6. In the following discussion the acquiring firm is Company P, for

advertisement

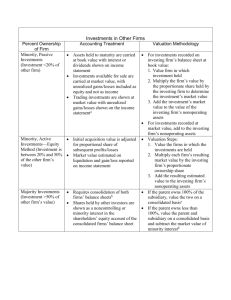

Chapter 13: Highlights 1. Securities that firms expect to hold for more than one year from the date of the balance sheet appear in “Investments in Securities,” which firms include in a separate section of the balance sheet between Current Assets and Property, Plant, and Equipment. When a company owns sufficient number of shares to control another company, it prepares consolidated financial statements. Consolidated financial statements combine, with some adjustments, the assets, liabilities, revenues, expenses, and cash flows of both companies. 2. The accounting for the investment in securities depends on the purpose of the investment and the percentage of voting stock that one corporation owns of another. Three types of investments are: (1) minority, passive investments, (2) minority, active investments, and (3) majority, active investments. 3. Minority, passive investments are bonds or shares of capital stock of another corporation viewed as a worthwhile expenditure and acquired for the anticipated interest, dividends and capital gains (increases in the market price of the shares). The percentage of shares owned is not so large (less than 20 percent of the voting stock) that the acquiring company can control or exert significant influence over the other company. The owner may intend to hold these shares for relatively short time spans and classify them as current assets, called marketable securities, or for an indefinite time and classify them as investments. 4. Minority, active investments are shares of another corporation acquired so that the acquiring corporation can exert significant influence over the other company's activities. Generally accepted accounting principles view investments of 20 percent to 50 percent of the voting stock of another company as minority, active investments "unless evidence indicates that significant influence cannot be exercised." Minority, active investments appear under investments on the balance sheet. 5. Majority, active investments are shares of another corporation acquired so that the acquiring corporation can control the other company both at the broad policy-making level and at the dayto-day operations level. Ownership of more than 50 percent of the voting stock of another company implies ability to control, unless there is evidence to the contrary. 6. In the following discussion the acquiring firm is Company P, for purchaser or parent, and the acquired firm is Company S, for seller or subsidiary. 7. Generally accepted accounting principles require the use of the equity method for minority, passive investments (Company P owns 20 percent or more of the voting stock of Company S, but not more than 50 percent). Under the equity method, Company P records the purchase of Company S’s stock at acquisition cost. Company P treats as income each period its proportionate share of the earnings of Company S. The entry to record this income is a debit to the account, Investment in Stock of S, and a credit to Equity in Earnings of Affiliate, an income statement account. Company P treats dividends received from Company S as a reduction in its investment in Company S. The entry to record dividends received is a debit to Cash and a credit to Investment in Stock of S. 8. One complication from using the equity method arises when the acquisition cost of P's shares exceeds P's proportionate share of the book value of the net assets (assets minus liabilities), or stockholders' equity, of S at the date of acquisition. P may pay an amount that differs from the book value of S’s recorded net assets because the market values of the net assets (for example, land, buildings) differ from their book values or because of unrecorded assets (for example, patents, goodwill) or unrecorded liabilities (for example, an unsettled lawsuit). To the extent that the excess purchase price results from anything other than goodwill, U.S. GAAP requires firms to write off the excess over the expected useful life. Firms need no longer amortize this excess to the extent it relates to goodwill and other assets with indefinite lives. The investor must test the investment annually for possible impairment. 9. Under the equity method the amount shown in the noncurrent section of the balance sheet for Investment in Stock of S will generally be equal to the acquisition cost of the shares plus Company P's share of Company S's undistributed earnings since the date Company P acquired the shares. Company P shows its share of Company S's net income as revenue each period on its income statement. 10. Ownership (by Company P) of more than 50 percent of another corporation’s (Company S’s) common stock usually implies an ability to control the investee. Company P can control both broad policy-making and day-to-day operations. The corporation exercising control through stock ownership is the parent, and the one subject to control is the subsidiary. Generally accepted accounting principles require the parent company to prepare consolidated financial statements with controlled subsidiaries. Consolidated statements report the financial position and operations of two or more legally distinct entities as if they were a single, centrally controlled economic entity. 11. When one company controls another, the controlling company could bring the legal existence of the controlled company to an end. However, some important reasons for continued existence of subsidiary companies are (a) to reduce the parent’s legal or operational risk, (b) to meet more effectively the requirements of state corporation and tax legislation, (c) to expand or diversify with a minimum of capital investment, and (d) to sell an unwanted operation with a minimum of administrative, legal and other costs. 12. Generally, consolidated financial statements provide more useful information than would separate financial statements of the parent and each subsidiary or than the equity method provides. The parent, because of its voting interest, can control the use of all of the subsidiary's assets. Consolidation of the individual assets, liabilities, revenues, expenses and cash flows of both the parent and the subsidiary provides a more realistic picture of the operations, cash flows and financial position of the single economic entity. . 13. State laws typically require each legally separate corporation to maintain its own set of books. The consolidation of these financial statements basically involves summing the amounts for various financial statement items across the separate company statements. Consolidated financial statements reflect the transactions between the consolidated group of entities and others outside the entity. Thus, the consolidation process involves adjustments to these summations to eliminate double counting resulting from intercompany transactions. The eliminations typically appear on a consolidation work sheet and not on the books of any of the legal entities being consolidated. 14. For example, a parent may lend money to its subsidiary. If the separate balance sheets were added together, then the funds would be counted twice - once as the notes receivable on the parent's books and again as cash or other assets on the subsidiary's books. Therefore, the consolidation process requires an entry to eliminate the receivable of the parent and the payable of the subsidiary in preparing consolidated statements. 15. Another example of an elimination entry to avoid double counting relates to the parent's investment account. If the assets of the parent (including the investment account) were added to the assets of the subsidiary, there would be double counting of the subsidiary's assets. At the same time the sources of financing would be counted twice if the shareholders equity accounts of Company S were added to those of Company P. Therefore, an eliminating entry removes the investment account of the parent and, correspondingly, shareholders' equity items of the subsidiary. In addition, the consolidation process requires the elimination of Company P's account, Equity in Earnings of Company S, to avoid the double counting of Company S's revenues and expenses. 16. A consolidated income statement is little more than the sum of the income statements of the parent and the subsidiaries. The consolidation process eliminates intercompany transactions such as sales and purchases in order to avoid double counting. Thus, the consolidated income statement attempts to show sales, expenses, and net income figures that report the results of operations of the group of companies in their dealings with the outside world. 17. The amount of consolidated net income for a period is the same as the amount that a parent company would report if it used the equity method of accounting for the intercorporate investment. That is, consolidated net income is equal to parent company's net income plus parent's share of subsidiary's net income minus profit (or plus loss) on intercompany transactions. However, under the equity method for an unconsolidated subsidiary, the parent's share of subsidiary's net income (adjusted for intercompany transactions) appears on a single line, Equity in Earnings of Unconsolidated Subsidiary. The consolidation process combines the individual revenues and expenses of the subsidiary (adjusted for intercompany transactions) with those of the parent, and eliminates the account Equity in Earnings of Unconsolidated Subsidiary, shown on the parent's books. 18. When a parent company owns less than 100 percent of the subsidiary, the minority stockholders continue to have a proportionate interest in the shareholders' equity of the subsidiary as shown in its separate corporate records. The amount of minority interest appearing in the balance sheet results from multiplying the common stockholders' equity of the subsidiary by the minority's percentage of ownership. 19. The amount of the minority interest in the subsidiary's net income shown on the consolidated income statement is generally the result of multiplying the subsidiary's net income by the minority's percentage of ownership. The consolidated income statement allocates the portion applicable to the parent company and the portion of the subsidiary's income applicable to the minority interest. Typically, the minority interest in the subsidiary's net income appears as a deduction in calculating consolidated net income. 20. Consolidated statements do not replace financial statements of individual corporations. For example, creditors of a consolidated subsidiary must rely on resources of the subsidiary to which they loaned funds and not on the assets of the consolidated entity. A corporation can declare dividends only from its own retained earnings. When a parent owns less than 100 percent of the shares, minority shareholder can judge the dividend constraints, both legal and financial, only by inspecting the subsidiary’s statements. 21. Firms frequently join in business ventures with other firms to share resources, personnel expertise, and to spread risks. This arrangement is a typical joint venture in which both firms share joint control. 22. Firms can account for joint ventures by: (a) the equity method, or (b) fully consolidating the joint venture and reporting the interest of the joint owner as an external interest, or (c) partially consolidate the joint venture (consolidate 50% of each asset, liability, revenue and expense). 23. U.S. GAAP requires firms to use the equity method to account for joint ventures (unless the fair value method is used) since the ownership permits each owner to exercise significant influence but not control. 24. A variable interest entity (VIE) is an entity that is either: (a) so small that the entity requires other financial support to sustain its activities, or (b) the entity’s owners lack meaningful decision rights.