k-12 markets overview–what`s hot and what`s not?

advertisement

Parthenon Perspectives

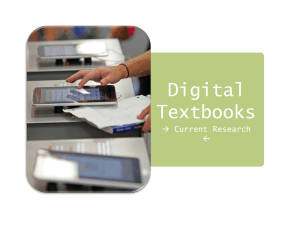

What is Next in K-12 Digital is Coming!

February 20, 2014

T HE PARTHENON G ROUP

Boston • London • Mumbai • San Francisco

What Informs Our Perspective?

Parthenon teams have completed over 900 education

projects in more than 60 countries

T HE P ARTHENON G ROUP

Education Sector Projects

Completed by Parthenon

Parthenon Offices

Pre-Kindergarten

K-12

Career and

Professional

University

Vocational

and Other

2

What Informs Our Perspective?

Public and private sector work provides us with a strong

sense of what is happening “on the front lines”

We advise a number of

leading education institutions…

• Local educational authorities, states, and

governments

T HE P ARTHENON G ROUP

…and work with the private companies

trying to meet their needs

• Educational publishing

• Assessments

• Charter schools, private K-12 schools, and

other innovative education providers

• Tutoring

• Global post-secondary institutions

• Intervention/Special Ed

• Foundations on the forefront of educational

reform

• Technology providers

• Consumer education products

3

Funding Pressures

Parthenon anticipates a slow recovery in educational

funding…

T HE P ARTHENON G ROUP

YoY Growth of K-12 Education Spending,

Actual vs. Forecast, FY1994-2018F

10%

8

6

4

2

Note: Fiscal Year July - June

Source: Congressional Budget Office; ARRA documents; Global Insight; U.S. Census; National Center for Education Statistics; NEA; Parthenon Analysis

2018F

2017F

2016F

2015F

2014F

2013F

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

-2

1994

0

4

Funding Pressures

…as a result, the next several years will continue to see

stagnant growth

T HE P ARTHENON G ROUP

YoY Growth of K-12 Education Spending,

Actual vs. Forecast, FY1994-2018F

Annual Growth Rate

6%

• State and local education spending is more

“discretionary” than other state/local budget

priorities (e.g., interest payments, Medicaid)

5.7%

• Continued federal budget shortfalls are

expected and rainy day funds are exhausted

4.1%

4

• New stimulus-level federal spending is

unlikely

2.3%

2

• Rising enrollments typically impact K-12

expenditure levels positively due to per pupil

spend formulas

• Increasing costs associated with education

(e.g., teacher salaries) tend to increase K-12

budgets

0

('92-'02)

('02-'12)

('12-'18)

Note: Fiscal Year July - June

Source: Congressional Budget Office; ARRA documents; Global Insight; U.S. Census; National Center for Education Statistics; NEA; Parthenon Analysis

5

Seeking Growth

The only growth sectors have been in digital courseware

and summative testing…

T HE P ARTHENON G ROUP

Instructional Materials Market (2005-2012F)

$8.2B

$8.6B

$8.6B

$8.1B

$8.3B

$7.8B

$7.5B

Magazines

Magazines

Magazines

Magazines

Magazines

Magazines

Magazines

Magazines

V ideo

Video

Video

Trade Books

Video

Video

Video

Trade Books

Video

Trade Books

Video

Trade Books

Trade Books

Trade Books

Trade Books

Trade Books

Manipulatives

Manipulatives

Manipulatives

Manipulatives

Manipulatives

Manipulatives

Manipulatives

Manipulatives

Digital

Courseware

Digital

Courseware

Digital

Courseware

Digital

Courseware

Digital

Courseware

Digital

Courseware

Print

Supple me nta ls

P rint

S upplemen tals

0%

State-Level

Tests

6%

Pr int

S upplementals

2008

State-Level

Tests

Modular

Software

-4%

Textbooks

2007

State-Level

Tests

State-Level

Tests

Modular

Software

7%

Textbooks

2006

Modular

Software

Digital

Courseware

7%

0%

2%

Textbooks

Textbooks

2005

Modular

Software

P rint

Supple me nta ls

State-Level

Tests

Textbooks

0

State-Level

Tests

Textbooks

20

State-Level

Tests

Modular

Software

Textbooks

40

Modular

Software

Digital

Courseware

-1%

Textbooks

60

P rint

S upple men tal s

State-Level

Tests

Modular

Software

Pr int

Su pplementals

Modular

Software

P rint

S upple men tal s

80

$8.4B

Print

Sup plementals

100%

CAGR

('05-'12 )

-7%

2009

2010

2011

2012F

Note: Modular software is defined as physical software (i.e. CD disk); Courseware is defined as online only; Market does not include formative assessments

Source: Simba

6

Seeking Growth

…and district decision maker sentiments indicate that the

digital transition, though gradual, continues…

T HE P ARTHENON G ROUP

Strategic Preference for Improving Outcomes

100%

83%

80

60

40

20

0

17%

Lower Class Size

Source: Parthenon Survey November 2012; n = 104 district leaders, 148 school leaders

Increase Technology Use

7

Seeking Growth

…across a broad spectrum of uses

T HE P ARTHENON G ROUP

Spending Breakdown for Digital Courseware

100%

Other

SAT / ACT / AP test prep

Gifted and talented materials

AP / high level courses

80

Special education materials for

students

Formative assessment

60

• Multiple products in the school / classroom

for similar uses is standard

• Purchasing criteria centers around:

‒ Enhancing Student Achievement

‒ Common Core Alignment

Part of regular instruction

40

‒ Price

‒ Student Engagement

‒ Ease of Implementation

20

0

Remediation materials for specific

students

Spending Allocation

Source: Parthenon Survey August 2014 (n=244 decision makers)

8

Digital Considerations

Moving from print to digital has tremendous implications

on business models

T HE P ARTHENON G ROUP

If you do not have a great product that is 1) easy to use, 2) engages students, and 3) enhances

outcomes – don’t worry about the rest because it will not be received!

1

Enhance Teaching and

Administrative

Workflows

Products and services that fit within, and enhance, established workflows

succeed; those that fight them fail

2

Selling is More Complex

Decision making for digital product often involves multiple constituents and

often (though not always) moves to a district vs. building purchase

3

Pricing Becomes

Challenging

Subscription vs. license; Per user vs. per site; myriad funding streams

4

Common Core, Common

Core, Common Core

Districts are much more sophisticated about how well aligned content and

services are with the Common Core

9

Enhancing Teaching and Administrative Workflows

What did the Teacher / Administrator do three minutes

before and after using your product?

Teaching Workflows

One of the largest workforces in the

Country, who:

• Tend to work alone;

• Have established classroom rhythms;

and are

• Change resistant – for good reasons

T HE P ARTHENON G ROUP

Administrative Workflows

Extreme budgetary and performance

pressure grappling with:

• Rising standards and persistent

performance gaps;

• Increasing statutory compliance

complexity;

• Distributed workforce with high turn-over

• Highly politicized constituents (unions,

parents, boards, politicians)

Do not fight these workflows – odds are, you do not know better!

10

Sales is More Complex

Sales into multiple constituents at the district level

requires a field sales force

T HE P ARTHENON G ROUP

1,000K

500

100

80% coverage can be

achieved with ~ 80 reps

50

Requires ~200-250 reps (or

inside sales)

20

10

5

2

“The

Big

250”

Enrollment

“The Next 1,000”

“The Tail End”

1

0

50

100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

950

1000

1050

1100

1150

1200

1250

1300

1350

1400

1450

1500

1550

1600

1650

1700

1750

1800

1850

1900

1950

2000

Enrollment (Logged)

200

~80% coverage can be

achieved with ~25 reps

Number of Districts

Concentration is especially acute when the largest school districts are considered – allowing

reasonably broad student number coverage with a moderately sized sales force

11

Sales is More Complex

Becoming more than a regional player will require a fairly

national sales force

T HE P ARTHENON G ROUP

>25K

10-25K

Source: NCES

12

Pricing Becomes Challenging

Subscription vs. license and per user vs. per site…

T HE P ARTHENON G ROUP

Pricing Models

(Subscription vs. License and Per User vs. Per Site)

Subscription vs. Perpetual License

•

Often determined by how districts budget

/ purchase

•

Large districts often demand flexibility

Total Lifecycle Cost

Per User vs. Per Site

•

Influenced by public perception “all

students have access to XXX”

•

Usage uncertainty plays a role

Total Cost of Ownership

Perpetual License

Per Site Subscription

Per User Subscription

•

All fees included

•

Subscription vs. License breakeven at

XXX years?

Number of Students

13

Pricing Becomes Challenging

Funding patterns require invoicing flexibility and a

consultative approach

T HE P ARTHENON G ROUP

Funding Sources for Digital Courseware

100%

80

Other

Other

S tudents (Or P arents) Out of P ocket

Enhancing Education ThroughTechnology

Foundations or Other Non-Profits

21rst Century

Individual School Operating

Budget

SIG

ARRA/ RTT/ i3

60

Specific Federal Programs

IDEA

40

District Curriculum Budget/

District General Funds

ESEA Title I

Funding Sources

Federal Programs

20

0

Source: Parthenon Survey August 2014 (n=244 decision makers)

14

Common Core

Expect districts to hold a sophisticated discussion

surrounding “mapped to” vs. “built to” Common Core

13M

T HE P ARTHENON G ROUP

Forty-five U.S. states and the District of Columbia have adopted Common

Core State Standards

10.5M

Di stri ctof Col umbi a

Rhode Isl and

New Mexico

10

Arkansas

Mississippi

8.8M

Vermo

ng

t

Wyo

mi n

No

rth Da

So

uth

Dako

kota

ta

Del aware

Montana

Hawai i

Mai ne

New Hampshi re

West Virginia

Idaho

8

Nevada

Iowa

Connecticut

Oregon

South Carolina

Wisconsin

Missouri

5

Kentucky

Louisiana

Colorado

Maryland

Massachusetts

Tennessee

Arizona

Washington

North Carolina

New Jersey

Michigan

Ohio

Illinois

3

5.3M

Kansas

Utah

Oklahoma

Alabama

Indiana

Georgia

Number

of States

+ DC

Al aska

Minnesota

Virginia

Pennsylvania

California

0

5M

Nebraska

Texas

New York

Florida

Smarter Balanced

PARCC

Neither

Did not Adopt CCSS

22

16

8

5

Note: Includes the District of Columbia, but not U.S. Territories (no student population data available); Oklahoma, Pennsylvania, and Georgia have decided to stay connected with the efforts in a

Advisory capacity, but have not committed to administering exams from the two consortia; New York, although a member of PARCC will use their own versions of Common Core assessments (1.8M

students); Alaska decided to stay with its own state standards, but is a member of SBAC; Minnesota adopted Common Core English standards in 2010, but kept its own math standards

Source: NCES Student Data for grades 3-11, 2010-2011

15

About The Parthenon Group and our advisory services

for investing in education

T HE P ARTHENON G ROUP

The Parthenon Group is a leading advisory firm focused on strategy consulting, with offices in Boston, London, Mumbai,

San Francisco, and Shanghai. Since its inception in 1991, the firm has embraced a unique approach to strategic advisory

services built on long-term client relationships, a willingness to share risk, an entrepreneurial spirit, and customized insights.

This unique approach has established the firm as the strategic advisor of choice for CEOs and business leaders of Global

1000 corporations, high-potential growth companies, private equity firms, educational institutions, and healthcare

organizations.

Parthenon has served as an advisor to the education sector since our inception in 1991. Our Education Practice – the first of

its kind across management consulting firms – has an explicit mission and vision to be the leading strategy advisor to the

global education industry. To achieve this, we invest significantly in dedicated management and team resources to ensure that

EDUCATION PRACTICE

our global expertise extends across public sector and non-profit education providers, foundations, for-profit companies and

service providers, and investors. Parthenon has deep experience and a track record of consistent success in working closely

with universities, colleges, states, districts, and leading educational reform and service organizations across the globe.

.

Learn more about us at www.parthenon.com.

Robert Lytle

Partner, Co-Head of Education Practice

robl@parthenon.com

617.478.7096

Twitter | @Robert_S_Lytle

Executive Assistant:

Deb Spitzley

deborahs@parthenon.com

617.478.6312

Follow Us

for Regular

Updates

Twitter | @Parthenon_Group

Facebook | www.facebook.com/ParthenonGroup

LinkedIn | www.linkedin.com/company/the-parthenon-group

16