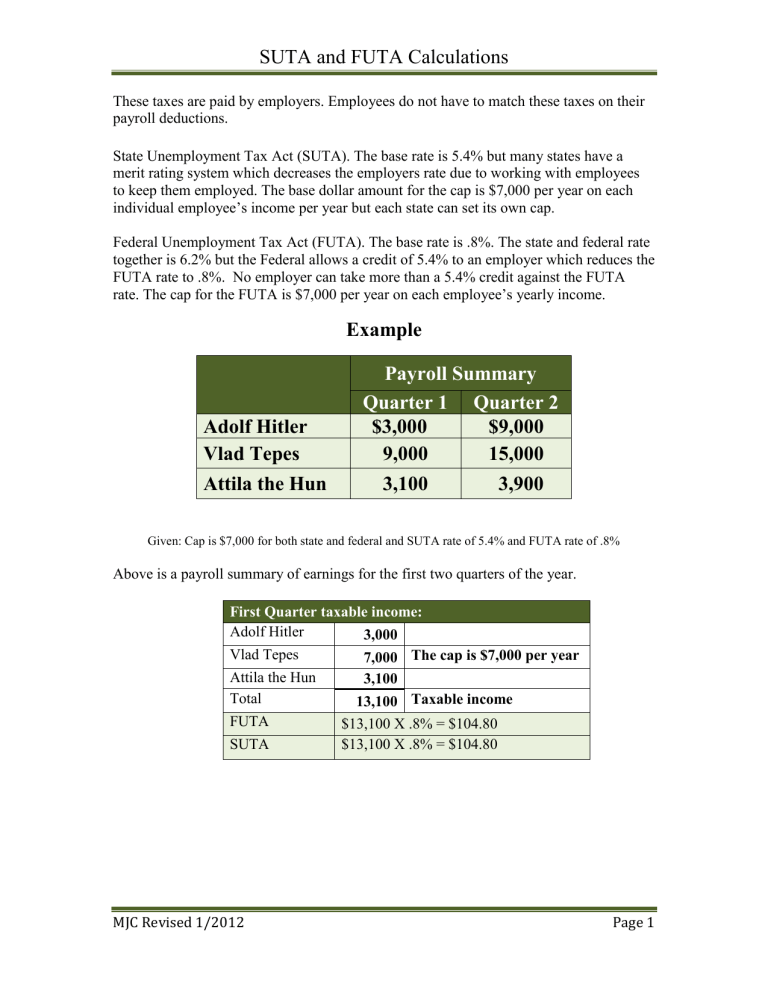

SUTA and FUTA Calculations These taxes are paid by employers. Employees do not have to match these taxes on their payroll deductions. State Unemployment Tax Act (SUTA). The base rate is 5.4% but many states have a merit rating system which decreases the employers rate due to working with employees to keep them employed. The base dollar amount for the cap is $7,000 per year on each individual employee’s income per year but each state can set its own cap. Federal Unemployment Tax Act (FUTA). The base rate is .8%. The state and federal rate together is 6.2% but the Federal allows a credit of 5.4% to an employer which reduces the FUTA rate to .8%. No employer can take more than a 5.4% credit against the FUTA rate. The cap for the FUTA is $7,000 per year on each employee’s yearly income. Example Adolf Hitler Vlad Tepes Attila the Hun Payroll Summary Quarter 1 Quarter 2 $3,000 $9,000 9,000 15,000 3,100 3,900 Given: Cap is $7,000 for both state and federal and SUTA rate of 5.4% and FUTA rate of .8% Above is a payroll summary of earnings for the first two quarters of the year. First Quarter taxable income: Adolf Hitler 3,000 Vlad Tepes Attila the Hun Total FUTA SUTA MJC Revised 1/2012 7,000 The cap is $7,000 per year 3,100 13,100 Taxable income $13,100 X .8% = $104.80 $13,100 X .8% = $104.80 Page 1 SUTA and FUTA Calculations Second Quarter taxable income: Adolf Hitler 4,000 (7,000 – 3,000 = 4,00 Vlad Tepes 0 Went over the cap in First Quarter Attila the Hun 3,900 (7,000 – 3,100 = 3,900) Total 7,900 Taxable income FUTA $7,900 X .8% = $63.20 FUTA SUTA $7,900 X 5.4% = $426.60 SUTA MJC Revised 1/2012 Page 2