presentation slides

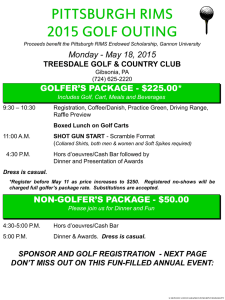

advertisement

RIMS Risk Maturity Model (RMM) Webinar with RIMS Chapter Officers A Mutual Opportunity Copyright 2012-2013 Risk and Insurance Management Society, Inc. 1 A Virtual Presentation for Your Chapter • Randy Besse – Saskatchewan Chapter • Carol Fox – RIMS • Steven Minsky – LogicManager Copyright 2012-2013 Risk and Insurance Management Society, Inc. 2 Answering the basic questions Who • Carol Fox and Steve Minsky What • Provide an educational forum for your chapter members When • Scheduled to meet your chapter needs Where • Wherever we can connect through the internet How • Using RIMS Adobe Connect platform Why • To provide a unique, sustainable, and practical experience Copyright 2012-2013 Risk and Insurance Management Society, Inc. 3 A “Win-Win” Proposition Chapter Wins RIMS Wins • • • • • • Greater use of the RIMS Risk Maturity Model • Encourage “friendly competition” through regional benchmarking • Build more mature risk management practices overall • Delivers on its mission to make your organizations more successful “Ready” presentation Delivered virtually Something different Build chapter camaraderie Build more mature risk management practices within the chapter • Encourage continuing dialogue Copyright 2012-2013 Risk and Insurance Management Society, Inc. 4 Poll: Have you taken the RIMS RMM Assessment? o o o o o Yes, multiple times Yes, one time Started once, but did not finish No, never Never heard of it before today Copyright 2012-2013 Risk and Insurance Management Society, Inc. 5 Delivering Value through RIMS Risk Maturity Model for Enterprise Risk Management Copyright 2012-2013 Risk and Insurance Management Society, Inc. 6 Agenda The Landscape The Plan Taking the RMM Assessment Using the Output A Proposition Questions Copyright 2012-2013 Risk and Insurance Management Society, Inc. 7 We can't solve problems by using the same kind of thinking we used when we created them. Albert Einstein THE LANDSCAPE Copyright 2012-2013 Risk and Insurance Management Society, Inc. 8 The Risk Professional: Balancing Risk and Reward Used with permission per RIMS license agreement with The Official Dilbert Store Copyright 2012-2013 Risk and Insurance Management Society, Inc. 9 The Evolving Role of the Risk Professional Source: RIMS and The IIA Risk Management and Audit: Forging a Collaborative Alliance Copyright 2012-2013 Risk and Insurance Management Society, Inc. 2012 10 What are the Implications for Risk Management? Expanding organizational risk management competencies Proactive • Objectives Focused • Predictive Indicators • Foresight • Strategic • Creates and captures value Reactive • Event Focused • Post Action Response • After-thought • Transactional • Protects Value Copyright 2012-2013 Risk and Insurance Management Society, Inc. 11 Any fool can know. The point is to understand. Albert Einstein THE PLAN Copyright 2012-2013 Risk and Insurance Management Society, Inc. 12 What Are Your Top Risks to Successful ERM? What stands in the way of successful ERM at your organization? “Whirlwind” Execution Ability Goal Confusion Multiple Priorities Disabling Culture Copyright 2012-2013 Risk and Insurance Management Society, Inc. 13 You Need a Plan! Shape the risk principles and policies of the company, track the capital risk capacity of the company, define who is responsible for managing the specific risks within the organization, and provide a framework for judging the effectiveness of risk-taking Make sure that there is a risk management system in place in each business that includes effective risk-control mechanisms as well as information systems that flow up to senior management What else? Quote Sources: Spencer Stuart Copyright 2012-2013 Risk and Insurance Management Society, Inc. 14 Why Use the RIMS Risk Maturity Model? Bridges the gap between theory and practice Guide to incremental improvement over time Measurable ERM value, based on priorities Addresses rating agency criteria on key attribute areas Can be used to build an ERM blueprint Creates value for the organization Career development tool Breadth of use Over 2,000 organizations Across multiple industries Copyright 2012-2013 Risk and Insurance Management Society, Inc. 15 RIMS Risk Maturity Model for ERM The Seven Attributes ERM-based approach • Executive support within the corporate culture ERM process management • Integration into business processes Risk appetite management • Accountability within leadership and policy to guide decision-making Root cause discipline • Linking outcomes with their sources Uncovering risks • Analyzing and documenting risks and opportunities Performance management Business resiliency and sustainability • Executing vision, mission and strategy utilizing risk metrics • Integration into operational planning and execution Copyright 2012-2013 Risk and Insurance Management Society, Inc. 16 Common Elements from RIMS Review RIMS RMM ISO 31000 OCEG BS 31100 COSO FERMA SOLVENCY II ERM-based Approach X X X X X X Process Management X X X X X X Risk Appetite Management X X X X X X Root Cause Discipline X Uncovering Risks X Performance Management X Business Resiliency and Sustainability X X X X X X X X X X X X X X X Source: RIMS Executive Report: An Overview of Widely Used Risk Management Standards and Guidelines, 2011 Copyright 2012-2013 Risk and Insurance Management Society, Inc. 17 Elements from RIMS RMM determine Your RMM Score Copyright 2012-2013 Risk and Insurance Management Society, Inc. 18 Leverage risk-reward tradeoffs Silo’d Activities Goals Copyright 2012-2013 Risk and Insurance Management Society, Inc. 19 Leverage risk-reward tradeoffs Activities Goals Copyright 2012-2013 Risk and Insurance Management Society, Inc. 20 You never fail until you stop trying. Albert Einstein TAKING THE RMM ASSESSMENT Copyright 2012-2013 Risk and Insurance Management Society, Inc. 21 Begin from RIMS website RIMS Risk Maturity Model Copyright 2012-2013 Risk and Insurance Management Society, Inc. 22 Copyright 2012-2013 Risk and Insurance Management Society, Inc. 23 Getting started is easy! Copyright 2012-2013 Risk and Insurance Management Society, Inc. 24 Completing the RMM assessment ERM assessment (example) Factor: Executive ERM support Indicators RIMS RMM indicators provide context for review Evaluation criteria Effectiveness Select each Proactivity of the 25 Factors Coverage Partially Ad Hoc Somewhat Reactive Select a score for each of the 3 evaluation criteria Partially Uncertain Copyright 2012-2013 Risk and Insurance Management Society, Inc. 25 RIMS Risk Maturity Model Structure Attributes Seven core areas of ERM that drive effectiveness Compatible with various specialized frameworks Risk competency measurement 25 factors and 68 indicators Objective evaluation criteria Key issues that differentiate maturity levels Maturity levels Five maturity levels Detailed descriptions unique for each attribute Leadership Measure to help reach goals for improvement Managed Benchmarking Repeatable Standing in peer group Initial Highlights ERM trends and priorities Ad hoc Copyright 2012-2013 Risk and Insurance Management Society, Inc. 26 The measure of intelligence is the ability to change. Albert Einstein USING THE OUTPUT Copyright 2012-2013 Risk and Insurance Management Society, Inc. 27 Copyright 2012-2013 Risk and Insurance Management Society, Inc. 28 Based on Your Responses Assessment describes the next level Each attribute is assigned a level Copyright 2012-2013 Risk and Insurance Management Society, Inc. 29 Copyright 2012-2013 Risk and Insurance Management Society, Inc. 30 Strategic Objectives Business Continuity Vendor Management Financial Reporting Compliance Information Security Compliance Business Process Identify & Assess Manage Response Options Monitor Business Results Copyright 2012-2013 Risk and Insurance Management Society, Inc. 31 In the middle of difficulty lies opportunity. Albert Einstein A PROPOSITION Copyright 2012-2013 Risk and Insurance Management Society, Inc. 32 Let’s Make a Deal, Saskatchewan Chapter! Each of you complete the RIMS Risk Maturity Model Assessment by December 20th. We will provide you with an aggregate Chapter Benchmarking Report for your January meeting o Standing in peer group o Highlighting ERM trends and potential priorities in your area Copyright 2012-2013 Risk and Insurance Management Society, Inc. 33 Copyright 2012-2013 Risk and Insurance Management Society, Inc. 34 Contact Information Steve Minksy CEO LogicManager +1 (617) 649-1321 Steven.Minsky@logicmanager.com Carol Fox, ARM Director of Strategic and Enterprise Risk Practice RIMS +1 212.655.6004 cfox@rims.org www.rims.org Copyright 2012-2013 Risk and Insurance Management Society, Inc. 35