $0.02 quarterly cash dividend on common shares in July 2013 NASDAQ: PSTB ¹ Unaudited. $ in thousands except per share amounts. ² Non-GAAP Financial Measure. Excludes merger-related expenses and securities gains. • Treasury Services • Trust & Wealth Management • Residential Mortgage Origination Financial Highlights¹ Adjusted Earnings per Common Share² $0.09 $0.09 2013Q1 2013Q2 $2,032,794 $1,983,571 $1,972,923 2012 Q4 2013Q1 2013Q2 $0.08 $0.02 2012Q2 $0.03 2012Q3 2012Q4 Total Assets $1,119,119 $1,110,188 2012Q2 2012Q3 Core Deposits (% of Total Deposits) 80.5% 81.8% 2012Q2 2012Q3 90.3% 90.5% 91.1% 2012Q4 2013Q1 2013Q2 Page 2 Executive Officers James C. (Jim) Cherry Chief Executive Officer/Director Nancy J. Foster Chief Risk Officer David L. Gaines Chief Financial Officer Bryan F. Kennedy, III President 32 years of banking experience including Chief Executive Officer of Mid-Atlantic Banking, President of Virginia Banking, Head of Trust and Investment Management for Wachovia Bank. 28 years of banking experience including Chief Risk Officer for CIT Group and Chief Credit Officer of Community Banking Group at LaSalle Bank. 24 years of banking experience including Chief Risk Officer for Corporate and Investment Banking, Senior VP and Comptroller, and Co-Manager of integration office for Wachovia Bank. 30 years of banking experience including President North Carolina, Regions Bank and Executive Vice President, Park Meridian Bank. Helped organize Park Sterling in October 2006. Independent Directors Leslie M. (Bud) Baker, Jr. Chairman Kim S. Price Vice Chairman Walter C. Ayers Director Larry W. Carroll Director Jean E. Davis Director Patricia C. Hartung Director Thomas B. Henson Director Jeffrey S. Kane Director Ben R. Rudisill, II Director Retired Chairman of Wachovia Corporation. Also served Wachovia as Chairman, President, Chief Executive Officer, and Chief Credit Officer, as well as President of the North Carolina Bank. Former President and Chief Executive Officer of Citizens South Banking Corporation and Citizens South Bank. Retired President and Chief Executive Officer of the Virginia Bankers Association. Served as member of ABA’s Communication Counsel, Government Relations Counsel and others. President and Chief Executive Officer of Carroll Financial Associates, Inc., a registered investment advisory firm. CPA background. Park Sterling organizer in October 2006. Retired Senior Executive Vice President for Operations, Technology and e-Commerce at Wachovia Corporation. Also formerly head of Human Resources and head of Retail Banking. Executive Director of Upper Savannah Council of Governments. Founding member and former Chair of Community Capital Corporation. President of Henson-Tomlin Interests, LLC and Senior Managing Director of Southeastern Private Investment Fund. Helped organize Park Sterling in October 2006. M&A attorney by background Retired Senior Vice President in charge of Charlotte office of Federal Reserve Bank of Richmond. Also served as head of Banking Supervision and Regulation. President of Rudisill Enterprises, Inc., since 1976. Former Chairman of Citizens South Banking Corporation and Citizens South Bank.