Results Announcement 2014

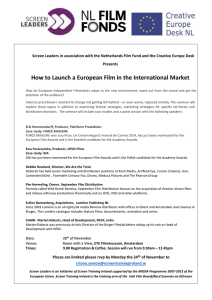

advertisement