clicking here - CMKM Diamonds Inc.

advertisement

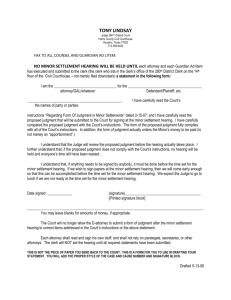

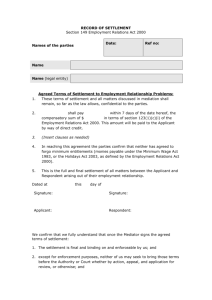

Shareholder Meeting #38 January 30, 2015 Meeting starts at 8 PM CST WELCOME! 1. 2. 3. 4. Turn up your computer speaker volume for live audio. Steve K will provide updates, news, and information about CMKM/NHHI business activities, and then open the floor for questions. Raise your hand if you have a question and Host will give you the floor when your turn comes. You can ask questions audibly by microphone or type them into the scroll. Please avoid asking the same questions as others. Let’s cover as much ground as possible. 1. 2. 3. 4. Wells Fargo – case settled (see additional slides for details). John Edwards has been cleared to stand trial. His defense counsel Richard Wright has petitioned the court to withdraw for lack of payment by Edwards. Criminal trial has been moved to 9/15/15. The evidentiary hearing in Clark County, NV District Court regarding our large judgment recovery has been moved to early February, 2015. Our law firm has been taking depositions this week in preparation for the hearing, which will determine if our judgment will stand. 1. 2. 3. Case has been settled, and as with all deals of this type, the terms and conditions of settlement are sealed and cannot be published. Circumstances and newly-acquired discovery dictated that a settlement was mandatory needed to be negotiated prior to a complete dismissal of our case. Shareholders will be able to see the settlement “numbers” on the CMKM 2015 tax return without CMKM violating the conditions of the settlement. Reasons that a settlement was mandatory: 1. New evidence of John Edwards’ heavy involvement acting as an “ex officio” officer of CMKM, which revives the in pari delicto defenses. 2. Bill Shepherd dropped out of case, leaving our local counsel unpaid with a large bill accruing. 3. Risk of local counsel withdrawing due to unpaid bills. Same local counsel is handling the large judgment that we are now defending in court. 4. Huge financial drain with zero hope of the case ever making it to trial – fighting a huge bank with unlimited resources and excellent lawyers. 5. The “damage model” was impossible to prove, and we would have ultimately lost the case. CMKM never had any real value or assets. It was always an “empty shell” used to perpetrate a stock fraud. 6. Structuring a settlement now allows CMKM to get access to discovery, bank account records and bank account funds that we would have never gotten with a dismissal. 7. The settlement should re-invigorate our judgment recovery efforts. 8. This is only a partial list of the reasons that settlement was not only prudent but mandatory. 1. 2. 3. Amazon is the world’s largest internet company with over 1M products for sale. It offers easy online shopping, good pricing, and huge selection. The Amazon link is another method of monetizing the CMKM website. Amazon portal profit for January, 2015 is $87.67 MTD, which helps offset our monthly overhead of +/- $250/month. 1. 2. 3. 4. The persistent rumors of a large trust and “payout” for CMKM shareholders are intrinsically linked to numerous “conspiracy” websites, including the Dinar pumper sites. These websites are huge revenue generators for the owners and associates. Every time a new forecast of imminent “payment” is issued, the traffic on these websites increases exponentially. There is a definite relationship between the CMKM “payout” myth and these conspiracy sites. 1. 2. 3. The radical reduction in oil prices has created both challenges and opportunities. Investors are reluctant to invest in oil deals until prices stabilize, so we will hold off on the Reg D fundraiser until a “bottom” in oil pricing is confirmed. Lower oil prices create buying opportunities and a reduction in drilling and infrastructure costs. If we are successful in collecting the large judgment we are working on then we will have the cash needed to purchase oil/gas assets outright. 1. 2. 3. 4. 5. Raise funding for purchase of oil/gas assets as able. Purchase and operate oil/gas assets. Add to the oil/gas asset base as rapidly as funds are available. Grow the revenue/profit stream exponentially. Return to trading when timing dictates. I will attempt to answer your questions within a reasonable time frame. Some questions/answers cannot be discussed in a public forum due to ongoing litigation or negotiations. I will not have the answer to some potential questions. However, all answerable questions will be addressed honestly and fairly. Raise your hand and you will be given the floor to ask your questions in order. The next Webinar will be held in February, 2015. If you have questions or comments please email me at stevek@cmkmdiamondsinc.com. Thank you and God bless!

![[Proposed] Final Order Approving Class Action Settlement and](http://s3.studylib.net/store/data/008611983_1-033aa864f7111c0b7a70143f805d66d1-300x300.png)