Court Presentation – June 2012

advertisement

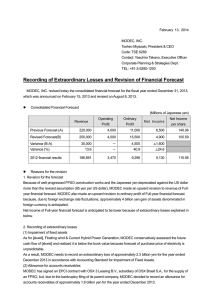

Bexar County Budget Department Spring 2012 FY 2011-12 Budget Update FY 2011-12 Budget Plan 2 The FY 2011-12 Adopted Budget targeted cuts needed to balance budget through the forecast period, while maintaining County capacity for service delivery and employee compensation, which included: $2 M (annualized) mid-year savings from May Freeze $5 M from Attrition/Vacancy Program $5 M from targeted cuts in FY 2011-12 Budget $5 M for Return on Investment (ROI) from use of Technology to be identified in FY 2012-13 Budget FY 2011-12 Original Forecast 3 $410 Salary and Benefit Adjustments $400 Millions $390 Health Insurance Transfer $380 $370 Service Delivery Plan $360 $350 $340 Baseline Funds Needed $330 $320 Current Funds Available $310 $300 08-09 09-10 10-11 11-12 12-13 13-14 14-15 15-16 Submitted Department Plans 4 Cost Savings CMAG - District Clerk Criminal District Attorney Criminal District Courts County Clerk District Clerk Economic Development Judge/Commissioners Justice of the Peace - Precinct 1 Justice of the Peace - Precinct 1, Place 3 Justice of the Peace - Precinct 2 Juvenile Purchasing ($60,459) ($821,202) ($91,465) ($260,863) ($316,070) ($100,001) ($25,951) ($12,375) ($19,842) ($22,435) ($1,100,000) ($40,974) Submitted Department Plans 5 County Manager Community Resources Information Technology Infrastructure Services Appellate Public Defender's Office Budget Human Resources Judicial Support Services Total County Manager’s Cuts ($426,216) ($938,513) ($571,024) ($124,578) ($49,522) ($214,660) ($183,962) ($2,508,475) Departments on the Attrition Plan 6 Amount Needed Constable Pct. 2 $51,895 County Auditor County Courts at Law $84,894 $110,466 Juvenile Courts $47,994 Probate Courts $39,277 Technology Savings 7 • Technology Efficiencies and Innovations: • Lawson Implementation $642,477 • Automation of County Clerk processes $191,275 • Re-negotiation of communication contracts $344,986 • Interactive Foreclosure Maps $238,252 • BCIT is working to realize additional savings toward the $5M goal. Targeted Cuts 8 • An additional $5 million in savings through targeted programmatic reductions were identified by the Budget Department. These savings were realized through Jail Staffing, reduction of Court Appointed Attorney Fees in the County and Civil Courts, reductions in Juvenile Detention costs, and recurring revenues. Revised Forecast Assumptions 9 House Bill 1038: appraisers taking into consideration surrounding properties to include foreclosures Community Housing Development Organizations lawsuit - County will LOSE approximately $1 million per year in Ad Valorem Based on preliminary tax rolls, ad valorem revenues for FY 2012-13 are less than the Fall Projection Revised Forecast Assumptions 10 Result: this forecast lowers projected property tax revenue growth from previous forecasts: Current (1.6%) in FY 2012-13 1% in FY 2013-14 2% in FY 2014-15 3% through FY 2016 Previous 1.0% 2.0% 3.0% 3.0% Dollar Decrease $ 4,962,392 $ 7,394,495 $ 9,972,513 $ 10,271,689 Revised Forecast Without Strategic Issues 11 FY 2010-11 Actual FY 2011-12 Estimate FY 2012-13 Projection Beginning Balance 54,710,249 61,003,379 61,269,150 Revenues 324,929,328 328,057,898 317,277,019* Available Funds 380,073,960 389,061,277 378,546,169 Expenditures 319,070,581 327,792,127 328,089,135 Fund Balance 61,003,379 61,269,150 50,457,034 General Fund *Original Projection for FY 2012-13 Revenues was $320,895,305, a difference of $3,618,286. Revised Forecast Without Strategic Issues 12 $405 $390 Baseline Funds Needed Millions $375 $360 $345 Available Funds $330 $315 $300 08-09 09-10 10-11 11-12 12-13 13-14 14-15 15-16 16-17 Revised Long Range Forecast 13 Strategic Issues Detention Update 15 Avergae Daily Population for the Month Jail Population Trends and Projections* 4,700 4,600 4,500 4,400 4,300 4,200 4,100 4,000 3,900 3,800 3,700 3,600 3,500 3,400 Peak FY 2012 2011 Last FY 2009 This FY Month * Total Population - includes Housed out of Facility and Sheriff's Department Electronic Leg Monitor (ELM) Work Release inmates Service Delivery Plan 16 • Planning tool for use in preparing for increased service demand as a result of: • Increases in overall Bexar County population • Increased population in unincorporated area • A more urban-like and developed unincorporated area Service Delivery Plan 17 • Used annual growth rate in the 2000s to project the growth through 2017 using 2010 population as the baseline Decade 1960-1969 1970-1979 1980-1989 1990-1999 2000-2009 2010-2019 Annual Percentage Population Increase 2.09 % 1.91 % 1.99 % 1.75 % 2.10 % 2.10 % Service Delivery Plan 18 • Bexar County’s population projected to increase by 13.3 percent through 2017 • Increase of 268,000 citizens • Estimated Bexar County population in 2017 of 1.9 million citizens Service Delivery Plan 19 • If cost-effective service delivery methods aren’t identified, the cost of serving our growing County population could be $19.2 million over the next five years. • This does not include “City Like” Services Service Delivery Plan 20 • If “City Like” Services were in the unincorporated area of Bexar County: • Tax rate increase of $1.2251 per $100 valuation • Would bring total tax rate up to $1.552 per $100 valuation • Constitutional Limit of $0.80 per $100 valuation • There is an RFP out to develop options for citizens in the unincorporated area to acquire more “City Like” Services, as needed. Service Delivery Plan 21 • County will need to change our way of delivering services: • E-gov, technology, automation • More efficient business processes • More cost-effective staffing models • Proactive service delivery planning program • Focus on Core Service Delivery Employee Compensation 22 Going forward, the County will need to identify ways to fund Cost of Living Adjustments to keep up with future inflation growth and maintain market competitiveness with other employers FYI: 1% salary increase for all County employees = $2,133,453 Employee Compensation 23 74% of County Operating Revenue is provided by property taxes Employee salaries and benefits account for 70% of County Operating Expenses Employee Healthcare 24 Medical inflation trends are expected to be 9% per year over the forecast period Segal Company: 9.6% source: 2012 Segal Health Plan Cost Trend Survey Aon Hewitt: 9.9% source: 2011 Healthcare Trend Survey Towers Watson: 7% source: 2011 Annual Towers Watson/National Business Group on Health Employer Survey Healthcare Five Year Forecast 25 Healthcare $70,000,000 $64,467,010 $65,000,000 $60,000,000 $59,144,046 $55,000,000 $54,260,592 $50,000,000 $49,780,360 $45,670,055 $45,000,000 $40,000,000 $41,899,133 $35,000,000 FY 11-12 FY 12-13 FY 13-14 FY 14-15 FY 15-16 FY 16-17 Employee Healthcare 26 Claims Group (total 2011 claims) % Claimants % Costs 8.4% 53.9% $5,000 $9,999 8.2% 15.2% $2,500 – $4,999 12.2% 12.9% $1,000 - $2,499 17.8% 10.2% $0 - $999 53.4% 7.8% $10,000+ Employee Healthcare 27 County Contribution $28,359,303 Employee/Retiree Contribution $10,088,519 Total Contributions $38,447,822 Total Contributions $38,447,822 Total Expenditures $41,410,516 Medical Plan Shortfall * $2,962,694 * Medical Plan shortfall based on current premium equivalent levels Employee Healthcare 28 • We have used one-time money for the past two years • Healthcare Changes: • County and employees pay more for same coverage • Reduce benefits to better match current contributions • Decrease costs through healthy lifestyle, preventive care, plan incentives • RFP Medical Insurance Provider Employee Healthcare 29 • Employee Health Clinic • Clinic Visits • • • FY 2010-11 FY 2011-12 Estimate 3,236 4,300 Types of services provided • • • • Pre-employment physicals Medical care for minor injuries or illness Preventive Health Screenings Wellness Programs Strategic Issues Summary 30 • Service Delivery Plan • Providing services to growing population • Employee Compensation • Maintain market competitiveness • Cost of Living Adjustments • Employee Healthcare • Rising healthcare costs • RFP for medical insurance provider • Complete BCIT Cost Savings Plan for inclusion in the Budget. LRFF Summary LRFF Summary 32 • Economic recovery has not yet resulted in increased revenue for the County • Offices and Departments will need help identifying funding for new programs • Prioritize new funding requests for one-time expenditures demonstrating reduction in future staffing needs (Increased productivity) • County still has to address strategic issues including healthcare LRFF Summary 33 The Proposed Budget will address the shortfall by: Refining Revenue Projections Continuing to identify operational efficiencies Budget Calendar 34 Budget Submissions Due May 25 Certified Tax Roll Received July 25 Proposed Budget Work Sessions Adopted Budget August 21 August 23 & 28, September 5 September 11