View Invoice Reader Presentation (PPT)

advertisement

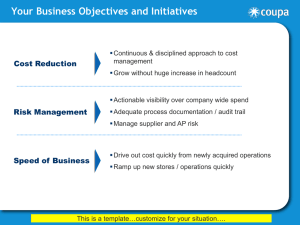

TIS in the Finance Department

Finance Challenges

Cashflow management

– DSO v DPO

– Visibility of information

– Manage accruals

Resource management

– Staff turnover

– Risk, training cost, consistency

Vendor and Exception management

– Vendor education – PO reference

– Invoice duplication

– Out-of-tolerance transactions

Invoice approval

– No control, delays process

Compliance

– Process audit, Management information

Accounts Payable Sub-Processes

Source: BearingPoint 2007

Accounts Payable Sub-Processes

66%

Where TIS can help

Source: BearingPoint 2007

Vendor Analysis

How the process works – Step One

Volume Report

Audit

Digital Mailroom

Post Receipt

Scanning

Document Classification

Invoices

Cheques

Remittance

Rejection Letters

Fax Receipt

Email Receipt

How the process works – Step Two

Volume Report

Statistical

Reporting

Audit

Audit

Digital Mailroom

Data Extraction

Post Receipt

Invoice Reader

Scanning

Freeform OCR

Document Classification

Engine Tuning

Invoices

PO / Non PO

Cheques

Remittance

Header, Footer & Line item

Rejection Letters

Data Correction

Fax Receipt

Self Learning

Email Receipt

Multiple Languages

ERP System

How the process works – Step Three

Volume Report

Statistical

Reporting

Financial

Reporting

Audit

Audit

Audit

Digital Mailroom

Data Extraction

Customer Rules

Validation

Post Receipt

Invoice Reader

Vendor Validation

Scanning

Freeform OCR

Units

Document Classification

Engine Tuning

Pricing

PO / Non PO

Multi Currency/VAT

Header, Footer & Line item

Duplicate Invoice Check

Rejection Letters

Data Correction

2/3/4 way match

Fax Receipt

Self Learning

Email Receipt

Multiple Languages

Invoices

Cheques

Remittance

ERP System

How the process works - Step Four

Volume Report

Statistical

Reporting

Financial

Reporting

Work in Progress

Reporting

Audit

Audit

Audit

Audit

Digital Mailroom

Data Extraction

Customer Rules

Validation

Workflow

Post Receipt

Invoice Reader

Vendor Validation

Exception Management

Scanning

Freeform OCR

Units

Approval Processing

Document Classification

Engine Tuning

Pricing

Discrepancy

PO / Non PO

Multi Currency/VAT

Resolution

Header, Footer & Line item

Duplicate Invoice Check

Vendor Management

Rejection Letters

Data Correction

2/3/4 way match

Multi Currency/VAT

Fax Receipt

Self Learning

Email Receipt

Multiple Languages

Invoices

Cheques

Remittance

Resource Analysis

ERP System

Solution Summary

Early visibility of transactional data

Cashflow

System will scale in volume

and applications

• Accounts Receivable

• Customer Services

• HR

• others…

a) Operational

Flexibility

Improve

Business

Outcome

Risk

Identifies duplicate

invoices and fraud

Cost

Efficiency

• Maximise AP resource

• Creates efficient exception

and rejection handling

• Reduces training

b) Business

• Assists

vendor education

• Capitalise on early payment discounts

• Vendor rationalisation

Compliance

Full audit of process

Questions

HOW INVOICE READER WORKS

Solution Overview

Management

Information

Paper

EDI

Invoice Reader

solution

Customer

Rules

Email

Throughput

Processed

Data and

Images

Fax

Management Information

Work in Progress

Financial Reports

ERP

Master Data

System Tuning

Exception

Management

Financial Reports

Approval

SAP GUI

SLA Statistics

Archive Link

Secure Web

Access

Provides “Fully Featured” Web

based access for remote

workers

Solution Overview

Management

Information

Paper

EDI

Invoice Reader

solution

Customer

Rules

Email

Throughput

Processed

Data and

Images

Fax

Management Information

Work in Progress

Financial Reports

ERP

Master Data

System Tuning

Exception

Management

Financial Reports

Approval

ERP GUI

SLA Statistics

Secure Web

Access

Image Repository

ERP

Provides “Fully Featured” Web

based access for remote

workers

Scanners and Image Quality

Kodak i1420

Kodak i660

Read the Invoice

Optical Character Recognition

Engine Comparison Algorithms

Field Level Engine Definitions

Dates

Amounts

etc...

Engine 1

25***8

Engine 2

2*5378

Engine 3

253478

Engine 4

2*34*8

Engine 5

25***8

Virtual Engine

Safe: All engines must return the same

Result

2****8

result.

Normal: Only engines that returned a result

are counted.

Majority: This is a simple majority vote.

Order: First engine determines the result

25**78

253478

255378

Find the Invoice Data – Generic Invoices

Freeform (Logic) Rule Sets

Edit Masks

@@######## or

RegEx ^(43|45)\d{8}$

Identifying Field Candidates

–

–

–

–

–

–

–

–

–

Keywords

Logical rules

Expressions

Masks

Validations

Graphical rules

Tables

Groups

Different languages

Keyword(s)

Field Groups

Validations

Net + VAT = Total Amount

Find the Invoice Data – Specific Supplier

Rule Sets for Top Suppliers

20% of all Invoices

Validation against ERP data

Specific data formats

Edit Masks

Keyword(s)

Find the Invoice Data – Learning

Learn Fields that are not

accurately recognised

Production Learning

– Data characteristics are learned

during manual data entry

Validation Against ERP

ERP Database Search

–

–

–

–

Validation against ERP data

Supplier identification

Purchase Order identification

Line-Item validation against

open orders

Exception Management

Validate Exceptions

against master data

and logical invoice

rules

OCR “on the fly” for

easy capture of text

Automatic

Validations against

business rules

Remote Exception

Management

Management Information

Dynamic Controller

• Real time process management

• Prioritise specific vendors

• Promote business data

Statistical Analyser

• Helps identify and educate

non-compliant vendors

Invoice Reader Financial Reporting

Vendor, PO, Non-PO, Invoice Number, Date,

Nett, Tax, Gross

– Earlier visibility of invoice data

– Centralised resource reference

Benefits

–

–

–

–

–

–

Early visibility – manage cashflow effectively

Vendor education (identify non-PO culprits)

Early payment discounts

Spend analysis and vendor rationalisation

Identify payment duplication

Highlight potentially fraudulent invoice attempts

Invoice Monitor for Process Control

Displays the status of invoices, incl. discounts, escalations

Transparency of the process during and after the invoice processing

Access to the workflow history, which can be archived after the process as PDF

Dynamic reporting via the selection of invoices in the invoice monitor (can be saved as templates)

Integrated SAP-rights for the user access

Factual Verification of Invoices

• Automatic identification of Factual Verification (based on email address etc.)

• Coding templates can be saved

• Electronic accounting stamp for cost centre, GL account, notes etc.

• Access to SAP documents

Invoice Approval via Web or SAP GUI

•Automatic identification and routing to relevant approver(s)

•Access via WEB or SAP GUI

•Approval on line-item level

•Automatic posting after all approvers have confirmed