2011 NSEF Presentation Nova Scotia liberal caucus

advertisement

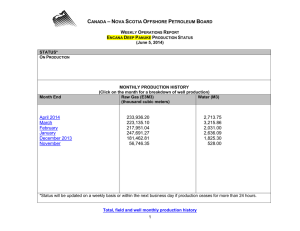

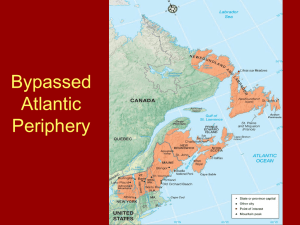

Equalization Fairness What it Means to the People of Nova Scotia March 2011 www.nsef.ca • A grassroots organization not affiliated with any political party • Everyday people dedicated to ending a grave injustice in Nova Scotia Federal Equalization “Parliament and the government of Canada are committed to the principle of making equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.” ―Canada Constitution Act (Section 36.2) Federal Equalization Transfer to Nova Scotia 2010-2011 $ 1,571 million Nova Scotia Public Service Expenditures† 14% Municipalities Province 86% † Historical average Provincial Distribution 2009-2010 The provincial government distributed less than 1% of the $1,571,000,000 federal transfer to the 42 communities in Nova Scotia entitled to Equalization payments.† † Note: The provincial government supplemented this amount ($15,050,000) with NSPI’s $17,000,000 Grant in Lieu of Taxes, to bring its total “equalization” distribution to $32,050,000. Municipal Indicators † HRM vs. CBRM Municipal Indicator 2.2.1 1.1.3 1.2.2 Indicators - Profile HRM 2007 Average Household Income ($) Residential Tax burden (Average Residential Taxes) ($) 66,339 CBRM Differential % 49,665 HRM 16,674 + 33.6% 2007 2009 1,410 1,072 884 1,006 526 66 HRM +59.6% + 6.6% Average Delivery of Services Per Household (Expenditure Per Household) ($) 2007 2009 3,740 3,727 2,260 2,568 1,480 1,159 HRM +65.5% +45.1% † Source: Service Nova Scotia and Municipal Relations – Municipal Indicators $40,000 Yarmouth Victoria St. Mary's Shelburne Richmond Queens-Liverpool Pictou Lunenburg Kings Inverness Hants West Hants East HRM Guysborough Digby Cumberland Colchester Clare Chester CBRM Barrington Argyle Antigonish Annapolis Royal Household Income Average Household Income $70,000 $65,000 $60,000 $55,000 $51,871 $50,000 $45,000 Tax per $100 Assessment CBRM vs. HRM Residential Location Dominion (Suburban) Glace Bay (Urban) Louisbourg (Suburban) New Waterford (Urban) North Sydney (Urban) Sydney Mines (Urban) Sydney (Urban) Commercial CBRM HRM Differential † Discount CBRM HRM Differential 1.99 1.20 + 67.0% -40% 4.31 3.683 + 17% -14.5% 2.01 1.30 + 55.0% -35% 4.31 3.713 + 16.1% -14% 1.94 1.20 + 62.0% -38% 4.31 3.683 + 17% -14.5% 2.00 1.30 + 54.0% -35% 4.31 3.713 + 16.1% -14% 2.03 1.30 + 56.0% -36% 4.31 3.713 + 16.1% -14% 1.91 1.30 + 47.0% -31.7% 4.31 3.713 + 16.1% -14% 2.19 1.30 + 69.0% -40.5% 4.89 3.713 + 32.7% -24.6% Discount † Discount to CBRM taxpayers if tax rates were equal to those in HRM † 0.50 Yarmouth Victoria St. Mary's Shelburne Richmond Queens-Liverpool Pictou Lunenburg Kings Inverness Hants West Hants East HRM Guysborough Digby Cumberland Colchester Clare Chester CBRM Barrington Argyle Antigonish Annapolis Royal Tax Rate Nova Scotia Residential Tax Rates Municipalities - Rural & Urban Rates 2.20 2.10 2.00 1.90 1.80 1.70 1.60 1.50 1.40 1.30 1.20 Rural 1.10 Urban 1.00 1.01 0.96 0.90 0.80 0.70 0.60 1.0 Yarmouth Victoria St. Mary's Shelburne Richmond Queens-Liverpool Pictou Lunenburg Kings Inverness Hants West Hants East HRM Guysborough Digby Cumberland Colchester Clare Chester CBRM Barrington Argyle Antigonish Annapolis Royal Tax Rate Nova Scotia Commercial Tax Rates Municipalities - Rural & Urban Rates 5.4 5.2 5.0 4.8 4.6 4.4 4.2 4.0 3.8 3.6 3.4 3.2 3.0 2.8 Rural 2.6 Urban 2.4 2.2 2.26 2.09 2.0 1.8 1.6 1.4 1.2 $1,000 Yarmouth Victoria St. Mary's Shelburne Richmond Queens-Liverpool Pictou Lunenburg Kings Inverness Hants West Hants East HRM Guysborough Digby Cumberland Colchester Clare Chester CBRM Barrington Argyle Antigonish Annapolis Royal Expenditure per Dwelling Service Expenditure per Dwelling Municipalities $4,200 $4,000 $3,800 $3,600 $3,400 $3,200 $3,000 $2,800 $2,600 $2,400 Service $ $2,200 $2,000 $1,800 $1,925 $1,600 $1,400 $1,200 Residential Tax Savings (if CBRM tax rates were equal to the rates in HRM) Location Sydney Glace Bay Annual Tax Savings† $882 $711 North Sydney New Waterford Sydney Mines Louisbourg $721 $698 $608 $737 Dominion CBRM Rural $787 $221 † For $100,000 assessment Provincial Distribution of “Equalization” to Eligible Municipalities (2010/2011) Total Entitlement (at 14%)†: $219,940,000 Total Distributed: $ 30,500,000 Total Diverted: $189,440,000 † Eligible municipalities are entitled to all of the remaining 86% ($1.549 B), as improved, provincially-funded services. CBRM “Equalization” Grant 2010/2011 Entitlement (@ 14%): $117,029,039 Actually Received: $ 16,228,901 “Equalization” Received† vs. Entitlement Cape Breton Region CBRM Received‡ Entitlement $ 16,228,901 $ 117,029,039 Inverness 459,297 3,312,060 Port Hawkesbury 271,063 1,954,676 8,535 61,547 Victoria † Note: To each of the 42 municipalities in Nova Scotia eligible for federal equalization transfer payments, the provincial government distributed less than one-seventh of the amount which they were entitled to receive to cover the public services they are required to provide. ‡ Source – Service Nova Scotia and Municipal Relations Equalization Calculator 2009-10 “Equalization” Received vs. Entitlement Mainland Nova Scotia Region Annapolis Antigonish Colchester Cumberland Digby Guysborough (Town) Hants Kings Lunenburg Pictou Queens Shelburne Yarmouth †Source Received† $ 1,062,642 48,522 1,594,601 2,855,536 857,465 476,169 403,670 224,553 345,812 3,371,610 819,514 746,291 725,819 Entitlement $ 7,662,871 349,899 11,498,907 20,591,698 6,183,309 3,433,726 2,910,925 1,619,285 2,493,702 24,313,185 5,909,638 5,381,616 5,233,990 – Service Nova Scotia and Municipal Relations Equalization Calculator 2010-11 CBRM Entitlement vs. Amount Required to Reduce Taxes to HRM level $120,000,000 $117,029,039 $100,000,000 $80,000,000 $60,000,000 $40,000,000 $18,000,000 $20,000,000 $0 CBRM Entitlement based on 14% Fairness Grant Required to reduce taxes to HRM Level A balance of $99,970,961 would remain for CBRM to provide improved services. Federal Equalization “Parliament and the government of Canada are committed to the principle of making equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.” ―Canada Constitution Act (Section 36.2) The Canadian Charter of Rights and Freedoms ... Equality Rights §15 (1) Every individual is equal before and under the Law and has the right to the equal protection and equal benefit of the law without discrimination . . . . Call to Action Members of the Nova Scotia Legislative Assembly must require the provincial government to direct 100% of the federal equalization transfer to the purpose specified in the Constitution. Federal Support to Nova Scotia 2009-10 Major Transfers • • • Equalization Transfer Canada Health Transfer Canada Social Transfer $ 1,571,000,000 $ 700,000,000 $ 304,000,000 Direct Targeted Support • • • Labour Market Training Funding Wait Times Reduction Transition Adjustment $ $ $ 14,000,000 7,000,000 74,000,000 Trust Funds • • • • • • Clean Air and Climate Change Trust Patient Wait Times Guarantee Trust HPV Immunization Trust Community Development Trust Public Transit Capital Trust 2008 Police Officers Recruitment Fund Total Federal Support $ 14,000,000 $ 8,000,000 $ 3,000,000 $ 12,000,000 $ 7,000,000 $ 2,000,000 $ 2,837,000,000 Conclusions • Section 36.2 of the Constitution represents the supreme law of the land. • No persons, including legislators, may pick and choose which laws they will ignore. • In misappropriating federal Equalization funds, the Nova Scotia government is violating the Charter rights of the citizens of the poorest communities in Canada. This amounts to constructive theft of their money, through higher taxation, and of public services they are due but are not being provided. Questions? nsef.ca@gmail.com www.nsef.ca