Asset Allocation and the Efficient Frontier

advertisement

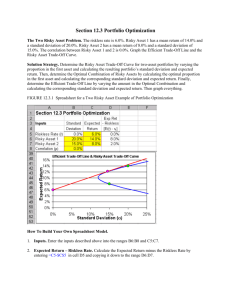

FOR INSTITUTIONAL USE ONLY | NOT FOR PUBLIC DISTRIBUTION Asset Allocation and the Efficient Frontier: Optimizing a portfolio’s risk/return profile J.P. Morgan Investment Academy SM The nuts and bolts of investment success Asset allocation Diversification The efficient frontier FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 1 Asset allocation versus diversification Asset allocation: A strategy that concerns itself with the way different investment classes are combined. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 2 Asset correlation Correlation: The relationship between the price movements of two securities or classes of securities in relation to one another. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 3 Asset allocation versus diversification Diversification: Spreads assets across a mix of investments within each class. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 4 The goal of asset allocation Create a diversified portfolio with an acceptable level of risk Achieve the highest possible return given that level of risk A portfolio or asset allocation that maximizes return for the level of risk is called an efficient portfolio FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 5 On the Y axis: Return = reward On the X axis: Risk = standard deviation Return (% reward) Risk and return Standard deviation = volatility = unpredictability = risk Risk (standard deviation) The above chart is shown for illustrative purposes only and is not indicative of any investment. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 6 The efficient frontier Input Expected return for each asset Standard deviation of each asset Correlation between the assets Output The above chart is shown for illustrative purposes only and is not indicative of any investment. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 7 The efficient frontier: Same risk, greater return Source: www.styleadvisor.com For illustrative purporses only. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 8 The efficient frontier Risk is measured by standard deviation. Return is measured by arithmetic mean. Risk and return are based on annual data over the period 1970-2006. Portfolios presented are based on modern portfolio theory. The above chart is shown for illustrative purposes only and is not indicative of any investment. An investment cannot be made directly in an index. Past performance is no guarantee of future results. Diversification does not eliminate the risk of experiencing investment losses. Risk is measured by standard deviation. Standard deviation measures the fluctuation of returns around the arithmetic average return of the investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns. Government bonds are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than bonds. The data assumes reinvestment of all income and does not account for taxes or transaction costs. Source: Stocks: Standard & Poor’s 500, which is an unmanaged group of securities and considered to be representative of the stock market in general; Bonds: 20-year U.S. Government Bond. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 9 Building more efficient portfolios For illustrative purposes only. Portfolios are based on mean-variance optimization subject to constraints. Portfolio statistics presented above are not intended to be guarantee of portfolio performance. Portfolio statistics based on 2010 USD Capital market Assumptions. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 10 Mapping an efficient frontier The efficient frontier can shift upward (increasing returns) … and to the left (reducing risk)… by diversifying across multiple asset classes with varied correlations to one another. For illustrative purporses only. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 11 Diversification can help improve returns and reduce volatility 12 Thank you We value your partnership. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 13 Disclosure The above commentary is intended solely to report on various investment views held by J.P. Morgan Asset Management. Diversification does not eliminate the risk of experiencing investment losses. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc. © 2013 J.P. Morgan Chase & Co. FOR INSTITUTIONAL USE ONLY / NOT FOR PUBLIC DISTRIBUTION 14