Life Insurance - Healthy Decisions

advertisement

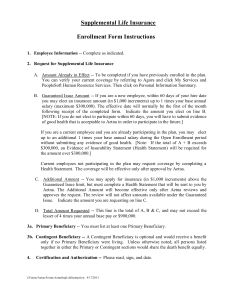

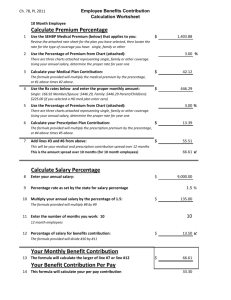

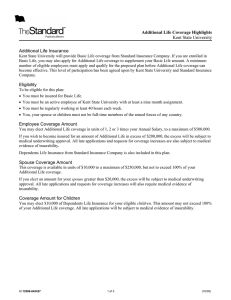

Life Insurance Overview of life insurance coverage 1 Basic and Supplemental Life Coverage on your life will be the total of your basic and supplemental life insurance Your total coverage will be one of the following: Basic life 1x 1x 1x 1x 1x + Supp life + none + 1x + 2x + 3x + 4x = = = = = = Total coverage 1x your base salary * 2x your base salary * 3x your base salary * 4x your base salary * 5x your base salary * * If your death is caused by an accident, up to 10x salary will be paid to your beneficiary Dependent Life Insurance You may cover your spouse/partner You may cover your qualified children (to age 19 and up to age 25 if full-time college student) If married with children, you may choose spouse only, children only or take full family coverage There are 4 levels of coverage Level $ 5,000/$ 2,000 $10,000/$ 5,000 $20,000/$10,000 $50,000/$10,000 Amt on spouse $ 5,000 $10,000 $20,000 $50,000 Amt per child $ 2,000 $ 5,000 $10,000 $10,000 Plan features Guarantee issue at hire (up to $650,000) and spouse/partner coverage up to $20,000 Evidence of Insurability (EOI) may be required in the future to enroll into extra coverage Group term life insurance – no cash value Per IRS, imputed income is reported on your W-2 if your base pay is $50,000+ 4 Plan features (cont’d) Accidental Death and Dismemberment (AD&D) protection on employee coverage You may convert to an individual policy upon your terminating employment Waiver of premium feature, if disabled Living benefit option, if terminally ill Coverage amount reduces by half at age 70 5 Plan features (cont’d) Premiums are determined by your age (rates are determined by your age bracket which calculates a higher premium for each 5-year age band), and your salary (as your base pay or your hours change, your premiums modify slightly up or down) Your dependent life insurance premiums are based on your age. 6 Beneficiaries You name a beneficiary for your basic and supplemental coverage. Do NOT list a minor child as your beneficiary as life insurance checks cannot go to minors. You are automatically the beneficiary for the dependent life insurance Primary beneficiary will receive the benefit Secondary or contingent beneficiary will receive the benefit ONLY if your primary beneficiary pre-deceases you 7