Revised Presentation BSG Year 16

advertisement

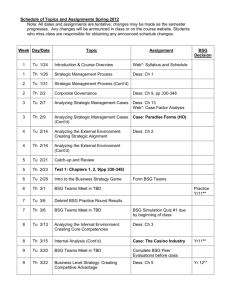

BSG Company B Industry 42 Presented by: •Sebastian Corredor Senior, Business Administration- Finance, December 2010 •Johnathan Lee Senior, Business Administration- Finance and Supply Chain Management, May 2011 •James Ball Senior, Accounting- Managerial Accounting, May 2011 5 Forces Analysis, Industry 42 COMPETITIVE FORCES LEVEL OF COMPETITION Years 11-14 1) SUPPLIERS HIGH: 52.8% superior materials usage thus prices increased 5.6% over the price base. 2) BUYERS HIGH: 7 different sellers -Most sales and revenues from wholesale segment -Switching costs are low 3) SUBSTITUTES LOW: No evidence customers will switch to other products on other industries. 4) RIVALRY MODERATE: only one competitor roughly equal in size (Co. A) -Industry has high rate of sales growth -Most sales from Wholesale segment -Even at full overtime production, capacity is shy to meet future demand 5) THREAT OF ENTRY LOW: No evidence that new companies will enter market. -Industry 42 distributed among companies A, B, C, D, E, F and G 5 Forces, New Entry, Industry 42 Summary: Suppliers: HIGH Buyers: HIGH Substitutes: LOW Rivalry: MODERATE Threat of Entry: LOW Because there are a total of TWO low forces, expected profitability of a new entrant would be ABOUT EQUAL to average cost of capital. BSG Strategic Group Map This strategic position represents the North America region in year 16. Key Success Factors From Footwear Industry: From BSG: Effective Quality Control S/Q Rating Economies of Scale Operational Efficiency Establishment of Brand Names Celebrity Appeal •Between the athletic footwear industry and BSG, effective quality control and S/Q rating are similar. Effective quality control benefits the S/Q rating in the simulation. •In addition, Operational Efficiency from BSG can be obtained by acquiring economies of scale as management reduces cost per unit by increasing capacity. •Furthermore, Establishment of Brand Names from the footwear industry and Advertising from BSG have similar connections. A major component of brand name recognition arises from celebrity appeal. Strength Assessment Strength Assessment Table • The strength assessment is based on the three BSG key success factors, taken from the North America wholesale segment in year 16 : • S/Q Rating • Operational Efficiency Key Success Factor Company Score Industry Average Strength Assessment Score S/Q Rating 6 5 4 0.533 0.555 4 315 97 5 • Celebrity Appeal • Based on the strength assessment score, management is performing at or above average in all three BSG key success factors. Operational Efficiency* Celebrity Appeal * Operational efficiency= Cost of Pairs Sold/Net revenues year 16 Market Share Growth Trend North America Europe/Africa Asia/Pacific Latin America Year 11 15.90% 16.30% 17.70% 14.50% Year 12 16.00% 15.20% 17.50% 14.70% Year 13 14.90% 14.90% 17.30% 14.50% Year 14 13.60% 14.70% 15.60% 15.20% Year 15 12.30% 13.60% 14.40% 13.30% Year 16 10.60% 10.30% 9.90% 9.40% Data only represents market share for wholesale segment. Analysis shows market share is decreasing on all geographic regions. Management should determine the causes for this decline in order to regain lost market share and build a sustainable competitive advantage in all four geographic regions. Wholesale Segment Market Share 20.00% 18.00% 16.00% North America 14.00% Europe/Africa Asia/Pacific 12.00% Latin America 10.00% 8.00% Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Financial Performance Trend EPS year 11 year 12 year 13 year 14 year 15 year 16 3.28 6.18 4.42 5.68 2.82 8.33 ROE 19.50% 27.80% 16.50% 19.60% 8.00% 19.80% Net Profit* 12.60% 18.30% 13.00% 15.90% 7.60% 17.80% *Net Profit as a percent on net revenues. ROE, EPS, and Net Profit were exceptional on year 12. Company B experienced a decline in years 13 and 15 but was able to increase them in year 14 and 16. As shareholders we would like to see these numbers return to their year 12 levels. Management should determine the causes of the decline in years 13 and 15 to prevent future fluctuation. ROE and Net Profit 30.00% 25.00% 20.00% ROE 15.00% Net Profit* 10.00% 5.00% 0.00% year 11 year 12 year 13 year 14 year 15 year 16 Earnings per share (EPS) 9.00 8.00 7.00 6.00 5.00 EPS 4.00 3.00 2.00 1.00 0.00 year 11 year 12 year 13 year 14 year 15 year 16 Recommendation To create and sustain competitive advantage in relationship with customers we recommend the following: We are pleased to see management has increased their celebrity endorsements and are operationally efficient, but they should keep an eye on the relationship between quality and price because it is not in line with their competitors. Thus the S/Q rating should increase or prices should decrease. • To create and sustain competitive advantage in relationship with shareholders we recommend the following: Management should continue giving out dividends and repurchase stocks in order to increase their earnings per share and stock price. References "Global Footwear Manufacturing: C1321-GL." IBISWorld Industry Report. 24. NCSU Libraries. Web. 14 Oct. 2010. <http://www.ibisworld.com/globalindustry/keyfactors.asp x?indid=500>.