Chapter 5

advertisement

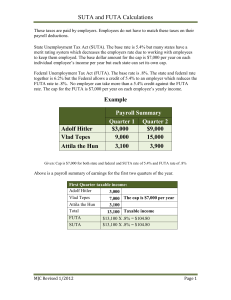

UNEMPLOYMENT COMPENSATION TAXES FUTA Federal Unemployment Tax Act Federal law that imposes an employer tax Required for administration of federal and state unemployment insurance programs SUTA State Unemployment Tax Act Different law in each state Funds used to pay benefits and administer program at individual state’s level FUTA originated through passage of SSA of 1935 Employers are liable for this tax if Pay $1,500 or more of wages in any quarter in current or prior year Employ one or more persons, on one day in each of 20 weeks in current or prior year Special rules for agricultural and household employers If employer owes FUTA – liable for entire year!! Employees include Part-time, temps and regular workers Workers on vacation/sick leave Agricultural employees (special rules) Household employer General rule is everyone is considered an EE if common-law relationship exists Also included Drivers who distribute food/beverage or deliver laundry Traveling salespeople (specific situations) Specific exceptions as follows Partners Directors Independent contractors Home workers Full-time life insurance salespeople Children under 21 working for parents RRTA or governmental employees Nonprofits (church, educational, etc.) Complete list on page 5.4 Employees generally covered under SUTA if covered under FUTA Likewise employers specifically excluded under federal law generally excluded under state laws Many states apply “ABC” test for SUTA exclusion Is the worker free from control/direction Is work performed outside usual course of business Is person customarily engaged in an independent trade or business With multi-state employees, sometimes a question arises as to which state ER should pay SUTA to (apply following in order) Where is work localized (work primarily performed) Where is operational base (management, business records) Where are operations directed (state where control exists) Employee’s residence If above does not yield appropriate answer, Interstate Reciprocal Coverage Arrangement may be fashioned Americans working overseas for American company are covered In all states except five and Puerto Rico Each employer’s rate based upon Employee turnover and State in which business is located Some states utilize reserve-ratio formula to lower contributions based on low risk of unemployment Some states reduce rates if employers make voluntary contributions to state fund Nonprofits have option to reimburse state for actual amount of unemployment benefits paid instead of paying percentage SUTA Dumping Prevention Act mandates that states enact laws to stop businesses from lowering their unemployment rates through creating new entities Experience rating reflects stability of ER’s employment history Also called merit rating Provides for reduction in SUTA rates Most common formula is reserve-ratio formula Positive balance employers will experience lower tax rate Some states require employees to contribute to SUTA Some states allow ERs to reduce SUTA rates by making voluntary contributions to state fund Taxable FUTA wage base caps at $7,000/year Taxable SUTA wage base caps at different amount in each state (pp 5.13 - 5.15) Wages include Bonuses, advances, severance pay Stock compensation - fair market value Tips Retroactive wage increases Complete list of taxable wages found on pp 5.8 5.9 Bonuses under supplemental compensation plan paid upon retirement, death or disability Advances or reimbursement of business expenses Retirement pay Educational assistance payments If part of nondiscriminatory plan Meals and lodging if for employer’s benefit Strike benefits Complete list on page 5.9 FUTA = 6.2% of first $7,000 of gross wages for each employee per year 5.4% credit against FUTA (allowed for SUTA taxes)* Therefore gross 6.2% less 5.4% credit = .8% net FUTA *Even if experience rating allows ER to pay a lower rate than 5.4% To get full 5.4% credit must have: Made SUTA contributions on timely basis On or before due date for filing Been located in a state that is not in default on their Title XII advances Title XII of the Social Security Act lends funds to states Provides unemployment compensation funds from federal government Credit is reduced (.3% per year beginning the second year after the advance) Deposit quarterly - but only if cumulatively over $500 Due dates are as follows* 1/1 - 3/31 4/1 - 6/30 7/1 - 9/30 10/1 - 12/31 deposit by 4/30 deposit by 7/31 deposit by 10/31 deposit by 1/31 Form 940 due by 1/31 of following year Filed annually *If falls on Saturday, Sunday or legal holiday, have until following business day If $500 or more, must deposit by last day of month following close of quarter If less, can wait and add to next quarter, then if it’s $500 or more, must deposit If never gets over $500, pay with Form 940 at year-end Use Form 8109 coupon and deposit with an authorized depository 940 has multiple sections Part I - Did company pay SUTA to one state? Part II – Calculate FUTA tax before adjustments Part III – Determine adjustments Part IV – Compare adjusted FUTA tax to deposits and calculated balance due or overpayment Part V – Report FUTA liability Parts VI – VIII – Delineate third party designee, paid preparer and sign Individual may sign if sole proprietorship Principal officer may sign if corporation Duly authorized member may sign if partnership Fiduciary may sign if trust or estate Form 940 due by January 31 of next year Or if timely deposits have been made, have until February 10 to file Need to attach Schedule A (Form 940) if multi-state employer or have SUTA credit reduced Filed with IRS District Center in which business is located Can e-file after submit electronic letter of application to IRS A final return must be filed in year company ceases doing business SUTA requirements vary widely by state In the states where EE also pays into SUTA, both EE and ER taxes deposited together SUTA quarterly contribution report generally shows Each employee’s gross wages and taxable SUTA wages (wage information) Contribution rate x taxable SUTA wages Amount of required payment Usually includes wage information report per employee Forms vary by state but may include: Status Reports Initial registration with state as employer liable for SUTA Wage Information Report Earnings per employee and SS# are reported Separation Reports Informs state of separated employees - aids in determination of eligibility for benefits Partial Unemployment Notices Notifies state and employees who have had their hours cut back to part-time of potential eligibility for partial unemployment benefits