Impact on US agriculture?

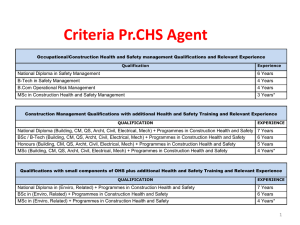

advertisement

1 © 2011 CHS Inc. Who controls the kingdom? Exploring Food Sovereignty Mark Palmquist Executive Vice President & Chief Operating Officer Ag Business © 2011 CHS Inc. What in the world is the world going to eat? A look at: • The world’s growing and evolving population • Why hungry nations want “food sovereignty” • Impacts on U.S. agribusiness • CHS system strategy Welcome, Baby 7 Billion The world’s population hit 7 billion on October 31, according to the U.N. population division Accelerating growth • • • • • • • • 1804 1927 1960 1974 1987 1999 2011 – – – – – – – 1 2 3 4 5 6 7 billion (after 250,000 years) billion billion billion billion billion billion 2050 – projected 9.3 billion © 2011 CHS Inc. Market Drivers: Demographics Market Drivers: Grain supply and demand outlook Net grain imports in developing countries Global grain production Source: FAO Feeding the world: Global Challenges Geopolitical risks Government intervention/distortion World economy/capital Food safety For growing nations, it’s about “Food Sovereignty” © 2011 CHS Inc. What do we mean by “Food Sovereignty?” • The ability of a nation to dependably access food to meet its citizens’ dietary requirements either by internal production or dependable imports © 2011 CHS Inc. The issues: Geopolitical Risks “Arab Spring” – What happens next? Ongoing Iraq/Iran/Turkey turmoil Unpredictable Pakistan 9 © 2011 CHS Inc. The issues: Government intervention/distortion In challenging times, we want to safeguard food supply: • • • • • • 10 Russia Ukraine Argentina China European Union United States © 2011 CHS Inc. The issues: World economy/capital Slowing world growth European financial crisis Inflation in emerging countries Currency manipulation 11 © 2011 CHS Inc. Controlling food destiny is name of the game Nations want to ensure: • Supply • Distribution • Price • Safety If you can’t raise it, control the source! 12 © 2011 CHS Inc. The headlines tell the story Saudi investors put $100 million into Ethiopian farm UAE stepping up agricultural investment in Sudan Pakistan offers farmland to foreign investors Korea’s Daewoo leases Madagascar land for feed, fuel Short of food? Rent half a country Asian nation’s invest in Brazilian production 13 © 2011 CHS Inc. Food safety poses challenges 2009 Hola Pops from Mexico contaminated with lead 2008 baby milk scandal with melamine from the contaminated protein working into the food chain a year later 2007 pet food recalls, another result of Chinese protein export contamination resulting from melamine as an adulterant 14 © 2011 CHS Inc. Impact on U.S. agriculture? A new competitive world 15 © 2011 CHS Inc. The world we live in today Old World U.S. agribusiness sources inputs domestically and globally U.S. originated grain moves to the domestic and global marketplace New World Global players originating grain from U.S. producers U.S. players sourcing grain globally Crop nutrients imported and exported Global growth creates tighter crude oil and energy supply/demand Outside investors invest in commodity businesses Aggressive market rationalization Asian influence in grain China Chongqing Grains COFCO Sino Grain South Korean Government 17 © 2011 CHS Inc. Japan Marubeni Mitsui Itochu Mitsubishi Sumitomo Zen-Noh A look at two multinationals Tokyo, Japan Omaha, NE Actively investing in U.S. agriculture Gavilon was formed in 2008 by investment funds: 35% of the Marubeni Group is owned in common stock by Financial Institutions Grain: Columbia Grain Crop Nutrients: Helena 18 © 2011 CHS Inc. Ospraie Special Opportunities Fund General Atlantic Soros Fund Management Gavilon Management New export players converge on PNW TEMCO; Tacoma (11.7%) (CHS, Cargill) LDC; Seattle(12.2%) AGP; Grays Harbor (3.8%) (AGP) EGT; Longview (16.9%) (Bunge, Itochu, Pan Ocean) KEC; Kalama (18.3%) (ADM, Gavilon, MSK) CHS; Kalama (14.1%) CGI; T-5, Portland(7.7%) UGC; Vancouver (Marubeni) (8.5%) (Mitsui ) CLD; Irving, Portland CLD; O-Dock, Portland (4.3%) (Cargill, LDC) (2.4%) (Cargill, LDC) Bunge Port of Longview Facility in PNW Joint Venture between Bunge, Itochu, and Pan Ocean (EGT, LLC) State-of-the-art export grain terminal First export terminal built in the U.S. in more than two decades Capable of holding four 110-car unit trains at any given time Shuttle train and barge unloading capabilities on the Columbia River Can handle 8 million metric tons annually © 2011 CHS Inc. Regional Market Dynamics 21 Aggressive pursuit of assets Overvalue pricing for assets Intimidation with new sites Approaching key personnel Conversion funding for business Retro-fitting asset base to next generation assets © 2011 CHS Inc. Closer to home: Shuttle Expansion Proposed Shuttles Announced Rumor © 2011 CHS Inc. Multinational “go-to-market” strategy Partner • “We would like to partner with you.” Buy • “We would like to buy you.” Build • “We will build next to you.” 23 © 2011 CHS Inc. The CHS system addresses global food needs CHS system strategy Domestic investments Strengthening U.S. origination through strong cooperative system alignment Building out global grain and crop nutrient origination capability 25 © 2011 CHS Inc. PNW export investments Additional CHS PNW capacity Combination cargo loading capability Alternative rail destination for corn and soybeans Bulk products capability Top-tier loading speed CHS U.S. Business Operations CHS System Locations Each dot represents a CHS location, member company or business affiliation Country Operations Locations 29 29 © 2011 CHS Inc. Stronger cooperative alignment Traditional buy/sell relationships Specific formal relationships including JVs and LLCs Opportunity to become fully part of CHS through Country Operations 30 © 2011 CHS Inc. Growing CHS global origination footprint Diversify origination • Be a reliable food source for global customers • Market knowledge • Risk diversification • Increase/diversify fertilizer supply • Additional profit opportunities Expand demand base • Increase market share of our producers’ products • Mitigate risk • Additional profit opportunities for member-owned system 31 © 2011 CHS Inc. CHS Global grain/CN footprint Tacoma Kalama Friona Geneva Duluth/Superior Barcelona Collins Romania, Hungary, Bulgaria, Serbia Myrtle Grove Mexico Kiev Krasnodar Amman Shanghai Hong Kong Brazil Australia Argentina Main Black Sea ports Constanta 33 The cooperative advantage As growing nations seek food sovereignty, cooperative relationships are attractive: • Farmer ownership • Dependability • Transparency • Integrity 34 © 2009 CHS Inc. Questions? © 2011 CHS Inc. 36 © 2011 CHS Inc.