File

Average Rate of Return

A2 Business Studies

Aims and Objectives

•

Aim:

To understand the investment appraisal technique:

Average Rate of Return.

•

•

•

•

Objectives:

Define ARR

Calculate ARR

Analyse ARR results

Evaluate ARR method

Starter

Explain what the payback method calculates.

Explain two benefits of the payback method.

Explain two drawbacks of payback method.

ARR Definition

Average Rate of Return assesses the merits of an investment by calculating the average annual profit as a percentage of the initial investment.

Step 1

Calculate the average annual profit by adding up all net cash flows divided by the number of years.

Average annual profit

= Total net cash flow / Number of Years

Step 1

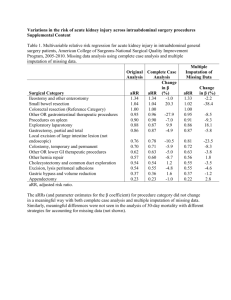

Machine A =

(£750,000) + £142,500 + £192,500 + £252,500 +

£252,500 + £292,500 = £382,500

Average Annual Profit =

£382,500/5 = £76,500

Step 2

Divide the average annual profit by the initial investment and show as percentage.

ARR = (Average Annual Profit/Initial Investment) x 100

Step 2

ARR = (£76,500/£750,000) x 100 = 10.2%

The ARR for machine A is 10.2 %

Machine B

Calculate the ARR for machine B.

Show all calculations and formulas in your working out.

Make everything obvious to the examiner!

Analysis and Evaluation of ARR

Higher the ARR the more potentially profitable the investment.

Analyse machine A’s and machine B’s ARR.

Evaluation: Benefits & Drawbacks

• Discuss the benefits and drawbacks of ARR method.

• Consider:

Interest Rates and lending

ROCE

Cash Inflows

Comparisons

Evaluation: Benefits

• Easy comparison with other forms of investment

• Can compare with interest rate

• Compared to current or target ROCE figure

Evaluation: Drawbacks

• Does not take into account specific timings of cash inflows.

• An investment may appear profitable, but if it takes four years before a positive net cash flow is achieved this might threaten the firm’s short term survival

Plenary

•

• Define ARR

Explain how to calculate ARR.