Merlin Secure Yielding Care Home Fund

advertisement

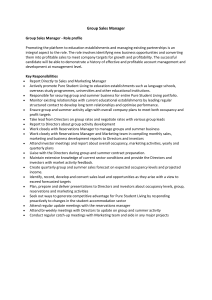

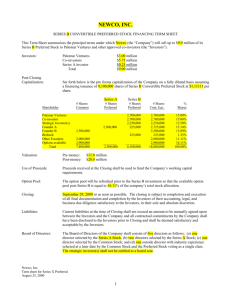

Merlin Secure Yielding Care Home Fund Investor Update January 2013 A sub-fund of the Falcon Investment Property SICAV PLC Date Nav Per share (€) RTN Launch 1,234 Dec ‘10 1,521 23.30% Jun ‘11 2,150 74.30% Dec ‘11 2,147 74.00% Jun ‘12 1,802 46.10% Oct ‘12 2,084 68.90% - This publication is directed solely at professional investors and not retail clients Growth of 68.9% since launch based on Net Asset Value per share Investment Objective Merlin is a distributing fund investing in the provision of residential care facilities in the UK and Europe and working in partnership with award-winning and expanding care providers. The fund targets the acquisition and development of purpose built care facilities with secure long-term rental covenants. While the fund will seek to acquire properties at below-market-value the primary intention NAV per share(€) 3,000 2,000 1,000 0 is to find secure incomes that will service debt and produce income to the fund, which can be used to distribute dividend to investors at the directors’ discretion. It is the medium term objective of the directors to build a yielding portfolio that will be suitable for a listing on a secondary market such as AIM or the LSE. Acquisitions Property Beds Occupancy Bedmar Utrera Chiclana 58 150 120 93% 84% 90% “The fund has performed profitably throughout its term and continues to do so. Care should be taken when viewing the fund valuation due to the fluctuation of the Euro. “ ….. Brad Lincoln Fund Director Update As published in the audited annual accounts presented to the CISX in November of this year, the Net Asset Value per share of the Fund increased by 46.1% compared over that at launch. In the next quarter a further growth up to 68.9% was recorded. The Directors believe this demonstrates the sense in the acquisition strategy. The fund was bought when the Spanish market had hit the bottom, and with the market having adjusted, it has been re-assessed based on yield payments, resulting in a significant gain for investors. In 2012 the accounts showed the fund has operated according to expectations, although there has been some effect from the currency fluctuations. The fund has acquired a new care home, Chiclana, which strengthens its portfolio. The NAV per share price at 30 September 2012 was 1689GBP, which reflects the improving exchange rate. The fund has been opened for a number of new investors. To view the full accounts update, visit: http://www.cisx.com/listedsecuritynewsitems.php ?companyID=3375 Market conditions The Bedmar Care Home The Utrera Care Home The UK media continues to report the high demand for elderly care in the UK and Europe and research analysts claim that places in care homes will need to increase by 82% over the next 20 years if the UK is to keep up with the rising number of over-85s in the country. Along with the new acquisition in Spain, the Directors have been investigating several opportunities to expand the fund portfolio with properties in both Spain and the UK currently under consideration. Advisers Administrator – Heritage International Fund Managers Limited Property Adviser – DevCo Limited (Guernsey) Auditors – Grant Thornton LLP Tax Advisers – KPMG Channel Islands Ltd The Chiclana Region 2 Status Acquired Acquired Acquired Key Facts Launch date – 28th May 2010 Minimum Subscription - £10,000 The Fund is authorized and regulated by the Maltese Financial Services Authority Contact: info@bestinternational.co.uk +44 (0) 845 130 9022 IMPORTANT DISCLAIMER Past performance is not an indicator of future results. This publication is for private circulation and for information purposes only and does not constitute a personal recommendation or investment advice or offer to buy/sell or an invitation to buy/sell securities in any Fund. The information and opinions have been obtained from or are based on sources believed to be reliable but cannot be guaranteed. No responsibility can be accepted for any loss arising from the use of this information.