chap 15 - Futures & Hedging

advertisement

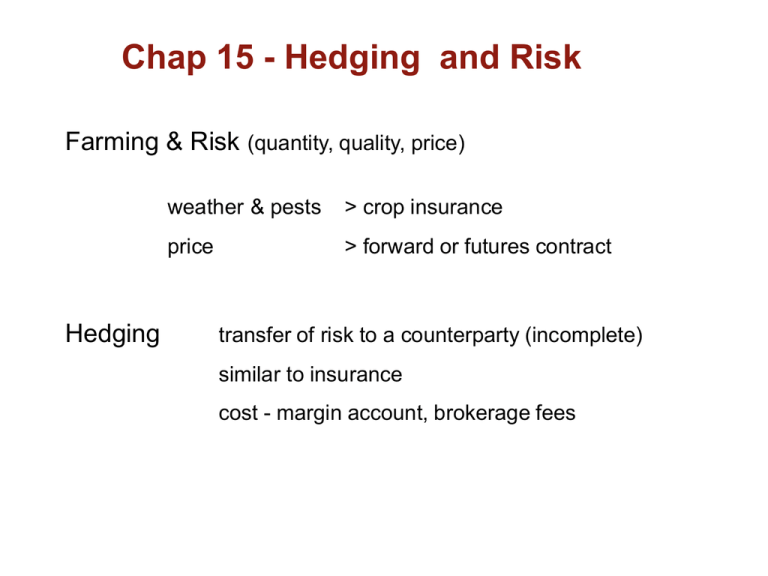

Chap 15 - Hedging and Risk Farming & Risk (quantity, quality, price) Hedging weather & pests > crop insurance price > forward or futures contract transfer of risk to a counterparty (incomplete) similar to insurance cost - margin account, brokerage fees Example: Perfect Short Hedge Simplifying Assumptions: October - post harvest; crop in storage (long physical corn) Return to storage = f(spot sale in May) Target return to storage = $0.25/bu Current spot price = $3.50 Current May futures = $3.75 Return to storage = $0.25 (October to May) spot market = delivery point (expected) The Short Hedge October: SELL May contract @ $3.75 May: May Futures and May Spot price (rises) = $3.75 SELL (deliver) Physical corn @ $3.75 Futures contract satisfied Return to storage = $0.25 = Target return Spot and Futures Convergence at contract expiry Arbitrage between spot and futures Spot & Futures Convergence March Contract Futures Price Basis Spot Oct March The Hedge: Prices Change Assume: Unexpected large crop in Argentina Lower cash price in May = $3.60 Farmer still protected (October cash price = $3.50) October: SELL May contract @ $3.75 May: BUY May contract @ $3.60 NET = $ 0.15 SELL physical corn @ $3.60 NET = $ 0.10 Return to storage = $ 0.25 The Result: The same regardless of price increase or decrease Hedging & the Basis Basis: Price difference between two locations in Space OR Time OR Both Space: Time: Local Spot Price ≠ Delivery Point Spot Price Current local Price ≠ Current May Futures Price Basis = cost of transfer (transport + storage + insurance etc.) Bt = Ft - Pt Current May Futures - Current Local Spot Price Successful Hedge <= Basis now vs Basis in May (time of delivery) Perfect Hedge <= Basis now = Basis in May Ontario Basis December 2011 Hedging, the Basis & the Return to Storage Generally: The basis is not stable over time Result: Actual return to storage > or < anticipated return Cash Market (physical) Futures Market NOW: BUY/OWN Corn @ P1 SELL May Futures @ F1 MAY: BUY May Futures @ F2 SELL Corn @ P2 Hedging, the Basis & the Return to Storage Return to storage = (P2 - P1) + (F1 - F2) Buy LOW and Sell HIGH in both markets Return = (F1 - P1) - (F2 - P2) = B1 - B2 B1 > B2 => Positive Return B1 < B2 => Negative Return Hedging: Using Futures to Target Price Problem: Pre-planting, farmers need to “price” the future crop Futures provide “price discovery” Banks want insurance against loan to farmer Locked in Price => less bank risk Solution: Use futures to “price” the crop & profitability Planting Decision: Hedged or not – it is a commitment to sell Not using futures/forward = Speculation Futures & the Pre-Plant Decision Profit = Returns in Cash and Futures Markets Cash return: (P2 - C1) C1 = Cost of production Futures return: (F1– F2) Sell - Buy Total Return = (P2 - C1) + (F1 – F2) = F1 – ((C1 + (F2 – P2)) = (F1 – C1) - B2 Anticipated Return – Basis @ delivery + BUY offset Complication – Anticipated yield ≠ Actual yield (uncertain) Futures & the Pre-Plant Decision Profit = Cash Return + Futures Return Rising Futures & Spot Price Cash return: (P2 - C1) = ($5.25 - $4.00) = $1.25 Futures return: (F1– F2) = ($5.00 - $5.25) = - $0.25 Total Return = $1.00 above cost of production $5.00/bu Futures & the Pre-Plant Decision Profit = Cash Return + Futures Return Falling Futures & Spot Price Cash return: (P2 - C1) = ($4.25 - $4.00) = $0.25 Futures return: (F1– F2) = ($5.00 - $4.25) = $0.75 Total Return = $1.00 above cost of production Speculative Spread Across Delivery Months May too LOW & Sept too HIGH ? => Basis too big ? Spread => Trade commodity across different delivery months Arbitrage the price spread Principal => Buy LOW, sell HIGH NOW: BUY May SELL Sept B1 LATER: SELL May BUY Sept B2 RETURN: Profit (loss) on MAY & SEPT Contracts π = B1 - B2 Speculative Straddle Across Commodities Principal: Act on abnormal price relationship between commodities Wheat vs corn Wheat too LOW relative to Corn? => Basis too small ? NOW: BUY wheat & SELL corn B1 LATER: SELL wheat & BUY corn B2 RETURN: Profit (loss) on wheat & corn contracts π = B2 - B1