financial forms

LIFE Platform meeting

Denmark 2008

Tommy Sejersen, Financial Desks

EC DG ENV – LIFE Unit

Telephone +32.2.295.15.35

E-mail: tommy.sejersen@ec.europa.eu

Legal Framework:

•

Grant Agreement

•

Common Provisions (CP)

•

Application guide

•

Financial Forms

Grant Agreement:

• Maximum grant amount

• Funding rate

• Project period

• Common Provisions (integrated in GA)

• Approved proposal (Annexed to GA)

Project participants

Budget of the project

Common Provisions

Project Actors:

• Beneficiary (Art 4)

• Partner (s) (Art 5)

• Co-financer (s) (Art 7)

• Subcontractor (s) (Art 6)

Art 6.4 : Public tenders obligatory for public beneficiary/partner

Competitive tenders for private beneficiary/partners

Art 6.5: Clear reference to the LIFE-project shall be included in the invoices/order form (also in Art 4.8 & 5.6)

• Amendment to the agreement (Art 13)

• Art 13.2 8th bullet point : 10% and 10.000 € rule

CP define: Eligible costs

(Art 21.1 -21.12)

Provided for in the provisional budget/ Directly necessary for the project

Incurred during the lifetime of the project:

- Legal obligation to pay (the cost) has been contracted after the project start and before the end date

- Execution of corresponding action starts after the project start and is completed before the end date

- Full payment before submission of final reports

- Incurred by the project participants

Exception:

Costs for independent audit Art 27 can be executed after project end date

– but must be terminated, invoiced and fully paid before submission of final report, and auditor is given the assignment before the project ends

CP define: Ineligible costs (Art 22)

Some examples:

Exchange rate losses

Debtors interest/interest on borrowed capital

Services in kind (e.g. voluntary work)

Licence or patent fees related to the protection of intellectual property right

CP define: Payments (Art 23)

The First pre-financing payment (40%)

The Second pre-financing payment (30%)

at least 150% of the first pre-financing used

New from 2005 (other conditions for the projects of 2004 and earlier)

The Balance final payment

Application guide

Section “How to fill in the financial application forms”

Example:

Personnel costs and calculation of annual number of working days,

Information requested in the financial reporting

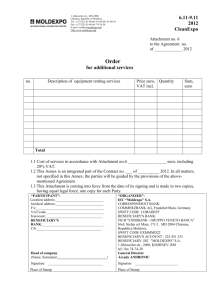

FINANCIAL FORMS

Where to find the model of financial forms: http://ec.europa.eu/environment/life/toolbox/fi nancial_sheet.htm

Excel based model offering conversion facility

New on-line financial reporting tool - FIRE

Statement of expenditure and income

To be delivered:

Project consolidated statement of expenditure, completed and signed by beneficiary

Participant statement of expenditure, completed and signed by each participant

In balance

Project income (profits generated by the project – Art 20.4)

No profit for beneficiary/partner (Art 20.3)

Interest accrued on the pre-financing amount (Art 20.6)

Name of participant:

Beneficiary (tick if applicable)

Statement of expenditures

Personnel

Travel

External assistance

Durable goods - Infrastructure

Durable goods - Equipment

Durables goods - Prototypes

Land/rightspurchase/lease

Consumable material

Other direct costs

Overheads

TOTAL

Financial Statement of the participant

Partner (tick if applicable)

Total real costs with non-recoverable VAT

€ 100,00

Total eligible costs with non-recoverable

VAT

Statement of income

€ 100,00 EU contribution

€ 10,00 € 10,00 Contribution of the beneficiary

€ 10,00

€ 20,00

€ 20,00

€ 10,00

€ 20,00

€ 10,00

€ 10,00

€ 10,00

€ 10,00 Contribution of the partners

€ 10,00 Other sources of funding

€ 10,00 Direct income

€ 10,00

€ 20,00

€ 10,00

€ 10,00

€ 10,00

Maximum is 7%, i.e. €9,1

€ 220,00 € 200,00 TOTAL

Exchange rate used to convert national currency into EURO, in case only one exchange rate is used (i.e. the exchange rate of the month of the submission of the financial statement as published by the Europena Central Bank):

Date of VAT declaration where appropriate

1

Date and signature

€

€ 20,00

€ 40,00

€ 60,00

% of eligible costs

€ 0,00

€ 0,20

€ 120,00 Budget MUST be in balance

FIRE

Financial check list

General principles:

• Analytical accounting system (“cost centre”).

• Identifiable and exclusive person to approve costs.

• Costs incurred by non-participants (Company groups) –Legal entities

• Mention of the project on the invoice received

Financial check list

Personnel costs (Art 21.2):

• Time registration (time sheets). Model - monthly time-sheet http://ec.europa.eu/environment/life/toolbox/times heet.htm

• Signature and approval of time sheets.

• Annual number of working days.

• Actual annual gross salary.

• Public staff

Calculation of personnel costs

A

B

C

D

E

F = sum of A to E

G

H

Annual salary before tax for the relevant calendar year including 13 th

(or more) month salary.

+ Compulsory social charges

+ Compulsory pension contribution

+ Compulsory holiday allowance

+ Other compulsory allowances

= Gross annual salary costs

Annual time units (*)

Holidays

I

J

Week-ends

Bank holidays

K Mandatory training, sickness etc

L = G-H-I-J-K Annual working hours

M=G/L Annual time unit rate

Financial check list

Travel and subsistence (Art 21.3):

• Internal rules for re-imbursement of travel expenses

• Prior approval by Commission for ex-EU travels

• Detailed specification of travel expenses, two lines if necessary.

• Group low value travel expenses (supported by accounting documents)

Financial check list

External Assistance Art 21.4):

1. Tender requirement of Art 6.4.

2. Mention the project in the invoice (Art 4.8, 5.6 & 6.5)

3. Subcontractors not project participants.

Financial Check list

Durable goods (Art 21.5 – 21.8):

• Purchased in the project period (Art 21.8)

• Actual depreciation (internal accounting standard) up to

25%/50% ceiling (Art 21.6)

• Inventory

• Clearly identifiable

• Nature projects

• 100% eligible – approved

• 25%/50% - not approved, but technically justified

• Prototype not used for commercial activities (Art 21.7)

Financial check list

Overheads (Art 21.12):

• 2005 projects 7% flat rate maximum

• Earlier projects overhead costs should be explained.

Financial check list

Partnership agreements (Art 4.7):

• Is there signed a partnership agreement

• Clear rules for collecting partner’s costs

GENERAL HINTS

FOR

FINANCIAL REPORTING

Study carefully the Common Provisions (CP) and

« re-read » them whenever a problem of administrative-financial nature occurs

Distribute the CP to all project partners and make sure that CP are applied by them

Oblige your partners to forward their project accounting data to you regularly.

Respect the classification of the budget

Keep the project accounting up-to-date , including regular update of the financial forms

Introduce all data requested , i.e. complete all “cells” of the financial forms, or explain why they remain “empty”

Describe with sufficient detail the types of purchased services/goods and their link with the work programme or action

Keep all appropriate supporting documentation for all expenditure and income – including copies of the partners’ supporting documentation

Supporting documentation - Examples: e.g. purchase orders, invoices, payment proofs, public tendering documents for personnel : monthly salary slips, presence/time sheets, calculation of social charges if not included in salary

Commission staff have made a confidentiality promise

VAT:

For VAT charges to be considered eligible the beneficiary must provide a declaration from the relevant national authorities that it and/or its partners must pay and may not recover the VAT for the assets and services required for the project.

Currency of the reports: only the Euro ( €), Art. 25.4 Payments made in different currencies: use the exchange rate applied by the European Central Bank on the first day of the month in which the financial report is presented to the

Commission

Where to find: http: // ec.europa.eu

/ budget / inforeuro / index.cfm

INDEPENDENT AUDIT

New from 2005

Maximum amount of grant ≥ € 500.000

pre-financing (s) > € 750.000

Final payment request > € 150.000

External/Independent

A uditor’s Report

• Find a model of the standard audit report at: http://ec.europa.eu/environment/life/toolbox/standardaudit.htm

![Facilities Claim Form [docx / 210KB]](http://s3.studylib.net/store/data/009702131_1-a76a963067a4586a4f8f1bca351ecaf7-300x300.png)