Personal budgets slide pack

advertisement

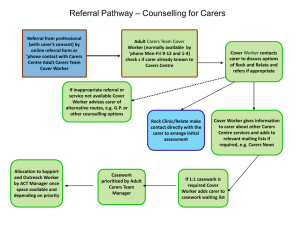

Personal budgets Care Act 2014 Outline of content Introduction Elements of the personal budget Calculating the personal budget Agreeing the final budget Use of a personal budget Use of a carer’s personal budget Appeals/disputes Summary 2 Introduction The Care Act places personal budgets into law for the first time, making them the norm for people with care and support needs. Personal budgets enable the person to: exercise greater choice take control over how their care and support needs are met It is vital that people: are clear how their budget was calculated have confidence that the personal budget allocation is correct and therefore sufficient to meet their care and support needs 3 Personal budgets Care Act 2014 Personal Health Budgets Personal Budgets Improving Life Chances of Disabled People 4 Personal budgets: evaluation of impact Increase in numbers of people receiving personal budgets, in March 2014, 648,000 people had one The POET survey (2013) gained data from 22 volunteer councils with responses from 2022 personal budget holders and 1386 carers 70% of personal budget holders reported a positive impact: independent as you want to be getting the support you need and want being supported with dignity 5 Care and support planning Third party Local authority 6 Elements of the personal budget The personal budget must always be an amount sufficient to meet the person’s care and support needs The overall cost must be broken down into: the amount the person must pay (following the financial assessment) the remainder of the budget that the authority will pay 7 Other costs that may be presented or excluded Presented • Local authority brokerage fee Presented • Any additional payment or a “top-up” Excluded • Costs for intermediate care or reablement must be excluded 8 Calculating the personal budget Transparency Timeliness Sufficiency 9 Sufficiency of the personal budget and implications for direct payment The personal budget must: always be sufficient reflect the cost to the local authority of meeting the person’s needs be open to challenge Direct payments are not intended to be less than is required to purchase care and support on the local market 10 Agreeing the final budget The final budget should be agreed at the end of the planning process Sign off should take place if the plan is within the indicative budget (or justifiably above it) the proposed use of the money is: appropriate legal meets the needs identified in assessment 11 Use of a personal budget Third party managed PB (ISF) Local authority managed PB Direct payments Mixed package Maximum possible range of options 12 Use of a carer’s personal budget The carer’s personal budget must enable the continuation of the carer role take into account carer outcomes have regard to carer wellbeing 13 Implications for the personal budget of the person needing care A carer’s need for support can be met by providing care to the person they care for Consider joint plans and budget The person would be liable to pay any charge, and must agree to do so 14 Carers’ personal budgets where the adult being cared for does not have eligible needs In these situations a carer will receive a support plan specifying: how the carer’s needs are going to be met and including a personal budget The personal budget must specify the costs to the local authority and the costs to the carer Replacement care costs have to be met by the person receiving care . 15 Appeals/disputes The local authority must make its own arrangements for dealing with complaints in accordance with the 2009 regulations 16 Summary The Act places personal budgets into law for the first time, making them the norm for people with care and support needs Personal budgets are designed to enable people to exercise greater choice and take control over how their care and support needs are met The personal budget must: always be sufficient to meet the person’s care and support needs include the cost to the local authority and the amount the person must pay exclude the provision of intermediate care and reablement The carers personal budget must enable the continuation of the carer role and must have regard to the wellbeing principle of the act The local authority is under an ongoing duty to keep the person’s plan and personal budget under review 17