Calculate Premium Percentage Calculate Salary Percentage Your

advertisement

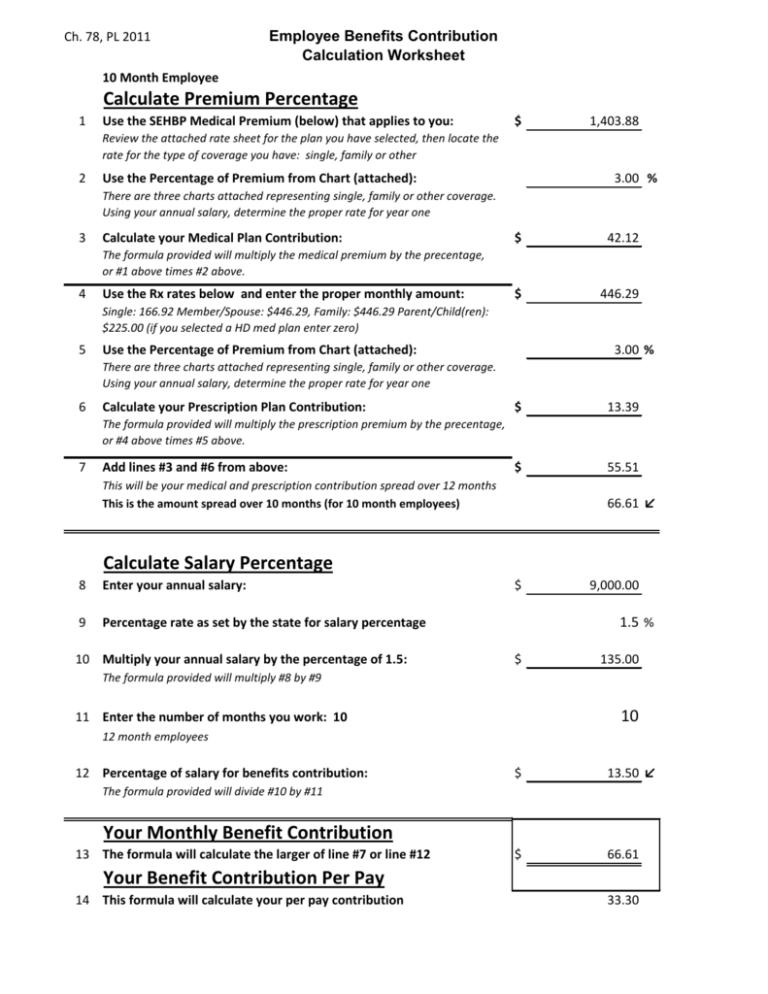

Ch. 78, PL 2011 Employee Benefits Contribution Calculation Worksheet 10 Month Employee Calculate Premium Percentage 1 Use the SEHBP Medical Premium (below) that applies to you: $ 1,403.88 Review the attached rate sheet for the plan you have selected, then locate the rate for the type of coverage you have: single, family or other 2 Use the Percentage of Premium from Chart (attached): 3.00 % There are three charts attached representing single, family or other coverage. Using your annual salary, determine the proper rate for year one 3 Calculate your Medical Plan Contribution: $ 42.12 $ 446.29 The formula provided will multiply the medical premium by the precentage, or #1 above times #2 above. 4 Use the Rx rates below and enter the proper monthly amount: Single: 166.92 Member/Spouse: $446.29, Family: $446.29 Parent/Child(ren): $225.00 (if you selected a HD med plan enter zero) 5 Use the Percentage of Premium from Chart (attached): 3.00 % There are three charts attached representing single, family or other coverage. Using your annual salary, determine the proper rate for year one 6 Calculate your Prescription Plan Contribution: $ 13.39 $ 55.51 The formula provided will multiply the prescription premium by the precentage, or #4 above times #5 above. 7 Add lines #3 and #6 from above: This will be your medical and prescription contribution spread over 12 months This is the amount spread over 10 months (for 10 month employees) 66.61 ↙ Calculate Salary Percentage 8 Enter your annual salary: 9 Percentage rate as set by the state for salary percentage 10 Multiply your annual salary by the percentage of 1.5: $ 9,000.00 1.5 % $ 135.00 The formula provided will multiply #8 by #9 10 11 Enter the number of months you work: 10 12 month employees 12 Percentage of salary for benefits contribution: $ 13.50 ↙ $ 66.61 The formula provided will divide #10 by #11 Your Monthly Benefit Contribution 13 The formula will calculate the larger of line #7 or line #12 Your Benefit Contribution Per Pay 14 This formula will calculate your per pay contribution 33.30 Ch. 78, PL 2011 Employee Benefits Contribution Calculation Worksheet SINGLE COVERAGE Salary Range less than 20,000 20,000-24,999.99 25,000-29,999.99 30,000-34,999.99 35,000-39,999.99 40,000-44,999.99 45,000-49,999.99 50,000-54,999.99 55,000-59,999.99 60,000-64,999.99 65,000-69,999.99 70,000-74,999.99 75,000-79,999.99 80,000-94,999.99 95,000 and over Year 1 1.13% 1.38% 1.88% 2.50% 2.75% 3.00% 3.50% 5.00% 5.75% 6.75% 7.25% 8.00% 8.25% 8.50% 8.75% Year 2 2.25% 2.75% 3.75% 5.00% 5.50% 6.00% 7.00% 10.00% 11.50% 13.50% 14.50% 16.00% 16.50% 17.00% 17.50% Year 3 3.38% 4.13% 5.63% 7.50% 8.25% 9.00% 10.50% 15.00% 17.25% 20.25% 21.75% 24.00% 24.75% 25.50% 26.25% Year 4 4.50% 5.50% 7.50% 10.00% 11.00% 12.00% 14.00% 20.00% 23.00% 27.00% 29.00% 32.00% 33.00% 34.00% 35.00% FAMILY COVERAGE Salary Range less than 25,000 25,000-29,999.99 30,000-34,999.99 35,000-39,999.99 40,000-44,999.99 45,000-49,999.99 50,000-54,999.99 55,000-59,999.99 60,000-64,999.99 65,000-69,999.99 70,000-74,999.99 75,000-79,999.99 80,000-84,999.99 85,000-89,999.99 90,000-94,999.99 95,000-99,999.99 100,000-109,999.99 110,000 and over Year 1 0.75% 1.00% 1.25% 1.50% 1.75% 2.25% 3.00% 3.50% 4.25% 4.75% 5.50% 5.75% 6.00% 6.50% 7.00% 7.25% 8.00% 8.75% Year 2 1.50% 2.00% 2.50% 3.00% 3.50% 4.50% 6.00% 7.00% 8.50% 9.50% 11.00% 11.50% 12.00% 13.00% 14.00% 14.50% 16.00% 17.50% Year 3 2.25% 3.00% 3.75% 4.50% 5.25% 6.75% 9.00% 10.50% 12.75% 14.25% 16.50% 17.25% 18.00% 19.50% 21.00% 21.75% 24.00% 26.25% Year 4 3.00% 4.00% 5.00% 6.00% 7.00% 9.00% 12.00% 14.00% 17.00% 19.00% 22.00% 23.00% 24.00% 26.00% 28.00% 29.00% 32.00% 35.00% Member & Spouse/Partner or Parent& Child(ren) Coverage Salary Range Year 1 Year 2 less than 25,000 0.88% 1.75% 25,000-29,999.99 1.13% 2.25% 30,000-34,999.99 1.50% 3.00% 35,000-39,999.99 1.75% 3.50% 40,000-44,999.99 2.00% 4.00% 45,000-49,999.99 2.50% 5.00% 50,000-54,999.99 3.75% 7.50% 55,000-59,999.99 4.25% 8.50% 60,000-64,999.99 5.25% 10.50% 65,000-69,999.99 5.75% 11.50% 70,000-74,999.99 6.50% 13.00% 75,000-79,999.99 6.75% 13.50% 80,000-84,999.99 7.00% 14.00% 85,000-99,999.99 7.50% 15.00% 100,000 and over 8.75% 17.50% Year 3 2.63% 3.38% 4.50% 5.25% 6.00% 7.50% 11.25% 12.75% 15.75% 17.25% 19.50% 20.25% 21.00% 22.50% 26.25% Year 4 3.50% 4.50% 6.00% 7.00% 8.00% 10.00% 15.00% 17.00% 21.00% 23.00% 26.00% 27.00% 28.00% 30.00% 35.00% 2012 Single Member/Spouse Family Parent/Child Direct 10 Direct 15 Direct 1525 Direct 2030 561.55 1123.1 1403.88 831.09 534.58 1069.16 1336.45 791.18 518.82 1037.64 1297.06 767.85 487.59 975.19 1218.99 721.64 * These rates are effective 1/1/2012, and are subject to change on 1/1/2013 2012 Single Member/Spouse Family Parent/Child Aetna HMO Aenta 1525 Aetna 2030 547.56 1095.12 1368.9 810.39 505.62 1011.23 1264.04 748.31 475.45 950.89 1188.62 703.66 * These rates are effective 1/1/2012, and are subject to change on 1/1/2013 2012 Single Member/Spouse Family Parent/Child Cigna HMO Cigna 1525 Cigna 2030 550.57 1101.14 1376.43 814.84 508.4 1016.79 1271.00 752.42 478.06 956.12 1195.15 707.53 * These rates are effective 1/1/2012, and are subject to change on 1/1/2013 2012 Single Member/Spouse Family Parent/Child NJ Direct 10 HD1500 Aetna HD1500 Cigna HD1500 583.32 1166.63 1458.29 863.3 571.91 1143.82 1429.77 846.42 574.36 1148.72 1435.91 850.05 These rates include the medical and prescription plans. Be sure to enter zero in the worksheet for the prescription plan. * These rates are effective 1/1/2012, and are subject to change on 1/1/2013