Discounted Cash Flow Methods of Valuation

advertisement

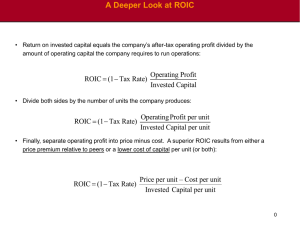

Measure: ◦ Free Cash Flow Discount Factor: ◦ Weighted Average Cost of Capital Assessment: ◦ Works best for projects, business units, and companies that manage their capital structure to a target level. Measure: ◦ Economic profit Discount Factor: ◦ Weighted Average Cost of Capital Assessment ◦ Explicitly highlights when a company creates value. Measure: ◦ Free Cash Flow Discount Factor ◦ Unlevered Cost of Equity Assessment: ◦ Highlights changing capital structure more easily than WACC-based models. Measure: ◦ Capital Cash Flow Discount Factor: ◦ Unlevered Cost of Equity Assessment: ◦ Compresses the FCF and the interest tax shield in one number, making it difficult to compare performance among companies and over time. Measurement: ◦ Cash Flow to Equity Discount Factor: ◦ Levered Cost of Equity Assessment ◦ Difficult to implement correctly because capital structure is embedded in cash flow. ◦ Best used when valuing financial institutions This method is specially valuable when extended to a multi-business company. Enterprise value equals the summed value of the individual operating units less the present value of the corporate centre costs, plus the value of non-operating assets. Value the company’s operations by discounting Free Cash Flow (FCF) at the weighted average cost of capital (WACC). Value non-operating assets ◦ Excess marketable securities, non-consolidated subsidiaries, other equity investments etc. Combining the value of operating assets and non-operating assets leads to enterprise value. Identify and value all non-equity financial claims against the company’s assets. ◦ Non-equity financial claims include fixed- and floating-rated debt, pension shortfalls, employee options and preferred stock. Subtract the value of non-equity financial claims from enterprise value to determine the value of equity. Divide equity value by the number of shares outstanding to determine share price. Value of an enterprise = ◦ PV of FCF during explicit forecast period + Continuing Value Use the key value driver formula to measure the continuing value ◦ Continuing value = [NOPLAT(at t+1)× (1g/RONIC)]/WACC-g NOPLAT: ◦ The NOPLAT should be based on a normalized level of revenues and sustainable margin and ROIC. ◦ The normalized level of revenue should reflect the mid point of its business cycle and cycle average profit margin RONIC: ◦ RONIC should be consistent with expected competitive conditions. ◦ Set RONIC equal to WACC ◦ For companies with sustainable competitive advantages, RONIC may be set equal to the ROIC during the later period of the explicit forecast period. Growth Rate: ◦ The best estimate is the long term rate of consumption growth for the industry’s product plus inflation. WACC: ◦ The WACC should incorporate a sustainable capital structure and an underlying estimate of business risk consistent with expected industry conditions. Use multiples Liquidation value Replacement cost The future is unknowable but, careful analysis can yield insights into how a company may develop. Analysts should not get engrossed in the details of individual line items. He should place aggregate results in the proper context The analyst must determine how many years to forecast and how details the forecast should be. The typical solution is to develop an explicit forecast for a number of years and then to value the remaining, called continuing value, by using a formula such as, the perpetuity formula. The explicit forecast period must be long enough for the company to reach a steady state. The company grows at a constant rate and reinvests a constant proportion of its operating profits into the business each year. The company earns a constant rate of return on new capital invested The company earns a constant return on its base level of invested capital As a result, free cash flow will grow at a constant rate and can be valued using a growth perpetuity. The forecast period should be long enough that the company's growth rate is less than or equal to that of the economy. ◦ Higher growth rates would eventually make companies unrealistically large, relative to the aggregate economy. In general, a forecast period of 10 to 15 years is appropriate. However, it may be longer for cyclical companies or those experiencing very rapid growth. Short explicit forecast period results in significant undervaluation of a company or requires heroic long term growth assumptions in the continuing value Long forecast faces the difficulty of forecasting individual line items Split the explicit forecast into two periods ◦ A detailed five-to-seven year forecast ◦ A simplified forecast for the remaining years, focusing on a few important variables, such as revenue growth, margins, and capital turnover This approach not only simplifies the forecast, it also forces the analyst to focus on the business’s long-term economics, rather than the individual line items of the forecast. Raw historical data ◦ Raw data should be collected from the company’s financial statements, footnotes, and external reports in one place. The raw data should be reported in its original form. Integrated financial statements ◦ Using from the raw-data work-sheet, the analyst should create a set of historical financials that find the right level of detail. ◦ The income statement should be linked with the balance sheet through retained earnings. ◦ This work-sheet will contain historical and forecasted financial statements. Historical analysis and forecast ratios ◦ For each line item in the financial statements, build historical ratios, as well as forecasts of future ratios. ◦ These ratios will generate the forecasted financial statements contained on the previous work-sheet. Market data and WACC ◦ All financial market data should be collected on one work-sheet. ◦ This work sheet will contain estimates of beta, the cost of equity, the cost of debt, and WACC, as well as historical market values and valuation/trading multiples for the company. Reorganised financial statements ◦ Once a complete set of financial statements ( both historical and forecasted) are built, reorganise the financial statements to calculate NOPLAT, its reconciliation to net income, invested capital and its reconciliation to total fund invested. ROIC and free cash flow ◦ Reorganised financial statements are used to build ROIC, economic profit, and free cash flow. ◦ Future free cash flow will be the basis of valuation. Valuation summary ◦ This work-sheet presents discounted cash flows, discounted economic profits, and final results. ◦ The valuation summary includes the value of operations, on-operating assets valuation, valuation of non-equity claims, and resulting equity value. Prepare and analyze historical financials Build the revenue forecast Forecast the income statement Forecast the balance sheet; invested capital and non-operating assets Forecast the balance sheet; investor funds Calculate ROIC and FCF Collect raw data from the reported financials and notes Use the raw data to build a set of financial statements; the income statement, balance sheet, and statement of retained earnings. Statement of retained earnings is critical for error checking during the forecasting process. Aggregate immaterial line items. Never aggregate operating and non-operating items. Top-down forecast : ◦ Estimate revenues by sizing of the total market, determining market share, and forecasting prices; Bottom-up approach: When possible, use both methods to establish bounds for the forecast ◦ Use company’s estimate of demand from existing customers, customer turnover, and the potential for new customers Rely on professional forecasts Focus on market share by competitors Make an assessment on which companies have the capabilities and resources to compete effectively and capture share. Make an assessment of how the company is positioned for the future Find answers to such questions as: ◦ Does the company have products and services to capture share? ◦ Do other competitors have products and services that will displace your company’s market position? Over the short term, top-down forecasts should build on the company’s announced intentions and capabilities for growth. Top-down approach starts with aggregate market and predicts penetration rates, price changes, and market shares Determine short-term forecasts of revenue from current customer base by aggregating sales projections across customers Eliminate a portion of estimated revenue based on an estimate of customer turnover. Project how many new customers the company will attract and how much revenue those customer will contribute Forecasting revenues over long time periods is imprecise because customer preferences, technologies and corporate strategies change. Constantly reevaluate whether the current forecast is consistent with industry dynamics, competitive positioning, and the historical evidence on corporate growth. Use multiple scenarios to model uncertainty Decide what economically drives the line item Estimate the forecasts ratio Multiply the forecast ratio by an estimate of its driver Pay special attention to depreciation and interest expenses and interest income. Operating items (other than depreciation) ◦ Forecast driver: Revenue ◦ Forecast ratios: COGS/Revenue; SG&A/Revenue Depreciation ◦ Forecast driver: Prior years net PP&E ◦ Forecast ratios: Depreciation/net PP&E ◦ Tying depreciation with gross PP&E requires forecasting asset retirements ◦ If, internal information is available, a formal depreciation table can be constructed. Operating items (other than depreciation) ◦ Forecast driver: Revenue ◦ Forecast ratios: COGS/Revenue; SG&A/Revenue Depreciation ◦ Forecast driver: Prior years net PP&E ◦ Forecast ratios: Depreciation/net PP&E ◦ Tying depreciation with gross PP&E requires forecasting asset retirements ◦ If, internal information is available, a formal depreciation table can be constructed.