Internal Check: Accounting Controls & Procedures

advertisement

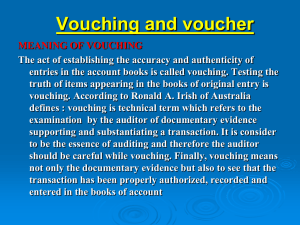

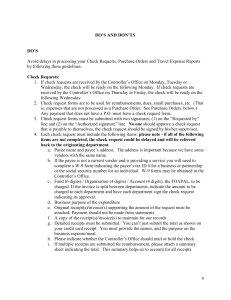

1 INTERNAL CHECK C. P. Mansoor Ahmed M. Com PGDBA Internal Control 2 Size – Operation “Internal Control is best regarded as the whole system of controls, financial and otherwise, established by the management in the conduct of a business including internal check, internal audit and other forms of control.” Internal Control 3 Accounting & Administrative Controls – Efficient and orderly conduct of transaction Safeguarding the assets in adherence to management policies Detection & Prevention of Errors & Frauds Ensuring Accuracy, Completeness, Reliability and Timely preparation of Accounting Data Internal Check 4 One of the Modes of Implementing Internal Control “a system under which the accounting methods and details of an establishment are so laid out that the accounts and the procedure are not under the absolute and independent control of any person – that, on the contrary, the work of one employee is complementary to that of another – and that a continuous audit of the business is made by the employees.” Good INTERNAL CHECK 5 Division of Work Job Rotation Authority Levels Separation of Custody and Recording Accounting Controls Vouching of CASH Transaction 6 OBJECTIVES: All Vouchers are Accounted No Fraudulent Payment is Made All Receipt & Payment are properly recorded Verify Cash in Hand & Cash at Bank Vouching – Voucher 7 Voucher: it is a documentary evidence supporting the transaction in the Books of Accounts. Verification of Transaction with counterfoils, Intelligence, Critical Bent of Mind, Common Sense, Observation. Vouching 8 Voucher Numbering – Ordering Attention to dates, names & amount Stamped, Initials etc Special Attention: Personal Name, Partner, Director Duly Signed, Authorized Duly Stamped Nature of Receipts & Payments Elucidation Scrutinize the Duplicate Vouchers Avoid involvement of Members of Client Staff Receipted Invoice Printed Receipts as Voucher Payments of Rent Rates & Taxes – Advances - Adjustments Internal Check as regards to Cash 9 Check internal operation Access to books of accounts Receipts against cash Rough Cash Book Remittances – opened before officer Automatic tills or cash register Deposit all cash receipt every day BRS prepared regularly Issue of Cheque – authorized by the officer Independent check of Castings of Cash Book Preparation of Wage sheet Payment by cheques except petty Collection by travellers Cash Book 10 Debit Credit Opening Balance Payment to Creditors Cash Sales Wages Receipts from Debtors Capital Expenditure Income from Interest, Dividends etc., Loans Loans Salaries Rents Received Agent’s & Traveler’s Commission Bills Receivable Travelling Allowance Commission Insurance of Premiums Sale of Investment Bills of Payable Bad Debt Bills Receivable Discounted & Dishonoured Dividends Freight Carriage & Custom Duties Subscription Bank Charges Insurance Claim Money Partner’s Drawings Share Capital Postage Sale of Fixed Assets Petty Cash Miscellaneous Receipts Internal Check as regard to PURCHASES 11 Orders – 2 copies (Supplier & Reference) On Receipt – Goods Receipt Book Invoice – Goods Receipt Book Verified Check Calculations in Invoice Invoice Copy – Person in charge Clerk – Purchases Book Initial the invoice copy. Duty of an Auditor – CREDIT PURCHASES 12 Return: Credit Note Purchase Return Journal Return Outwards Book Gate Keeper’s Outwards Book In clients name Authorize person in charge Date of Invoice – Period under review Review of Verification Goods on Invoice – Capital Test Check – Purchases Book Expenses Debited to Purchases Account Compare the Books Stamp, Check Mark, Initial Duplicates Credit Conformation Statement Internal Check as regard to SALES 13 Order – Order Received Book (Name, Particulars of Goods, Date & Mode of Transport) Copy – Dispatch Department Clerk compares goods in order packed by DD Rate of charge – Responsible officer Preparation of Invoice – 2/3 copies One copy – clerk – sales book One copy – gatekeeper – goods outward book Traveler Sales Man – 3 copies Duties of an Auditor – CREDIT SALES 14 Reasons for Return Gatekeeper Sales Return Book Credit Note Review Internal Check System in Place Invoice – Sold SalesonBook Goods Sale orCompare Return System Order Received Book, Goods Outward Book, Goods Sent onOutward Consignment Gatekeeper’s Book, Delivery Note etc SalePackages of Asset – treated as a ordinary sale & Empties Statement of accounts from client Check sales during last days and weeks Journal invoice – duplicates Cancelled SalesBought Tax Ledger & Insurance etc debited & credited into appropriate accounts Sales Ledger Sales to sister concerns and associates Total Accounts & Sectional Balancing Different trade discounts - examined Internal Check as Regard to WAGES 15 Check inclusion for Dummy Workers Errors or Fraud – piece work records Clerical Works Dispensed Employees – Retained Over Stating – Rates Over Stating Hours/days of Work Conversion of unpaid wages Over footing of pay roll sheets Understatement of deduction Internal Check with regard to WAGES 16 Time Records Preparation of Wage Sheet Piece Work Records Payment of Wages Duties of an Auditor - WAGES 17 Check Loop hole Wage Sheet or Wage Book Calculation are Correct Wages payable, paid & unpaid Dummy Workers Initialed ID verification Authorized Number of workers Wage sheet – ESI Card, PF Account Total wages – estimates of costing department Duly signed - comparison Leave register Wage payment vs. advance payment Employment of Casual Labourer Test Check INTERNAL AUDIT 18